FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

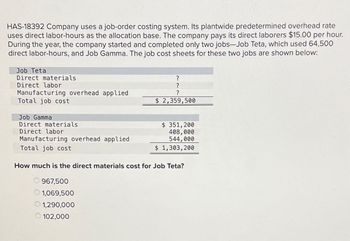

Transcribed Image Text:HAS-18392 Company uses a job-order costing system. Its plantwide predetermined overhead rate

uses direct labor-hours as the allocation base. The company pays its direct laborers $15.00 per hour.

During the year, the company started and completed only two jobs-Job Teta, which used 64,500

direct labor-hours, and Job Gamma. The job cost sheets for these two jobs are shown below:

Job Teta

Direct materials

Direct labor

Manufacturing overhead applied

Total job cost

?

?

?

$ 2,359,500

Job Gamma

Direct materials

Direct labor

Manufacturing overhead applied

Total job cost

$ 351,200

408,000

544,000

$ 1,303,200

How much is the direct materials cost for Job Teta?

967,500

1,069,500

1,290,000

102,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours 30,000 $ 252,000 $ 2.10 Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job T687 was completed with the following characteristics: Number of units in the job 10 Total machine-hours 30 $ 675 $ 1,050 Direct materials Direct labor cost The of overhead applied to Job T687 is closest to: your intermediate calculations decimal places.) Multiple Choice $315 $252 $378 $63arrow_forwardComputing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate Mickley Company’s plantwide predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $ 17.00 per hour. The following information pertains to Job A-500: Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job?arrow_forwardsarrow_forward

- Hilltop Manufacturing uses a predetermined manufacturing overhead rate based on machine hours to allocate manufacturing overhead to jobs. Selected data about the company's operations follows: Actual manufacturing overhead cost $500,000 Estimated manufacturing overhead cost $550,000 Estimated direct labor cost $175,800 Estimated direct labor hours 50,500 Actual direct labor hours 60,700 Estimated machine hours 40,600 Actual machine hours 35,800 By how much was manufacturing overhead overallocated or underallocated for the year? (Round intermediary calculations to the nearest cent.)arrow_forwardVerizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $188,870. Estimated direct labor cost was $456,280 for 18,700 hours. Actual costs for the most recent month are summarized here: Item Description Direct labor (1,500 hours) Indirect costs Indirect labor Indirect materials. Factory rent Factory supervision Factory depreciation Factory janitorial work Factory insurance General and administrative salaries Selling expenses 3. Calculate actual manufacturing overhead costs. 4. Compute over- or underapplied overhead. Required: 1. Calculate the predetermined overhead rate. 2. Calculate the amount of applied manufacturing overhead. 89 Complete this question by entering your answers in the tabs below. SEP Total Cost $ 45,629 84 2,570 3,460 3,240 4,760 5,680 1,230 1,830 4,260 5,380 TAO Oarrow_forwardLupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job T687 was completed with the following characteristics: Number of units in the job Total machine-hours Direct materials Direct labor cost Multiple Choice If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: Note: Round your intermediate calculations to 2 decimal places. O O $113.60 $754.00 $397.60 10 30 $ 690 $ 1,370 $288.40 30,500 $ 610,000 $ 6.00arrow_forward

- Malcolm Company uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. The estimates for the year were: Manufacturing overhead $16,240 Direct labor hours 11,600 The actual results for the year were: Manufacturing overhead $21,700 Direct labor hours 13,000 The cost records for the year will show Group of answer choices Overapplied overhead of $5,460. Underapplied overhead of $5,460 Overapplied overhead of $ 3,500. Underapplied overhead of $3,500arrow_forwardHarootunlan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job T629 was completed with the following characteristics: Number of units in the job Total machine-hours The amount of overhead applied to Job T629 is closest to: Multiple Choice $1,620 $780 O $1,200 50 200 O $420 80,000 $ 312,000 $ 2.10 Karrow_forwardValvano Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $340,000, variable manufacturing overhead of $2.20 per machine-hour, and 30,000 machine-hours. The estimated total manufacturing overhead is closest to: 1. $406,000 2. $375,000 3. $420,000 4. $340,000arrow_forward

- Jensen Fences uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company's Work in Process Inventory account for the month of June: Debits to account: Balance, June 1 Direct materials Direct labor $5,000 $18,000 $12,300 Manufacturing overhead (applied to jobs as 125% of direct labor cost) $15,375 Total debits to account Credits to account: Transferred to Finished Goods Inventory account $50,675 $44,000 $6,675 Balance, June 30 Instructions a. Assuming that the direct labor charged to the jobs still in process at June 30 amounts to $1,600, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of June 30. b. Prepare general journal entries to summarize: 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during June. 2. The transfer of…arrow_forwardTyler Tooling Company uses a job order cost system with overhead applied to products on the basis of machine hours. For the upcoming year, the company estimated its total manufacturing overhead cost at $257,070 and total machine hours at 62,700. During the first month of operations, the company worked on three jobs and recorded the following actual direct materials cost, direct labor cost, and machine hours for each job: Direct materials used Direct labor Machine hours Job 101 11,600 $ $ 16,900 1,800 hours Job 102 $ 8,700 $ 6,200 2,000 hours Job 103 $ 5,900 $ 4,500 1,100 hours Total $ 26,200 $ 27,600 4,900 hours Job 101 was completed and sold for $50,800. Job 102 was completed but not sold. Job 103 is still in process. Actual overhead costs recorded during the first month of operations totaled $15,690. Required: 1. Prepare a journal entry showing the transfer of Job 102 into Finished Goods Inventory upon its completion. 2. Prepare the journal entries to recognize the sales revenue and…arrow_forwardHahn Company uses job-order costing. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $15 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 54,500 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost ? ? ? $ 1,533,500 $ 235,000 345,000 184,000 $ 764,000 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education