FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

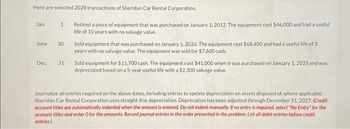

Transcribed Image Text:### Selected 2028 Transactions of Sheridan Car Rental Corporation:

#### January 1

- **Transaction**: Retired a piece of equipment.

- **Details**: The equipment was purchased on January 1, 2012, for $46,000. It had a useful life of 10 years with no salvage value.

#### June 30

- **Transaction**: Sold a piece of equipment.

- **Details**: The equipment was bought on January 1, 2026, for $68,400 with a useful life of 3 years and no salvage value. It was sold for $7,600 cash.

#### December 31

- **Transaction**: Sold a piece of equipment for $11,700 cash.

- **Details**: The equipment was purchased on January 1, 2025, for $41,000. It was depreciated based on a 5-year useful life with a $2,300 salvage value.

### Instructions for Journal Entries:

Journalize all entries required on the specified dates, including any updates to depreciation on assets disposed of, where applicable. Note that Sheridan Car Rental Corporation uses straight-line depreciation. Depreciation has been adjusted through December 31, 2027. Follow these guidelines when recording the journal entries:

- Credit account titles should be automatically indented when the amount is entered.

- Do not indent manually.

- If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.

- Record journal entries in the order presented in the problem.

- List all debit entries before credit entries.

This educational content is designed to help accounting students understand how to handle transactions related to equipment retirement and sales, including the necessary adjustments for depreciation.

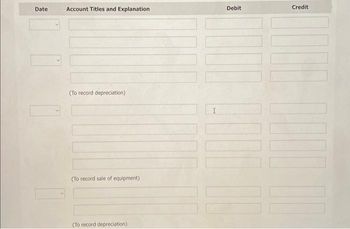

Transcribed Image Text:### Journal Entry Template for Recording Financial Transactions

This template is structured to assist in recording various financial transactions, such as depreciation and the sale of equipment. This is an essential part of accounting, whereby each transaction is recorded in a journal before being posted to the general ledger. The specific layout seen in the image includes columns for the date, account titles and explanations, debit amounts, and credit amounts.

#### Structure and Explanation of the Template:

- **Date:** This column is used to input the date on which the transaction occurs. Each row represents a new transaction date.

- **Account Titles and Explanation:** This column is crucial for specifying the accounts involved in the transactions. It also includes a brief explanation for each transaction, helping clarify the nature of each recorded entry.

- **Debit:** Here, you enter the amount that is to be debited for each transaction. Debits increase asset or expense accounts and decrease liability, revenue, or equity accounts.

- **Credit:** This column is used for noting the amount to be credited. Credits do the opposite of debits; they increase liability, revenue, or equity accounts and decrease asset or expense accounts.

#### Specific Transactions:

1. **To Record Depreciation:**

- The sections labeled "(To record depreciation)" indicate where you should record transactions related to the depreciation of assets over time. Depreciation is a method of allocating the cost of a tangible asset over its useful life.

2. **To Record Sale of Equipment:**

- The section labeled "(To record sale of equipment)" is designated for logging transactions involving the sale of equipment. The sale of equipment often involves recording the removal of the asset and recognizing any gain or loss on the sale.

Given these areas, each transaction must ensure that the total of the debit side equals the total of the credit side, maintaining the balance required in double-entry bookkeeping.

### Example Journal Entry:

Suppose on January 1, you need to record depreciation on equipment worth $1,000. The entry would look like this:

- **Date:** January 1

- **Account Titles and Explanation:**

- Debit: Depreciation Expense – $1,000

- Credit: Accumulated Depreciation – $1,000

For the sale of equipment, where equipment worth $5,000 is sold for $4,500, the entry could look like this:

- **Date:** January 15

- **Account Titles and Explanation:**

- Debit:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Skip to question [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $144,000 cash on January 2. On January 3, Onslow paid $ 8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $17, 280 salvage value. Straight line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. 3. Prepare journal entries to record the machine's disposal under each separate situation: (a) it is sold for $24, 500 cash and (b) it is sold for $98, 000 cash.arrow_forwardAnswer without image, every entry should have narratedarrow_forward3 Amanda Company purchased a computer that cost $10,600. It had an estimated useful life of five years and a residual value of $1,300. The computer was depreciated by the straight-line method and was sold at the end of the third year of use for $5,150 cash How much of a gain or loss should Amanda record? 024701arrow_forward

- I tried to get help with this question before I appreciate whoever tried to help however it wasn't filled out very well also the tabs include the dates of Jan 1, June 30, Dec 31starrow_forwardZorzi Corporation purchased a Machine on January 1 2017 for $80 000. The machinery is estimated to have a salvage value of $8 000 after a useful life of 8 years. Compute the depreciation expense using the Straight-line method for 2017 O S8.900 O $9.000 O $9 100 O $9.200arrow_forwardDiaz Company owns a machine that cost $126,300 and has accumulated depreciation of $91,700. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. Diaz sold the machine for $17,000 cash. Diaz sold the machine for $34,600 cash. Diaz sold the machine for $41,200 cash. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01arrow_forward

- Nonearrow_forwardHere are selected 2022 transactions of Concord Corporation. Jan. 1 Retired a piece of machinery that was purchased on January 1, 2012. The machine cost $61,900 and had a useful life of 10 years with no salvage value. June 30 Sold a computer that was purchased on January 1, 2020. The computer cost $35,800 and had a useful life of 4 years with no salvage value. The computer was sold for $4,300 cash. Dec. 31 Sold a delivery truck for $9,450 cash. The truck cost $23,800 when it was purchased on January 1, 2019, and was depreciated based on a 5-year useful life with a $3,300 salvage value. Journalize all entries required on the above dated , including to update depreciation on assets disposed of, where applicable. Use straight-line depreciation.arrow_forwardZorzi Corporation purchased a Machine on January 1, 2017 for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. Compute the depreciation expense for 2017 using the sume of the years didgets method assuming the machine was purchased on October 1, 2017 O $2,500 O $12.000 O S7.500 O $10,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education