Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

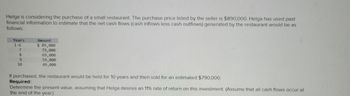

Transcribed Image Text:Helga is considering the purchase of a small restaurant. The purchase price listed by the seller is $890,000. Helga has used past

financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as

follows:

Years

1-6

7

8

9

10

Amount

$ 89,000

79,000

69,000

59,000

49,000

If purchased, the restaurant would be held for 10 years and then sold for an estimated $790,000.

Required:

Determine the present value, assuming that Helga desires an 11% rate of return on this investment. (Assume that all cash flows occur at

the end of the year.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $105,000, and if you sold it today, you would net $120,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $35,000 plus an initial investment of $4,800 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Price you paid for the space two years ago. B. Capital expenditure to outfit the space. C. Feasibility study for the new coffee shop. D. Initial investment in inventory. E. Amount you would net after taxes should you sell the space today. Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar.) 1 Opportunity Cost $ 2 Capital Expenditure (outfit of space) $ 3 Change in Net Working Capital $ $ 4 Free Cash Flowarrow_forwardDaniel runs a bakery. The cash flow estimate for the bakery is $95,600, with a 35% probability, and $60,500, with a 65% probability. The present value factor is 0.95238. Given this information, what is the expected cash flow? $72,785 $100,380.10 $27,314 $91,047.53arrow_forwardWildcat Pizza, Inc. would like to open a new restaurant in Boston. The initial investment to purchase the building is $420,000, and an additional $50,000 in working capital is required. Since this store will be operating for many years, the working capital will not be returned in the near future. Wildcat expects to remodel the store at the end of 3 years at a cost of $100,000. Annual net cash receipts from daily operations (cash receipts minus cash payments) are expected to be as follows: Year 1 $80,000 Year 2 $115,000 Year 3 $118,000 Year 4 $140,000 Year 5 $155,000 Year 6 $167,000 Year 7 $175,000 The company’s required rate of return is 13 percent. Assume management decided to limit the analysis to 7 years. Find the net present value of this investment. = 81, 067 Use trial and error to approximate the internal rate of return for this investment proposal. Calculate the payback period (include working capital in the initial investment).…arrow_forward

- Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Colby Hepworth has just invested $550,000 in a book and video store. She expects to receive a cash income of $120,000 per year from the investment. b. Kylie Sorensen has just invested $1,700,000 in a new biomedical technology. She expects to receive the following cash flows over the next 5 years: $350,000, $490,000, $850,000, $480,000, and $370,000. c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year. d. Rahn Booth invested $1,500,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years. Required: 1. What is the payback period for Colby? Round your answer to two decimal places. years 2. What is the payback period for Kylie? Round your answer to one decimal place. years 3. How much did Carsen invest in the project? 4. How much cash does Rahn receive each year? per yeararrow_forward22. John Wiggins is considering the purchase of a small restaurant. The purchase price listed by the seller is $840,000. John has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forwardam. 105.arrow_forward

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardMr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows: Windy Acres Yearly Aftertax Cash Inflow 30,000 35,000 50,000 65,000 70,000 Coefficient of Variation 0-0.35 0.35-0.40 0.40-0.50 Over 0.50 Windy Acres Hillcrest Apartments Mr. Backster is likely to hold the apartment complex of his choice for about 25 years and will use this period for decision-making purposes. Either apartment can be purchased for $175,000. Mr. Backster uses a risk-adjusted discount rate approach when evaluating investments. His scale is related to the coefficient of variation (for other types of investments, he also considers other measures). Hillcrest Windy Acres Probability 0.2 O Both 0.2 0.2 0.2 0.2 None Discount Rate 7% O Both O None Hillcrest Apartments 12 15 not considered Yearly Aftertax Cash Inflow a.…arrow_forwardDonna Clark wants to open a restaurant in a historic building. The property can be leased for 20 years but not purchased. She believes her restaurant can generate a net cash flow of $75,000 the first year and expects an annual growth rate of 4 percent thereafter. If a discount rate of 17 percent is used to evaluate this business, what is the present value of the cash flows that it will generate? (Round factor values to 5 decimal places, e.g. 1.52145 and final answer to 2 decimal places, e.g. 52.75.) Present value tAarrow_forward

- The owner of a pizza restaurant needs to buy a new pizza oven for the restaurant. The oven costs $450, is expected to last 5 years, and will be depreciated using the straight line method. If the total cash inflows from the new oven are constant at $750 for the next 5 years, and the total cash outflows are constant at $380 for the next 5 years, determine the cash flow for the pizza restaurant in the second year assuming the tax rate is 34%. $ Place your answer in dollars and cents.arrow_forwardHow do I solve for the chart?arrow_forwardplease show the cash flow diagram and complete given and solution. thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education