FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Mike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following transactions were completed.

List of accounts:

- Accounts Payable

Accounts Receivable Accumulated Depreciation -Buildings- Accumulated Depreciation-Equipment

- Accumulated Depreciation-Delivery Trucks

- Advertising Expense

- Buildings

- Cash

- Debt Investments

- Delivery Trucks

- Depreciation Expense

- Equipment

- Gasoline Expense

- Income Summary

- Income Tax Expense

- Income Taxes Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Long-term Debt

- Long-term Investments

- Maintenance and Repairs Expense

- Miscellaneous Expense

- Mortgage Payable

- No Entry

- Notes Payable

- Notes Receivable

- Owner's Capital

- Owner's Drawings

- Patent Needs

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Salaries and Wages Expense

- Salaries and Wages Payable

- Service Revenue

- Short-Term Investments

- Stock Investments

- Supplies

- Supplies Expense

- Ticket Revenue

- Unearned Rent Revenue

- Unearned Service Revenue

- Utilities Expense

| July 1 | Owner invested $9,800 cash in the company. | ||

| 1 | Purchased used truck for $6,560, paying $1,640 cash and the balance on account. | ||

| 3 | Purchased cleaning supplies for $740 on account. | ||

| 5 | Paid $1,440 cash on a 1-year insurance policy effective July 1. | ||

| 12 | Billed customers $3,030 for cleaning services performed. | ||

| 18 | Paid $820 cash on amount owed on truck and $410 on amount owed on cleaning supplies. | ||

| 20 | Paid $1,640 cash for employee salaries. | ||

| 21 | Collected $1,310 cash from customers billed on July 12. | ||

| 25 | Billed customers $2,050 for cleaning services performed. | ||

| 31 | Paid $240 for maintenance of the truck during month. | ||

| 31 | Owner withdrew $490 cash from the company. |

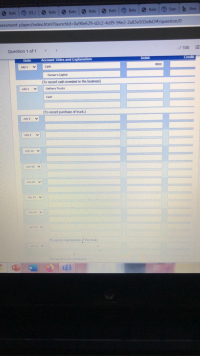

Journalize the July transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Below is a trial balance as of 12-31-2019 for Richmond Field Inc. Cash Accounts receivable Inventory Property, plant, and equipment Accumulated depreciation Accounts payable and accrued liabilities Income taxes payable Bonds payable Deferred income tax liability Common stock Additional paid-in capital Retained earnings, 1/1/18 Sales Sales returns and allowances Rental income Dividend income Cost of goods sold Salary expenses All other employee expenses Advertising expense Insurance expense Last name begins with Travel expenses All other expenses Loss on discontinued division Income tax rate is 20% and tax has not been included in trial balance. Dr. Problem 2 Prepare a balance sheet as of 12/31/19 for Richmond Field Inc A-F Trial Balance Cr. 1,775,000 2,695,000 2,085,000 8,566,000 Problem 1 Prepare a multiple step income statement for 2019 for Richmond Field. The tax rate is 20% 40,000 8,500,000 2,600,000 500,000 50,000 50,000 150,000 125,000 300,000 27,436,000 1,000,000 1,211,000…arrow_forwardSe.104.arrow_forwardThese items are taken from the financial statements of Sarasota Corp. at December 31, 2025. Buildings Accounts receivable Prepaid insurance Cash Equipment Land Office expense Income tax expense Depreciation expense Interest expense Common shares Retained earnings (January 1, 2025) Accumulated depreciation-buildings Accounts payable Income taxes payable Bank loan payable (due July 1, 2027) Accumulated depreciation-equipment Interest payable Service revenue (a) Calculate the net income for the year. Net income $ $123,800 14,700 5,480 13,850 96,400 71,600 680 232 6,240 3,040 72,500 46,800 53,400 9,830 1,290 109,500 21,900 4,210 16,592arrow_forward

- Prepare an income statement with the information below. Need asap.arrow_forwardFollowing are the financial statements and other supplementary information for Summer Corporation for its year-ended December 31, 2022: Sales Cost of goods sold Gross Margin Depreciation Expense Wage Expense Other operating expenses Interest Expense Loss on Sale of Equipment Income Before Tax Income Tax Expense Net Income Current Assets Cash Accounts receivable Inventory Prepaid Expenses Non-Current Assets Equipment Accumulated Depreciation Total Assets Current Liabilities Accounts Payable Income Taxes Payable Wages Payable barnet Davable $1,055,000 (545,000) 510,000 (37,000) (103,000) (55,000) (25,000) (Z.800) 282,200 (112,880) $169,320 2022 $102,560 98,000 85,900 6,700 275,000 (54,000) $514,160 $32,500 5,600 8,800 6,500 Long-Term Liabilities and Shareholders' Equity LT Notes Payable Common Shares Retained Earnings Total Liabilities and Shareholders' Equity 6,500 2021 $145,000 -42,440 110,000 -12,000 43,000 42,900 1,200 5,500 Change 125,000 150,000 (25,000) 29,000 $399,200 114,960…arrow_forwardRahularrow_forward

- College Spirit sells sportswear with logos of major universities. At the end of 2019, the followingbalance sheet account balances were available.Accounts payable $104,700Accounts receivable 6,700Accumulated depreciation 23,700Bonds payable 180,000Cash 13,300Common stock 300,000Furniture 88,000Income taxes payable $ 11,400Inventory 481,400Long-term investment 110,900Note payable, short-term 50,000Prepaid rent (current) 54,000Retained earnings, 12/31/2019 84,500Required:1. Prepare a classified balance sheet for College Spirit at December 31, 2019.2. Compute College Spirit’s working capital and current ratio at December 31, 2019.3. CONCEPTUAL CONNECTION Comment on College Spirit’s liquidity as of December 31,2019.arrow_forwardThe following items are taken from the financial statements of the Riverbed Service for the year ending December 31, 2020: Accounts payable $ 18400 Accounts receivable 11000 Accumulated depreciation – equipment 27800 Advertising expense 20900 Cash 15000 Owner’s capital (1/1/20) 100600 Owner's drawings 13800 Depreciation expense 12300 Insurance expense 3100 Note payable, due 6/30/21 69200 Prepaid insurance (12-month policy) 6200 Rent expense 16900 Salaries and wages expense 31800 Service revenue 132300 Supplies 4100 Supplies expense 5900 Equipment 207300 What is the balance that would be reported for owner’s equity at December 31, 2020?arrow_forwardThe following balances were taken from the books of Bonita Corp. on December 31, 2020. Interest revenue $87,400 Accumulated depreciation—equipment $41,400Cash 52,400 Accumulated depreciation—buildings 29,400Sales revenue 1,381,400 Notes receivable 156,400Accounts receivable 151,400 Selling expenses 195,400Prepaid insurance 21,400 Accounts payable 171,400Sales returns and allowances 151,400 Bonds payable 101,400Allowance for doubtful accounts 8,400 Administrative and general expenses 98,400Sales discounts 46,400 Accrued liabilities 33,400Land 101,400 Interest expense 61,400Equipment 201,400 Notes payable 101,400Buildings 141,400 Loss from earthquake damage 151,400Cost of goods sold 622,400 Common stock 501,400 Retained earnings 22,400 Assume the total effective tax rate on all items is 20%. Prepare a multiple-step income statement; 100,000 shares of common stock were outstanding during the year. (Round earnings per share to 2 decimal places, e.g. 1.48.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education