Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

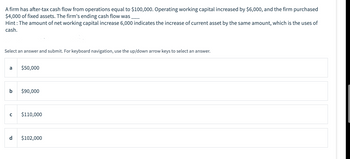

Transcribed Image Text:A firm has after-tax cash flow from operations equal to $100,000. Operating working capital increased by $6,000, and the firm purchased

$4,000 of fixed assets. The firm's ending cash flow was______

Hint: The amount of net working capital increase 6,000 indicates the increase of current asset by the same amount, which is the uses of

cash.

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

b

с

$50,000

$90,000

$110,000

d $102,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- do not provide solution in image format.arrow_forward25.Gingerbread Corp hired a new intern for the summer. The intern was assigned the job of preparing the year-end statement of cash flow but was having some trouble trying to determine where to classify the following transactions. TRANSACTION Cash Flow Cash payment of dividends to common stockholders 30,000 Cash payment for purchase of land 468,000 Cash proceeds from sale of equipment 15,000 Cash proceeds from issuing Gingerbread common stock 45,000 Cash payments on long-term note payable 175,000 Cash payments to purchase stock in another company 51,000 Determine Net cash from financing. Be careful to analyze if it is a cash outflow (negative) or cash inflow (positive). If the cash flow is negative put the value in parenthesis. Example: (400,000). No dollar signs. Net cash from financing?arrow_forwardTB EX Gu. 4-185 During the current year, a company provides services... 6. During the curremt year, a company provides services on account for $110,000. By the end of the year, SE been recelved. In addition, cash payments for the year were employees' salaries, $56,000; office suppli $25,000. Determine the amount of operating cash flows the company will report in the current year. (Cash ou minus sign.)arrow_forward

- Analyse and comment on the impact of the following events on a companies balance sheet, income statement and cash flow statement. E. g. Company purchases Machinery for $100,000 in cash. Effect. Obvious impact Fixed Asset increased, Balance sheet affected. Company will start recording depreciation expense in Income Statement Cash Outfi ow will reduce balance of cash on balance sheet. Current Ratio likely affected adversely and Working Capital. Analysis. Company may experience increase in Accounts Payable because of such a substantial cash outflow. This will affect Current Liabilities. Or. Company may have to seek short term loan from the bank as a back up in case there is any disturbance in receivables in the future. To counter this substantial cash outflow. Company should have negotiated with a bank a low interest loan to purchase machine over time in instalments. 1)A Manufacturing company ABC: relies on several suppliers for raw materials, often these materials are purchased on 90…arrow_forwardTask 4: XYZ corporation had net cash flows from operating activities of $90.000 in last year. During the year, XYZ cost $60.000 for property, plant and equipment; sold them for $12.000; paid dividends of $40.000. a) You should calculate the company's free cash flow and explain the result. b) On January 2021, XYZ purchased a truck for $ 70.000. The Chief accountant supposed that the truck will last six years for 200.000 miles, with an estimated residual value $ 22.000 at the end of that time. Compute the depreciable cost for the year 2021 under the straight-line method. c) You should prepare the journal entry for the depreciation of the truck in 2021arrow_forwardDengararrow_forward

- A company reported average total assets of $249,000 in Year 1 and $292,000 in Year 2. Its net operating cash flow was $19,875 in Year 1 and $29,000 in Year 2. (1) Calculate its cash flow on total assets ratio for both years. (2) Did its cash flow on total assets improve in Year 2 versus Year 1? Complete this questlon by entering your answers In the tabs below. Required 1 Required 2 Calculate its cash flow on total assets ratio for both years. Cash Flow on Total Assets Ratio Choose Numerator: Choose Denominator: Cash Flow on Total Assets Ratio Year 1: Year 2: Required 2 >arrow_forward23. Gingerbread Corp hired a new intern for the summer. The intern was assigned the job of preparing the year-end statement of cash flow but was having some trouble trying to determine where to classify the following transactions. TRANSACTION Cash Flow Cash payment of dividends to common stockholders 30,000 Cash payment for purchase of land 468,000 Cash proceeds from sale of equipment 15,000 Cash proceeds from issuing Gingerbread common stock 45,000 Cash payments on long-term note payable 175,000 Cash payments to purchase stock in another company 51,000arrow_forwardI am needing help with the following question. I have attached a photo below. Jasneet Corporation’s comparative balance sheet for current assists and liabilities was as follows: (See attached photo) Adjust net income of $185,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forward

- I want correct solutionarrow_forwardUse the starting balance sheet, income statement, and the list of changes to answer the question. Between January 1 and March 31, 2023: Cash decreases by $200,000 Other Assets increase by $300,000 Paid - In Capital does not change Dividends paid of $300,000 What is the value for Liabilities on March 31, 2023 ? Note: Account change amounts are provided in dollars but the financial statement units are thousands of dollars. Please specify your answer in the same units as the financial statements (i.e., enter the number from your updated balance sheet).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education