SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Determine the total amount of ending inventory

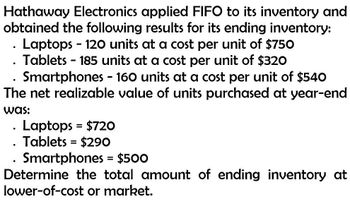

Transcribed Image Text:Hathaway Electronics applied FIFO to its inventory and

obtained the following results for its ending inventory:

•

Laptops - 120 units at a cost per unit of $750

Tablets - 185 units at a cost per unit of $320

Smartphones - 160 units at a cost per unit of $540

The net realizable value of units purchased at year-end

was:

. Laptops = $720

Tablets = $290

. Smartphones = $500

Determine the total amount of ending inventory at

lower-of-cost or market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- calculate exat answerarrow_forwardCrane Company applied FIFO to its inventory and got the following results for its ending inventory. Cameras 100 units at a cost per unit of $60 Blu-ray players 150 units at a cost per unit of $70 iPods 120 units at a cost per unit of $80 The net realizable value at year-end was cameras $70, Blu-ray players $65, and iPods $75.Determine the amount of ending inventory at lower-of-cost-or-net realizable value. Ending inventoryarrow_forwardAll details check and provide solutionarrow_forward

- Lily Company applied FIFO to its inventory and got the following results for its ending inventory. Cameras 135 units at a cost per unit of S65 Blu-ray players 170 units at a cost per unit of S70 iPods 125 units at a cost per unit of $85 The net realizable value at year-end was cameras S73, Blu-ray players $65, and iPods $77. Determine the amount of ending inventory at lower-of-cost-or-net realizable value. Ending inventory %24arrow_forward1arrow_forward1arrow_forward

- expert pleease solve this. General account subject questionarrow_forwardA company adopted the LIFO method when its inventory was $1,800. One year later its ending inventory was $2,100,and costs had increased 5 % during the year.what is the ending inventory using dollar-value LIFO? Round to the nearest dollar.arrow_forwardSLR Corporation has 2,500 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Product 1Product 2Cost$80$50Selling price$145$51Costs to sell$11$3 Determine the carrying value of SLR’s inventory (i.e., ending balance) assuming that the lower of cost or net realizable value (LCNRV) rule is applied to individual products.arrow_forward

- At year-end 20X8, Ancho Canned Chile has 8,000 units on hand at a weighted-average cost of $13 per item. Sales for the year were at $16 per item. Resellers cost Ancho an average $4 per unit. a. What is Ancho’s ending inventory applying LCNRV by item? b. If the loss is not significant enough to warrant disclosure on the income statement, what year-end journal entry does Ancho record? c. If the market value of the inventory increases in the following year, can Ancho recognize the recovery?arrow_forwardA company had the following purchases during the current year: January: February: May: September: November: 10 units at $120 20 units at $125 15 units at $130 12 units at $135 10 units at $140 On December 31, there were 26 units remaining in ending inventory. Using the LIFO inventory valuation method, what is the cost of the ending inventory? ☐ $3,280. ○ $3,200. ○ $3,540. ☐ $3,445. ○ $3,640.arrow_forwardRizza Co. has an average age of inventory equal to 25 days. If its end ofyear inventory level is P8,500, then what does that imply for the cost ofgoods sold during the year? A. P582B. P21,250C. P124,100D. P4964arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT