FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

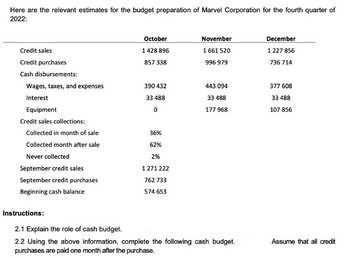

Transcribed Image Text:Here are the relevant estimates for the budget preparation of Marvel Corporation for the fourth quarter of

2022:

Credit sales

Credit purchases

Cash disbursements:

Wages, taxes, and expenses

Interest

Equipment

Credit sales collections:

Collected in month of sale

Collected month after sale

Never collected

September credit sales

September credit purchases

Beginning cash balance

Instructions:

October

1428 896

857 338

390 432

33 488

0

36%

62%

2%

1271222

762 733

574 653

November

1661 520

996 979

443 094

33 488

177 968

2.1 Explain the role of cash budget.

2.2 Using the above information, complete the following cash budget.

purchases are paid one month after the purchase.

December

1227 856

736 714

377 608

33 488

107 856

Assume that all credit

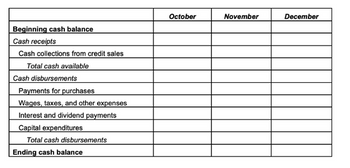

Transcribed Image Text:Beginning cash balance

Cash receipts

Cash collections from credit sales

Total cash available

Cash disbursements

Payments for purchases

Wages, taxes, and other expenses

Interest and dividend payments

Capital expenditures

Total cash disbursements

Ending cash balance

October

November

December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11. Calculating the Cash Budget Here are some important figures from the budget of Crenshaw, Inc., for the second quarter of 2019. LO 3 April May June $598,000 282,000 $689,000 $751,000 Credit sales 302,000 338,000 Credit purchases Cash disbursements 137,000 129,000 179,000 Wages, taxes, and expenses 15,600 15,600 15,600 Interest 53,500 6,600 248,000 Equipment purchases The company predicts that 5 percent of its credit sales will never be collected 35 percent of its sales will be collected in the month of the sale, and the re- maining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2019, credit sales were $561,000. Using this information, com- plete the following cash budget: April May June $182,000 Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements Purchases 289,000 Wages, taxes, and expenses Interest Equipment purchases Total cash disbursements…arrow_forwardHow much should this company expect in cash collections for the month of January? ROUND TO NEAREST WHOLE DOLLARarrow_forwardBhupatbhaiarrow_forward

- Do not give solution in imagearrow_forwardPlease do not give solution in image format thankuarrow_forwardPrepare Cash Budget For 3 Months Brewster Corporation expects the following cash receipts and disbursements during the first quarter of the year (receipts exclude new borrowings and disbursements exclude interest payments on borrowings since January 1) January February March $280,000 $300,000 $270,000 Cash receipts Cash disbursements 260,000 340,000 280,000 The expected cash balance at January 1, is $62,000. Brewster wants to maintain a cash balance at the end of each month of at least $60,000. Short-term borrowings at 1% interest per month will be used to accomplish this, if necessary. Borrowings (in multiples of $1,000) will be made at the beginning of the month in which they are needed, with interest for that month paid at the end of the month. Prepare a cash budget for the quarter ended March 31. Brewster Corporation Cash Budget for the Quarter Ended March 31 January Beginning cash balance Cash receipts Short-term borrowings Cash available Cash disbursements Interest payment Total…arrow_forward

- Nonearrow_forwardThe Foress Antique Mall budgeted credit sales in the first quarter of 2021 to be as follows: January February March $188,800 200,600 214,000 Credit sales in December 2020 are expected to be $236,000. The company expects to collect 70 percent of a month's sales in the month of sale and 30 percent in the following month. Estimate cash receipts for each month of the first quarter of 2021. Collection of credit sales Collection of December sales $ Collection of January sales Collection of February sales Collection of March sales $ January $ $ February $ $ March Ac Goarrow_forwardHere are some important figures from the budget of Cornell, Inc., for the second quarter of 2020: April May June Credit sales $ 312,000 $ 292,000 $ 352,000 Credit purchases 120,000 143,000 168,000 Cash disbursements Wages, taxes, and expenses 43,200 10,700 62,200 Interest 10,200 10,200 10,200 Equipment purchases 72,000 134,000 0 The company predicts that 5 percent of its credit sales will never be collected, 40 percent of its sales will be collected in the month of the sale, and the remaining 55 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2020, credit sales were $182,000, and credit purchases were $122,000. Using this information, complete the following cash budget. (Do not round intermediate calculations.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education