FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

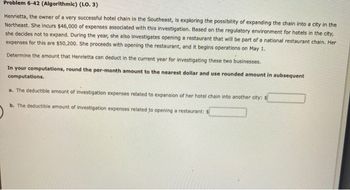

Transcribed Image Text:Problem 6-42 (Algorithmic) (LO. 3)

Henrietta, the owner of a very successful hotel chain in the Southeast, is exploring the possibility of expanding the chain into a city in the

Northeast. She incurs $46,000 of expenses associated with this investigation. Based on the regulatory environment for hotels in the city,

she decides not to expand. During the year, she also investigates opening a restaurant that will be part of a national restaurant chain. Her

expenses for this are $50,200. She proceeds with opening the restaurant, and it begins operations on May 1.

Determine the amount that Henrietta can deduct in the current year for investigating these two businesses.

In your computations, round the per-month amount to the nearest dollar and use rounded amount in subsequent

computations.

a. The deductible amount of investigation expenses related to expansion of her hotel chain into another city: $

b. The deductible amount of investigation expenses related to opening a restaurant: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Virginia is an accountant for a global CPA firm. She is being temporarily transferred from the Raleigh, North Carolina, office to Tokyo. She will leave Raleigh on October 7, 2020, and will be out of the country for four years. She sells her personal residence on September 30, 2020, for $255,000 (her adjusted basis is $230,000). Upon her return to the United States in 2024, she purchases a new residence in Los Angeles for $245,000, where she will continue working for the same firm. Required: What are Virginia’s realized and recognized gain or loss? (If there is no gain or loss is recognized, select "No gain/loss".) What is Virginia’s basis in the new residence?arrow_forwardYou are serving on a jury. A plaintiff is suing the city for injuries sustained after a freak street sweeper accident. In the trial, doctors testified that it will be five years before the plaintiff is able to return to work. The jury has already decided in favor of the plaintiff. You are the foreperson of the jury and propose that the jury give the plaintiff an award to cover the following: (a) The present value of two years' back pay. The plaintiff's annual salary for the last two years would have been $33,000 and $36,000, respectively. (b) The present value of five years' future salary. You assume the salary will be $40,000 per year. (c) $100,000 for pain and suffering. (d) $12,000 for court costs. Assume that the salary payments are equal amounts paid at the end of each month. If the interest rate you choose is an EAR of 8 percent, what is the size of the settlement? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Size of the…arrow_forwardMr. Don is the director of A-Design Inc., a federally incorporatedcompany in Canada, specializing in the design and manufacturing ofarmrests for the wheelchair industry. A-Design invested $100,000 in aproduction machine, which has a useful life of 10 years, and put $10,000 in its bank account. In an attempt to improve company sales and profits, Mr. Don planned tooffer two purchasing options to the clients of his company. Option 1:$250 deposit upfront$500 yearly fee for 5 years Option 2:$1300 deposit upfront$300 yearly fee for 3 years Assuming an interest rate of 5% per year compounded every 6 months over aperiod of 5 years on the money put in the bank, how much will A-Design have in its bank account at the end of the fifth year?arrow_forward

- Timmy and Tammy, boyfriend and girlfriend (but not married and with no present intention to marry), have co-owned (50-50) and lived together in a home in Dallas for five years. Now they plan to sell because they’ve decided to move to Alaska. They tell you, their CPA, that they anticipate around $600,000 total profit on the sale. You advise them that they – (a) must get married before they sell in order to maximize the § 121 exclusion. (b) must get married by year-end in order to maximize the § 121 exclusion. (c) will pay no tax on a total of $250,000 of the gain, split evenly between them on their respective “single” tax returns. (d) will pay no tax on a total of $500,000 of the gain, split evenly between them, on their respective “single” tax returns. (Choose the answer you believe to be correct and defend your choice.)arrow_forwardA local chapter of the Society for Protection of the Environment benefited from the voluntary services of two attorneys. One served as a member of the Society's board of directors, performing tasks comparable to other directors. During the year, he attended 20 hours of meetings. The other drew up a lease agreement with a tenant in a building owned by the Society. She spent five hours on the project. The billing rate of both attorneys is $200 per hour. In the year in which the services were provided, the Society should recognize revenues from contributed services ofarrow_forwardMr. Don is the director of A-Design Inc., a federally incorporated company in Canada, specializing in the design and manufacturing of armrests for the wheelchair industry.A-Design invested $100,000 in aproduction machine, which has auseful life of 10 years, and put $10,000 in its bank account. In an attempt to improve company sales and profits, Mr. Don planned tooffer two purchasing options to the clients of his company Option 1:$250 deposit upfront$500 yearly fee for 5 years Option 2:$1300 deposit upfront$300 yearly fee for 3 years Assuming an interest rate of 5% per year over a period of 5 years on the moneyput in the bank, how much will A-Design have in its bank account at the end of thefirst year?arrow_forward

- You are serving on a jury. A plaintiff is suing the city for injuries sustained after a freak street sweeper accident. In the trial, doctors testified that it will be five years before the plaintiff is able to return to work. The jury has already decided in favor of the plaintiff. You are the foreperson of the jury and propose that the jury give the plaintiff an award to cover the following: (a) The present value of two years' back pay. The plaintiff's annual salary for the last two years would have been $34,000 and $37,000, respectively. (b) The present value of five years' future salary. You assume the salary will be $41,000 per year. (c) $100,000 for pain and suffering. (d) $13,000 for court costs. Assume that the salary payments are equal amounts paid at the end of each month. If the appropriate rate you choose is an EAR of 7 percent, what is the size of the settlement? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Size of the…arrow_forwardJosaline, the owner of a construction company, is planning to purchase specialized equipment to complete a contract awarded to her company. The first cost of the equipment is $250,000 with a life of 3 years at which time she will no longer need the equipment. The operating cost is expected to be $75,000 per year. Alternatively, a subcontractor can perform the work for $175,000 per year. Because the equipment is specialized, Josaline is notsure about the salvage value. She estimates a likely salvage of $90,000, but it might have to be scrapped for as little as $10,000 in three years. TheMARR is 15% per year.a. Is her decision to buy the equipment sensitive to the salvage value?b. Determine the salvage value at which the two alternatives break even.arrow_forwardJerry, who is age 56, was just called into the president’s office at Napa Sunrise, Inc. He just learned that his position has been eliminated in the recent reorganization. While he is devastated, he thinks he may attempt to retire and work on his golf game. Jerry has a retirement plan at Napa Sunrise, which permits lump-sum distributions, and has accumulated some personal savings, but not enough to sustain him until age 65. Jerry also worked for KMA for 30 years and expects to receive a pension from KMA at age 65. He also expects to receive Social Security at age 67. Which of the following is correct? A. Jerry could begin taking substantially equal periodic payments, which would avoid the early withdrawal penalty, but he could not stop the payments until age 59 ½. B. Jerry cannot access his funds at Napa Sunrise prior to full retirement age for the plan. C. Jerry can take any distribution permitted by the Napa Sunrise plan and avoid the early withdrawal penalty…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education