Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

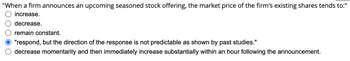

Transcribed Image Text:"When a firm announces an upcoming seasoned stock offering, the market price of the firm's existing shares tends to:"

increase.

decrease.

remain constant.

"respond, but the direction of the response is not predictable as shown by past studies."

decrease momentarily and then immediately increase substantially within an hour following the announcement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose a stockarrow_forwardH. As a new analyst, you have obtained the prices for the stocks of both Lulu and Lemon. Both stocks did not paid any dividends during the entire period. (1) (II) (III) Your manager has asked you (i) to compute the rate of return and standard deviation of the two stocks and suggest that because these companies produce similar products, you should continue your analysis by (ii) computing their covariance and correlation. Show all calculations. Year 2019 2020 2021 2022 2023 Closing prices of LuLu Closing prices of Lemon 20.50 30.10 19.92 28.50 22.45 30.10 24.50 40.30 20.50 36.40 Compute the return and standard deviation of a portfolio with 60% investment in Lulu and 40% in Lemon. Would you recommend putting these two stocks together in a portfolio? Explain why or why not.arrow_forwardA stock is expected to pay a dividend next year of $2.1. The dividend amount is expected to grow at an annual rate of 6.9% indefinitely. Assuming a required return on the stock of 10.8% in the future, the dividend yield on the stock is %. Margin of error for correct responses: +/- .05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456, 12.3456%, or $12.3456, you should enter 12.35).arrow_forward

- In the event of unexpected news announcement, such as a significant reduction in profit expectations, which of the following is NOT a likely stock price reaction?: Select one: a. The price instantaneously adjusts to the new information. b. No reaction, since the market has already learned to "expect the unexpected" The price over-adjusts to the new information, but eventually falls to the appropriate price. d. The price partially adjusts to the new information.arrow_forwardchoose the answer onlyarrow_forward品 Check my work Consider the following information: Probability of Rate of Return if State Occurs State of Economy Economy Stock A Stock B .050 130 .220 -33 .23 oped Recession .23 Normal .63 Boom .14 .46 Book Hint a. Calculate the expected return for the two stocks. (Do not round interme calculations and enter your answers as a percent rounded to 2 decimal places 32.16.) b. Calculate the standard deviation for the two stocks. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places 32.16.) Print a. Expected return of A Expected return of B b. Standard deviation of A Standard deviation of B Graw **. **** APR 08 F3 F1 F2arrow_forward

- Show the monthly return of the company and S&P 500 in the same graph. What is your interruption interpretation of the change of return of the company comparing with the market index? Calculate the monthly standard deviation and return for both the company and S&P 500. What is your interruption of the risk and return of the company comparing with the market index? S&P 500 last 6 months : Date Open High Low Close* Adj. close** Volume 01 Apr 2022 4,540.32 4,593.45 4,381.34 4,392.59 4,392.59 37,024,560,000 01 Mar 2022 4,363.14 4,637.30 4,157.87 4,530.41 4,530.41 100,978,320,000 01 Feb 2022 4,519.57 4,595.31 4,114.65 4,373.94 4,373.94 73,167,790,000 01 Jan 2022 4,778.14 4,818.62 4,222.62 4,515.55 4,515.55 73,279,440,000 01 Dec 2021 4,602.82 4,808.93 4,495.12 4,766.18 4,766.18 68,699,830,000…arrow_forwardInvestors expect a company to announce a 9 percent decrease in earnings, but instead the company announces a 1 percent decrease. If the market is semistrong-form efficient, which of the following should happen? a. The stock’s price rises because the earnings decrease was less than expected. b. The stock’s price stays the same because earnings announcements have no effect if the market is semistrong-form efficient. c. The stock’s price decreases slightly because the company had a slight decrease in earnings.arrow_forwardJennifer establishes an investment account to pay for college expenses for her daughter. She plans to invest X at the beginning of each month for the next 20 years. Beginning at the end of the 17th year, she will withdraw 55,000 annually. The final withdrawal at the end of the 20th year will exhaust the account. She anticipates earning an annual effective yield of 11% on the investment. Calculate X. 276.80 307.70 317.60 346.20 349.10arrow_forward

- Based on the CAPM, Jensen's Alpha of a firm a) equals zero if the firm's stock returns have underperformed as compared to the market after adjusting for its beta risk. b) is positive if the firm's stock returns have overperformed as compared to the market after adjusting for its beta risk. c) is negative if the firm's stock returns have overperformed as compared to the market after adjusting for its beta risk. d) equals one if the firm's stock returns have underperformed as compared to the market after adjusting for its beta risk.arrow_forward84. You complete a test of autocorrelation on daily data for a thinly traded stock and the Durbin Watson statistic is 1.15. If the stock has a return of -0.33% late in the trading day and you are convinced that other investors are not aware of the results, based on the test results and probabilities, an investor would: Buy or long the stock in late trading. Sell or short the stock in late trading. Wait an additional day to buy the stock. Wait an additional day to short the stock. Take neither a long or short position in the stock. None of the above answers is correct.arrow_forwardCan small adjustments to a flow lead to large changes in a stock? Group of answer choices A.There is no way to determine if this is possible. B.Yes, given enough time. Even a small change in flow will accumulate over time. C.No. If the change in the flow is small, the change to the stock must also be small. D.Yes. If a penny is deducted from an account of $10,000, that change is large because every penny counts. E.No. Flows can’t change in small ways.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education