Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Hello

We had this example in

My question:

How come they dont have to pay tax of the

in the example it says 4$ Million - 1.5$ Million = 2.5$ Milllion in Tax

why is it no 4 + 1.5 =5.5 $ Million in Tax

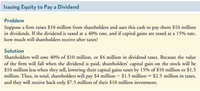

Transcribed Image Text:Issuing Equity to Pay a Dividend

Problem

Suppose a firm raises $10 million from sharcholders and uses this cash to pay them $10 million

in dividends. If the dividend is taxed at a 40% rate, and if capital gains are taxed at a 15% rate,

how much will sharcholders receive after taxes?

Solution

Sharcholders will owe 40% of $10 million, or $4 million in dividend taxes. Because the value

of the firm will fall when the dividend is paid, shareholders' capital gain on the stock will be

$10 million less when they sell, lowering their capital gains taxes by 15% of $10 million or $1.5

million. Thus, in total, sharcholders will pay $4 million – $1.5 million = $2.5 million in taxes,

and they will receive back only $7.5 million of their $10 million investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- choose the letter of the correct answer Yana Corp. has a profit before tax of P90 million. If the company's times interest covered ratio is 4, what is the total interest charge? a. P15Mb. P30Mc. P40Md. P50Me. P60Marrow_forward(MORNING) AC corporation earns $4.30 per share before taxes. The corporate tax rate is 35%, the personal tax rate on dividends is 20%, and the personal tax rate on non-dividend income is 39%. What is the total amount of taxes paid if the company pay $2.00 dividend? This questuon: 10 polniS) possibie O A. $2.29 O B. $2.67 OC. $1.91 O D. $1.52 O Time Remaining: 00:50:30 Next O tv MacBook Air DII DD 80 F12 F9 F10 F11 esc F5 F6 F7 F8 F1 F2 F3 F4 @ $ & delete %3D 1 2 4 7 { Y U P Q W E tab J K = - .. .. - *arrow_forwardWhat was the firm's net income if the firm paid income taxes of $2,000 and the average tax rate was 25%, O A. $1,000 B. $6,000 O c. $8000 O D. $7,000arrow_forward

- Please help me with the question correct all parts or pls skiparrow_forwardMalbar Gold has taken a loan of two million on which it pays an interest of 4.5 %. If the current tax rate 37.5 %. What is the firm's after tax cost of debt? Select one: Oa. None of these Ob. 3.44 O c. 4.42 O d. 2.81arrow_forwardQuickly pleasearrow_forward

- 3. (a) Debt is 20% of assets for an organization. Total assets are$10,000. The tax rate is 40%. The interest rate is 10%. EBIT profit is$1000. What is the after taxes and interest profit? What is the ROE?Profit_______________ROE________________(b) If in 1(a) debt is increased to 50% of assets, what will be the aftertaxes and interest profit and the ROE?Profit__________________ROE___________________arrow_forward1. Which of the following nominal rates does not apply to a C corporation? a. 10% b. 15% c. 25% d. 35% 2. Which of the following is never included in gross income? a. Loss on stock sale b. Social security benefits c. Gifts d.Unemployment benefits 3. What is George’s gross income if he has the following: Salary = $78,000; Dividends = $4,000; interest on city of San Francisco bonds = $2,000; a gain of $14,000 on a stock sale and a $4,000 loss on a small sole proprietorship that he owns. a. $78,000 b. $84,000 c. $92,000 d. $96,000 4. Azure Corporation (a C corporation) sold $100,000 of merchandise for which it paid $40,000. It also paid $35,000 of other expenses. All transactions were in cash. What is Azure’s Corporation’s after-tax net cash inflow? a. $21,250 b. $25,000 c. $60,000 d. $100,000 5. Koral Corporation can invest in a project that costs $400,000. The projectisexpectedtohaveanafter-taxreturnof$250,000ineachof years 1 and 2. Koral normally uses a 10 percent discount rate to…arrow_forwardA company with no debt financing has EBIT of $1000. The corporate tax rate is 40%. So the company's net income is $600. What would be the return to all investors if the company had been financed partly with debt so that interest expenses was $200?arrow_forward

- Refer to the corporate marginal tax rate information in Table 2.3 . b-1 Compute the average tax rate for a corporation with exactly $335,001 in taxable income. Average tax rate % b-2 What is the average tax rate for a corporation with exactly $18,333,334? Average tax rate % c. The 39 percent and 38 percent tax rates both represent what is called a tax “bubble.” Suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $216,000. What would the new 39 percent bubble rate have to be? (Round your answer to 2 decimal places. (e.g., 32.16)) Bubble rate %arrow_forwardMa4. The difference between LIFO and FIFO valuation methods is $2,500. Given that the corporation pays a 35% tax rate, what is the savings to the organization to use the LIFO method of accounting.arrow_forwardKk.323.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education