FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Content

Latu.edu/ultra/courses/_25163_1/cl/outline

Remaining Time: 49 minutes, 32 seconds.

Question Completion Status:

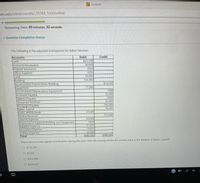

The following is the adjusted trial balance for Baker Services.

Debit

Credit

Accounts

Cash

Accounts Receivable

Prepaid Insurance

Office Supplies

Land

Building

Accumulated Depreciation-Building

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Salaries Payable

Unearned Revenue

Mortgage Payable

Baker, Capital

Baker, Withdrawals

Service Revenue

Salaries Expense

Depreciation Expense-Building and Equipment

Supplies Expense

Insurance Expense

Utilities Expense

Total

$31,100

30,000

3500

3200

59,000

150,000

$14,500

77,000

7000

25,000

2000

26,000

106,000

34,500

23,000

275,000

64,000

5600

11,000

14,600

18,000

$480,000

$480,000

There were no new capital contributions during the year. After the closing entries are posted, what is the balance in Baker, Capital?

O $173,300

O $1500

O $163,300

O $209,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identify the current liability associated with each of the following operating activities 1-Perform work on a warranty claim 2-Pay income taxes 3-Purchases supplies 4-Pay payroll taxes 5-Borrow money for operations using a short term note 6-Process cash received in advance from customers 7-Purchase inventory 8- Pay employee salariesarrow_forwardThe following information relates to SaveSA, a service enterprise: Pre adjusted trial balance of SaveSA at 28 February 202 3. Debit Credit R R. Land and buildings at cost 130 000 Furniture and fittings at cost 50 000 Accumulated depreciation - 28/02/2022: Furniture and Fittings 5000 15% Mortgage bond secured by land & buildings 50 000 Capital 95 500 Trade debtors 23 350 Trade creditors 13 400 Bank overdraft 960 Drawings 7 300 Petty cash 550 Stationery 2 450 Salaries 35 10 0 Insurance 9 500 Electricity 11 000 Telephone 1 860 Fees earned 89 500 Rent income 17 500 Bank charges 750 271 860 271 860 Additional Information: 1. The Account of S Sorry, a debtor owing R200 must be written off. 2. A provision for doubtful debts at 5% on outstanding trade debtors balances still to be created. 3. Rent income amounts to R950 per month and the rental has been charged for the year. 4. Provide for interest for the year still outstanding on mortgage bond. 5. Provide for depreciation on furniture and…arrow_forwardDon't give answer in image formatarrow_forward

- Blue Spruce Corp. had the following items to report on its balance sheet: Employee advances Amounts owed by customers for the sale of services (due in 30 days) Refundable income taxes Interest receivable Accepted a formal instrument of credit for services (due in 18 months) A loan to company president Dishonored a note for principal and interest which will eventually be collected $17870 $15650 $20920 $1520 $14270 3190 1300 1050 2380 Based on this information, what amount should appear in the "Other Receivables" category? 10400 1380arrow_forwardCan you provide the statement of profit and loss please Thanks in advancearrow_forwardThe following information relates to Automative Services on 30 June 2021. Vehicles Service Revenue Wages Expenses Cash at Bank Prepaid Insurance Wages Payable Depreciation expense Vehicles Accounts receivable Supplies Expense Supplies Unearned revenue 135,000 160,000 72,000 97,500 13,500 33,750 13,500 13,200 6,000 6,500 12,500 2,750 11,100 9,750 Drawings Electricity Expense Accounts payable Capital Loan payable (due in 2021) Loan payable (due in 2025) Land Accumulated Depreciation- Vehicles Required: Prepare a fully classified Balance Sheet in narrative format for the financial year. 25,000 17,500 250,000 60,000arrow_forward

- The following items are taken from the financial statements of the Riverbed Service for the year ending December 31, 2020: Accounts payable $ 18400 Accounts receivable 11000 Accumulated depreciation – equipment 27800 Advertising expense 20900 Cash 15000 Owner’s capital (1/1/20) 100600 Owner's drawings 13800 Depreciation expense 12300 Insurance expense 3100 Note payable, due 6/30/21 69200 Prepaid insurance (12-month policy) 6200 Rent expense 16900 Salaries and wages expense 31800 Service revenue 132300 Supplies 4100 Supplies expense 5900 Equipment 207300 What is the balance that would be reported for owner’s equity at December 31, 2020?arrow_forward37 )arrow_forwardpls answer thanks.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education