Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

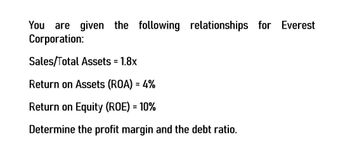

Determine the profit margin and the debt ratio of this financial accounting question

Transcribed Image Text:You are given the following relationships for Everest

Corporation:

Sales/Total Assets = 1.8x

Return on Assets (ROA) = 4%

Return on Equity (ROE) = 10%

Determine the profit margin and the debt ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the statements provided Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on assets Return on stockholders’ equity For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2% A competitor of ACME has for the same time period reported the following three ratios: Current ratio 1.52Long-term debt to equity .25 or 25%Net profit margin .08 or 8% Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.arrow_forwardAssume you are given the following relationships for the Haslam Corporation:Sales/total assets 1.2Return on assets (ROA) 4%Return on equity (ROE) 7%Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forwardPlease helparrow_forward

- Assume you are given the following relationships for the Clayton Corporation: Sales/total assets 1.5 Return on assets (ROA) 3% Return on equity (ROE) 5% Calculate Clayton's profit margin and debt ratio.arrow_forwardNeed Answer with correct answer pleasearrow_forwardUsing the Du Pont Identity Method, calculate return on equity given the following information. Profit margin 16%; total asset turnover 0.85; equity multiplier 1.5. OA. OB. O C. O D. OE 20.40% 21.40% 22.40% 23.40% 24.40%arrow_forward

- Assume the following relationships for the Caulder Corp.:Sales/Total assets 1.33Return on assets (ROA) 4.0%Return on equity (ROE) 8.0%Calculate Caulder’s profit margin and debt-to-capital ratio assuming the firm uses onlydebt and common equity, so total assets equal total invested capital.arrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets 1.5× Return on assets (ROA) 8.0% Return on equity (ROE) 12.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: %arrow_forwardAnswer? ? Financial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning