Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

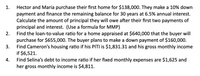

Transcribed Image Text:Hector and Maria purchase their first home for $138,000. They make a 10% down

payment and finance the remaining balance for 30 years at 6.5% annual interest.

Calculate the amount of principal they will owe after their first two payments of

principal and interest. (Use a formula for MMP)

Find the loan-to-value ratio for a home appraised at $640,000 that the buyer will

purchase for $655,000. The buyer plans to make a down payment of $160,000.

Find Cameron's housing ratio if his PITI is $1,831.31 and his gross monthly income

if $6,521.

Find Selina's debt to income ratio if her fixed monthly expenses are $1,625 and

her gross monthly income is $4,811.

1.

2.

3.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (3).arrow_forwardMystia Green is considering the purchase of a house, which will cost her $450,000. She will borrow the entire purchase price and make monthly payments over the next twenty years. The first payment is due next month, and the interest rate is 6.50% per annum (p.a.), compounded monthly She will owe $_________on the house immediately following the 121 st payment.arrow_forwardJanet's parents want her to go to the same college that they did. They decided to pay a lump sum payment today of $126000 so she will be able to make 4 years of quarterly withdrawals. The college provide an annuity of 6%, compounded quarterly. If Janet will make her first withdrawal in 8 years, what is the size of each withdrawal?arrow_forward

- Jenny and Leo plan to purchase a new house and the couple is able to obtain a 25-year 3.6% (per annum, compounded monthly) amortised loan but they must put down 20% deposit. The loan requires end-of-month repayments of $2,500 where the first payment is due a month after the loan is taken. Assuming that the couple has enough savings for the down payment, what is the cost of the house that they want to purchase? a. 494,068.50 b. 2,470,342.49 c. 750,000 Od. 617,585.62arrow_forwardBryce and David plan to purchase a home for $176,000. They will pay 20% down and finance the remainder for 15 years at the APR of 8.2%, compounded monthly. a) How large are the monthly payments? $ b) What will be their loan balance right after they have made their 156th payment? $ c) How much interest will they pay during the 13th year of the loan? $ d) If they were to increase their montly payments by $120, how long would it take to pay off the loan? Give your answer in whole months.arrow_forwardA couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 23.00 years and pool the money into a savings account that pays 3.00% APR. They plan on living for 28.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? Yearly Contribution $1,000.00 $10,000.00 Account Fidelity Mutual Fund Vanguard Mutual Fund Employer 401k Balance $23,186.00 $180,962.00 $315,917.00 Submit Answer format: Currency: Round to: 2 decimal places. $15,000.00 APR 6.00% 8.00% 6.00%arrow_forward

- A couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $40,000 when the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly. (Round your answer to two decimal places.)arrow_forwardAmy purchases an annuity that will give her payments of R at the end of each quarter for seven years. She will receive the first of these payments in 1.5 years. If Amy paid $50,000 for this annuity and will earn a nominal rate of interest of 6% compounded quarterly,(a) write the equation of value (using the appropriate actuarial notation) for this annuity at the time of purchase. Be sure to indicate the effective rate per payment period being used.(b) find the value of R.arrow_forwardA couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have 39,000$ When the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly.?round your answer to two decimal places.arrow_forward

- Mikayla and Peyton plan to send their son to university. To pay for this they will contribute 9 equal yearly payments to an account bearing interest at the APR of 8.6%, compounded annually. Four years after their last contribution, they will begin the first of five, yearly, withdrawals of $57,300 to pay the university's bills. How large must their yearly contributions be?arrow_forwardA couple is saving for retirement with three different accounts. The table below shows the current balances in their accounts, along with their yearly contribution, and the yearly return on each account. The couple will retire in 22.00 years and pool the money into a savings account that pays 4.00% APR. They plan on living for 27.00 more years and making their yearly withdrawals at the beginning of the year. What will be their yearly withdrawal? Yearly Contribution Account Fidelity Mutual Fund Vanguard Mutual Fund Employer 401k Balance $24,316.00 $184,560.00 $304,945.00 $1,000.00 $10,000.00 $15,000.00 APR 6.00% 8.00% 6.00%arrow_forwardCindy and Rick purchased a home for $145,000 and financed it with a 30-year fixed-rate loan at 6.25% annual interest. If they put a 20% down payment on the house, what would be their monthly payment for principal and interest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education