FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left 150 bikes in ending inventory. The income statement information under variable costing follows.

| Sales (225 × $1,600) | $ | 360,000 | |

| Variable product cost (225 × $625) | 140,625 | ||

| Variable selling and administrative expenses (225 × $65) | 14,625 | ||

| Contribution margin | 204,750 | ||

| Fixed |

56,250 | ||

| Fixed selling and administrative expense | 75,000 | ||

| Net income | $ | 73,500 | |

1. Prepare this company's income statement for its first month of operations under absorption costing.

2. Fill in the blanks:

Transcribed Image Text:Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement

under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left

150 bikes in ending inventory. The income statement information under variable costing follows.

Sales (225 x $1,600)

$ 360,000

Variable product cost (225 x $625)

Variable selling and administrative expenses (225 x $65)

Contribution margin

140,625

14,625

204,750

Fixed overhead cost

56,250

Fixed selling and administrative expense

75,000

Net income

73,500

1. Prepare this company's income statement for its first month of operations under absorption costing.

2. Fill in the blanks:

O Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Fill in the blanks:

The dollar difference in variable costing income and absorption costing income

fixed overhead per

units

unit.

< Required 1

Required 2

Transcribed Image Text:Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement

under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left

150 bikes in ending inventory. The income statement information under variable costing follows.

Sales (225 x $1,600)

Variable product cost (225 x $625)

Variable selling and administrative expenses (225 x $65)

Contribution margin

$ 360,000

140,625

14,625

204,750

Fixed overhead cost

56,250

Fixed selling and administrative expense

75,000

Net income

73,500

1. Prepare this company's income statement for its first month of operations under absorption costing.

2. Fill in the blanks:

O Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

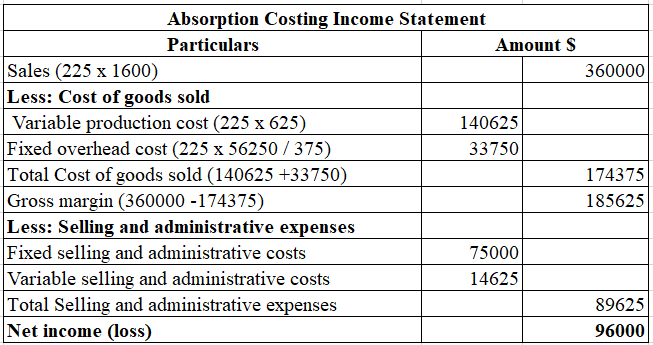

Prepare this company's income statement for its first month of operations under absorption costing.

HAYEK BIKES

Absorption Costing Income Statement

Sales

360,000 V

Less: Cost of goods sold

Variable product costs

O$ 140,625

Fixed overhead costs

33,750 O

Cost of goods sold

174,375

Gross margin

185,625 O

Variable selling and administrative expenses

14,625

Fixed selling and administrative costs

45.000 x

Total selling general and administrative expenses

59,625

Net income (loss)

2$

126,000 x

Fixed costs added to inventory

< Required 1

Required 2 >

Expert Solution

arrow_forward

Step 1

Answer 1)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 bikes were produced and 225 were sold; this left 150 bikes in ending inventory. The income statement information under variable costing follows. Sales (225 × $1,600) $ 360,000 Variable product cost (225 × $625) 140,625 Variable selling and administrative expenses (225 × $65) 14,625 Contribution margin 204,750 Fixed overhead cost 56,250 Fixed selling and administrative expense 75,000 Net income $ 73,500 1. Prepare this company's income statement for its first month of operations under absorption costing.arrow_forward! Required information [The following information applies to the questions displayed below.] Cool Sky reports the following for its first year of operations. The company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Income Statement (Absorption Costing) 1b. Assume the company uses absorption costing. Prepare its income statement for the year under absorption costing. Sales Cost of goods sold Gross profit Income Income $ $ $ $ 5,040,000 3,240,000 1,800,000 1,404,000 396,000 $ 60 per unit $ 22 per unit $ 8 per unit 528,000 per year $ 11 per unit 105,000 per yeararrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead $ 147 0 6,900 6,600 300 Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $ 24 $ 54 $ 18 $ 18 $ 186,300 $ 27,600 Multiple Choice $114 per unit $141 per unit $123 per unitarrow_forward

- Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $917. Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative 0 13,000 9,000 4,000 1. Absorption costing unit product cost 2. Variable costing unit product cost $ 210 $ 440 $ 58 $18 $ 770,000 $ 550,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing. Compute the unit product cost for one gamelan.arrow_forwardneed helparrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead. Variable selling and administrative expense Multiple Choice Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $110 per unit $137 per unit $143 0 $120 per unit 6,850 6,550 300 $93 per unit $23 $53 $17 $17 $184,950 $ 27,300arrow_forward

- Keyser Corporation, which has only one product, has provided the following data concerning its most recent month of operations Selling price $113 Units in beginning inventory 3700 Units produced 8,600 Units sold 8,700 Units in ending inventory 600 Variable costs per unit: Direct materials: Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense $ 24 $ 41 $5 $ 15 $68,800 $ 162,700 The company produces the same number of units every month, although the sales in units very from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month What is the net operating income for the month under absorption costing?arrow_forwardJax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. Sales price $ 57.50 per unit Direct materials $ 10.50 per unit Direct labor $ 8.00 per unit Variable overhead $ 12.50 per unit Fixed overhead $ 1,237,500 per year 1. Compute gross profit assuming (a) 75,000 units are produced and 75,000 units are sold and (b) 110,000 units are produced and 75,000 units are sold.2. By how much would the company’s gross profit increase or decrease from producing 35,000 more units than it sells?arrow_forwardThe following information was collected for the first year of manufacturing for Appliance Apps: Direct Materials per Unit $2.50 Direct Labor per Unit $1.50 Variable Manufacturing Overhead per Unit $0.25 Variable Selling and Administration Expenses $1.75 Units Produced 39,000 Units Sold 35,000 Sales Price $12 Fixed Manufacturing Expenses $117,000 Fixed Selling and Administration Expenses $20,000 Question Content Area Prepare an income statement under variable costing method. Appliance AppsIncome Statement $- Select - - Select - $- Select - - Select - $- Select - - Select - - Select - $- Select - Question Content Area Prepare a reconciliation to the income under the absorption method. Appliance AppsReconciliation $- Select - - Select - $- Select -arrow_forward

- Grace Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense $6,400 $18,600 $5,600 SS $(20,400) $ $ $ 95 0 3,500 3,100 400 22 What is the net operating income for the month under absorption costing? 2975 39 55,900 3,000arrow_forwardIda Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $840. Selected data for the company's operations last year follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative The absorption costing income statement prepa Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income 0 300 275 25 $ 100 $310 $ 30 $ 35 $ 66,000 $ 31,000 by the company's accountant for last year appears below: $ 231,000 181,500 49,500 40,625 $ 8,875 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. Prepare an income statement for last year using variable costing.arrow_forwardGet Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education