FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

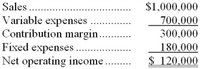

The following is Addison Corporation's contribution format income statement for last month:

The company has no beginning or ending inventories. A total of 20,000 units were produced and sold last month.

1. What is the company's contribution margin ratio?

250%

B. 150%

C. 70%

D. 30%

2. What is the company's break-even in units?

20,000 units

B. 0 units

C. 18,000 units

D. 12,000 units

3. If sales increase by 100 units, by how much should net operating income increase?

$400

B. $4,800

C. $1,500

D. $2,500

Transcribed Image Text:Sales .

Variable expenses

Contribution margin

Fixed expenses.

Net operating income.

$1,000,000

700,000

300,000

180,000

$ 120.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Green and White Company reported the following monthly data: 3,600 units $ 27 per unit $ 2 per unit $ 3 per unit $ 3.50 per unit $ 14,400 in total $0.50 per unit Units produced Sales price Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses What is Green and White's contribution margin for this month if 1,140 units were sold? Multiple Choice O $64,800 O $20,520 $30,780 $97,200 $3,600 in total $25,080arrow_forwardAssume that Corn Co. sold 7,800 units of Product A and 2,200 units of Product B during the past year. The unit contribution margins for Products A and B are $34 and $63, respectively. Corn has fixed costs of $370,000. The break-even point in units is a.7,330 units b.9,163 units c.10,996 units d.13,744 unitsarrow_forwardAssume that Corn Co. sold 6,900 units of Product A and 3,100 units of Product B during the past year. The unit contribution margins for Products A and B are $33 and $56, respectively. Corn has fixed costs of $398,000. The break-even point in units is a.11,901 units b.14,877 units c.9,918 units d.7,934 unitsarrow_forward

- iller Company's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (32,000 units) $ 160,000 $5.00 Variable expenses 64,000 2.00 Contribution margin 96,000 $ 3.00 Fixed expenses 50,000 Net operating income $ 46,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 12% ? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 22% ? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 4% ? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 12% ?arrow_forwardABC Corporation has sold 1,000 units of product in a month and provided the following contribution format income statement. Assume that the following information is within the relevant range.Total sales revenue 50,000 Total variable expenses 32,000 Contribution margin 18,000 Fixed expenses $ 12,000 Net operating income 6,000 The break-even point in unit sales is closest to:arrow_forwardJilk Incorporated's contribution margin ratio is 61% and its fixed monthly expenses are $48,500. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $139,000? $84,790 $5,710 $36,290 $90,500arrow_forward

- Subject: accountingarrow_forwardTt2.arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 32.00 19.00 $13.00 Sales (8,300 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 265,600 157,700 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 8 $ 107,900 55,200 $ 52,700 1. What would be the revised net operating income per month if the sales volume increases by 80 units? 2. What would be the revised net operating income per month if the sales volume decreases by 80 units? 3. What would be the revised net operating income per month if the sales volume is 7,300 units?arrow_forward

- Rovinsky Corp, a company that produces and sells a single product, has provided its contribution format income statement for November. Sales (5,700 units) $319,200 Variable Expenses 188,100 Contribution Margin 131,100 Fixed Expenses 106,500 Net Operating Income 24,600 Calculate the breakeven point in: a. sales units (round to the nearest whole unit) b. and sales dollarsarrow_forwardMiller Company’s contribution format income statement for the most recent month is shown below: Total Per Unit Sales (36,000 units) $ 180,000 $ 5.00 Variable expenses 72,000 2.00 Contribution margin 108,000 $ 3.00 Fixed expenses 43,000 Net operating income $ 65,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 17%? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 24%? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 3%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 13%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education