FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

An annual report for International Paper Company included the following note:

The last-in, first-out inventory method is used to value most of International Paper’s U.S. inventories . . . If the first-in, first-out method had been used, it would have increased total inventory balances by approximately $293 million and $290 million at December 31, 2017, and 2016, respectively.

For the year 2017, International Paper Company reported net income (after taxes) of $2,144 million. At December 31, 2017, the balance of International Paper Company’s

Transcribed Image Text:2. Determine the amount of retained earnings that International Paper would have reported at the end of 2017 if it always had used

the FIFO method (assume a 30 percent tax rate). (Enter your answer in millions. Do not round your intermediate calculations.

Round your final answer to the nearest whole number.)

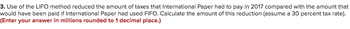

Transcribed Image Text:3. Use of the LIFO method reduced the amount of taxes that International Paper had to pay in 2017 compared with the amount that

would have been paid if International Paper had used FIFO. Calculate the amount of this reduction (assume a 30 percent tax rate).

(Enter your answer in millions rounded to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In its 2016 income statement, Hendrickson Company reported cost of goods sold of $340,000. Later, Hendrickson determined that beginning inventory for 2016 was understated by $92,000, and the ending inventory for 2016 was understated by $40,000. What should be the corrected amount for cost of goods sold for 2016? A) $340,000 B) $392,000 C) $288,000 D) $380,000arrow_forwardThe following information is available for Sandhill Co. for three recent fiscal years. 2017 2016 2015 Inventory $562,019 $571,288 $327,592 Net sales 1,955,632 1,697,750 1,304,721 Cost of goods sold 1,522,434 1,280,731 939,086 Calculate the inventory turnover, days in inventory, and gross profit rate for 2017 and 2016. (Round inventory turnover to 1 decimal place, e.g. 5.2, days in inventory to 0 decimal places, e.g. 125 and gross profit rate to 1 decimal place, e.g. 5.2%.) 2017 2016 Inventory Turnover times times Days in Inventory days days Gross Profit Rate % %arrow_forwardWant to give you a correct answerarrow_forward

- 6. On January 1, 2011, Folk Company changed from the average cost method to the FIFO method to account for its inventory. Ending inventory for each method was given below. Folk Company accrues tax expense on December 31 of each year and pays the tax in April of the following year. The income tax rate is 30%. What is the net income to be reported in 2011 after the change to the FIFO inventory method? a. 1,610,000 b. 2,300,000 c. 1,750,000 d. 1,890,000arrow_forwardAmount of finished products inventory for 2017 in the Notes to the Consolidated Financial Statements. (Enter your answer in millions.) The company’s effective income tax rate for 2017 in the Notes to the Consolidated Financial Statements. (Round your percentage answer to 1 decimal place.)arrow_forwardRomanoff Industries had the following inventory transactions occur during 2013: Units Cost/unit 2/1/13 Purchase 18 $45 3/14/13 Purchase 31 $47 5/1/13 Purchase 22 $49 The company sold 50 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? a. $1,106 b. $1,184 c. $2,316 d. $2,394arrow_forward

- During 2021, Sheridan Company purchased $4100000 of inventory. The cost of goods sold for 2021 was $4049000 and the ending inventory at December 31, 2021, was $410000. What was the inventory turnover for 2021? a. 9.9. b. 10.5. c. 11.3. d. 9.4.arrow_forwardOn January 1, 2024, the Coldstone Corporation adopted the dollar-value LIFO retail inventory method. Beginning inventory at cost and at retail were $170,000 and $273,000, respectively. Net purchases during the year at cost and at retail were $719,200 and $890,000, respectively. Markups during the year were $9,000. There were no markdowns. Net sales for 2024 were $844,400. The retail price index at the end of 2024 was 1.05. What is the inventory balance that Coldstone would report in its 12/31/2024 balance sheet? Note: Do not round intermediate calculations. Multiple Choice $249,600 $327,600 $202,760 $262,080arrow_forwardDuring 2017, Windsor Inc. changed from LIFO to FIFO inventory pricing. Windsor began operations in 2015 and its pretax income in 2016 and 2015 under LIFO was $610,000 and $706,000, respectively. Pretax income using FIFO pricing in the prior years would have been $636,000 in 2015 and $762,000 in 2016. In 2017, Windsor reported pretax income using FIFO pricing of $731,000. Show comparative income statements for Windsor beginning with “Income before income tax,” as presented in the 2017 income statement. The tax rate for all years is 30%. 2017 2016 2015 Income before income tax $enter a dollar amount $enter a dollar amount $enter a dollar amount Income tax enter a dollar amount enter a dollar amount enter a dollar amount Net Income $enter a total amount $enter a total amountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education