FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

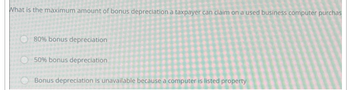

Transcribed Image Text:What is the maximum amount of bonus depreciation a taxpayer can claim on a used business computer purchas

80% bonus depreciation

50% bonus depreciation.

Bonus depreciation is unavailable because a computer is listed property

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the amount of property tax due: Tax rate Assessed value Amount of property tax due 40 mills $65,000arrow_forwardL 16arrow_forward8. Youngstown Decking is an accrual basis taxpayer. On July 1, 2022, Youngstown paid $22,800 cash for a comprehensive liability and property insurance policy that covers a 24-month period. The deduction for insurance expense for 2022 is: a.$11,400. b.$22,800. c.$6,650. d.$5,700. e.$950.arrow_forward

- If you live in a state that needs to collect $18 million in property taxes and has a tax rate of 2.77%, what is that states taxable valuearrow_forward1arrow_forwardA single taxpayer has the following information for 2020: $195,000 23,500 1,500 8,900 14,800 AGI State income taxes State sales tax Real estate taxes Gambling losses (gambling gains were S$5,000) The taxpayer's total allowable itemized deductions for 2020 are: A) $15,000 B) $47,200 C) $38,900 D) $24,800arrow_forward

- In picture below:arrow_forwardQUESTION 8 Given the following information, calculate the total annual tax liability of the homeowner: market value of property: $350,000; assessed value of property: 40% of the market value; exemptions: $2,000; millage rate: 33.95 mills. O $11, 882.50 O $4,753.00 O $4,685.10 O $46,851.00arrow_forwardA taxpayer sold machinery for $24,000 on December 31, 2021. The machinery had been purchased on January 2, 2019 for $30,000, with 100% bonus depreciation being used. For 2021, the taxpayer should report O Ordinary income of $24,000 O $30,000 ordinary income O §1231 gain of $6,000 and ordinary income of $24,000 O §1231 gain of $24,000 and ordinary income of $6,000 O $1231 gain of $24,000 Darrow_forward

- Firm E must choose between two alternative transactions. Transaction 1 requires a $9,150 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $14,800 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 45 percent.arrow_forwardA taxable investment produced interest earnings of $2,800. A person in a 26 percent tax bracket would have after-tax earnings of: (Round your answer to the nearest whole number.) Multiple Choice $2,800. $728. $1,347. $2,072. $2,285.arrow_forwardThe maximum amount a taxpayer may claim for the lifetime learning credit is: $2,000 per return. $2,000 per qualifying student. $2,500 per return. $2,500 per qualifying student.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education