FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello can I find the Total asset turnover ratio, Fixed asset turnover ratio, Receivables turnover ratio, Inventory turnover ratio, Accounts payable turnover ratio, and Cash conversion cycle length for 2021 and 2020?

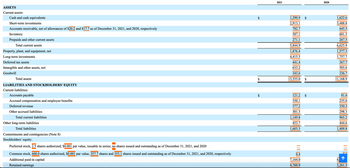

Transcribed Image Text:ASSETS

Current assets:

Cash and cash equivalents

Short-term investments

Accounts receivable, net of allowances of $20.2 and $17.7 as of December 31, 2021, and 2020, respectively

Inventory

Prepaids and other current assets

Total current assets

Property, plant, and equipment, net

Long-term investments

Deferred tax assets

Intangible and other assets, net

Goodwill

Total assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

Accrued compensation and employee benefits

Deferred revenue

Other accrued liabilities

Total current liabilities

Other long-term liabilities

Total liabilities

Commitments and contingencies (Note 8)

Stockholders' equity:

Preferred stock, 2.5 shares authorized, $0.001 par value, issuable in series; no shares issued and outstanding as of December 31, 2021, and 2020

Common stock, 600.0 shares authorized, $0.001 par value, 357.7 shares and 353.1 shares issued and outstanding as of December 31, 2021, and 2020, respectively

Additional paid-in capital

Retained earnings

$

2021

1,290.9

2,913.1

782.7

587.1

271.1

5,844.9

1,876.4

4,415.5

441.4

633.2

343.6

13,555.0

121.2

350.1

377.2

301.3

1,149.8

453.7

1,603.5

=

0.4

7,164.0

4,760.9

$

$

$

2020

1,622.6

3,488.8

645.5

601.5

267.5

6,625.9

1,577.3

1,757.7

367.7

503.6

336.7

11,168.9

81.6

235.0

350.3

298.3

965.2

444.6

1,409.8

BLITT

6.

3,261.3

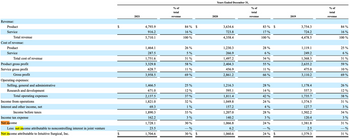

Transcribed Image Text:Revenue:

Product

Service

Total revenue

Cost of revenue:

Product

Service

Total cost of revenue

Product gross profit

Service gross profit

Gross profit

Operating expenses:

Selling, general and administrative

Research and development

Total operating expenses

Income from operations

Interest and other income, net

Income before taxes

Income tax expense

Net income

Less: net income attributable to noncontrolling interest in joint venture

Net income attributable to Intuitive Surgical, Inc.

$

$

2021

4,793.9

916.2

5,710.1

1,464.1

287.5

1,751.6

3,329.8

628.7

3,958.5

1,466.5

671.0

2,137.5

1,821.0

69.3

1,890.3

162.2

1,728.1

23.5

1,704.6

% of

total

revenue

84% $

16%

100 %

26%

5%

31%

58 %

11%

69 %

25 %

12%

37%

32%

1%

33 %

3%

30%

- %

30% $

Years Ended December 31,

2020

3,634.6

723.8

4,358.4

1,230.3

266.9

1,497.2

2,404.3

456.9

2,861.2

1,216.3

595.1

1,811.4

1,049.8

157.2

1,207.0

140.2

1,066.8

6.2

1,060.6

% of

total

revenue

83% $

17%

100 %

28 %

6%

34%

55 %

11%

66 %

28%

14%

42%

24 %

4%

28%

3%

24 %

-%

24% $

2019

3,754.3

724.2

4,478.5

1,119.1

249.2

1,368.3

2,635.2

475.0

3,110.2

1,178.4

557.3

1,735.7

1,374.5

127.7

1,502.2

120.4

1,381.8

2.5

1,379.3

% of

total

revenue

84 %

16%

100%

25%

6%

31%

59%

10%

69%

26%

12%

38 %

31%

3%

34%

3%

31%

-%

31%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A fixed stream of cash flows occurring at the beginning of each period for a fixed period of time is known as: Select one: a. Ordinary annuity b. Constant annuity c. Annuity due d. Financial annuityarrow_forwardDistinguish between annual income in the presence of depreciation and annual operating cash flow?arrow_forwardFind the internal rate of return (IRR) for the following cash flows. Enter your answer as a percent and include at least two decimal points, e.g., 8.35 for 8.35 %, not 0.08. Year Cash Flow 0 750 1 200 2 375 3 250 4 100 5 75arrow_forward

- Direction: Define, draw the cash flow diagram, and write the general formula of the following: ANNUITY 1. Ordinary Annuity a) Sum/Future of Ordinary Annuity b) Present Worth of Ordinary Annuity 2. Annuity Due 3. Deferred Annuityarrow_forwardWhich of the following ratios would a lender find most useful in monitoring a borrower's ability to make loan payments? () PE ratio Return on assets Total asset turnover Inventory turnover () Cash coverage ratio Previous Page Next Page Page 6arrow_forwardThe following information relates to four assets: Probability Return on E Return on F Return on G Return on H 0.1 10% 6% 14% 2% 0.2 10% 8% 12% 6% 0.4 10% 10% 10% 9% 0.2 10% 12% 8% 15% 0.1 10% 14% 6% 20% (a) What is the expected return for each of the assets? (4) (b) Calculate the variance of each asset. (8) (c) Determine the covariance of asset F and G. (4) (d) What is the correlation coefficient between assets F and G? (4)arrow_forward

- How do you take the present value of a stream of cash flows. How does it work for annual payments, weekly payments, quarterly payments, and monthly payments? Provide examples of eacharrow_forwardPerform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth).arrow_forwardPlease help mearrow_forward

- Consider the table given below to answer the following question. Year 1 2 3 4 7 9. 10 Asset value 13.00 14.56 16.31 18.26 19.91 21.70 23.65 25.07 26.58 28.17 Earnings 1.56 1.75 1.96 2.19 2.39 2.50 2.60 2.63 2.13 2.25 Net investment 1.56 1.75 1.96 1.64 1.79 1.95 1.42 1.50 1.59 1.69 Free cash flow (FCF) 0.55 0.60 0.54 1.18 1.13 0.53 0.56 Return on equity (ROE) 0.12 0.12 0.12 0.12 0.12 0.115 0.11 0.105 0.08 0.08 Asset growth rate Earnings growth rate 0.12 0.12 0.12 0.09 0.09 0.09 0.06 0.06 0.06 0.06 0.12 0.12 0.12 0.09 0.04 0.04 0.01 -0.19 0.06 Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7, 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? Assume 11% cost of capital. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) X Answer is complete but not entirely correct. Present value 2$ 19.72 X million 6.arrow_forwardWhich figure of merit provides an interest rate at which the present value of the future cash flows equals the amount invested? a) NPV b) IRR c) Cap Rate d) DCF Please ensure accuracy and explain your choicearrow_forwardCompute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018; confirm that RNOA= NOPM x NOAT.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education