Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve himl

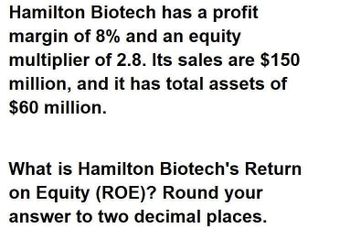

Transcribed Image Text:Hamilton Biotech has a profit

margin of 8% and an equity

multiplier of 2.8. Its sales are $150

million, and it has total assets of

$60 million.

What is Hamilton Biotech's Return

on Equity (ROE)? Round your

answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- As the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and gL = 8.00% (constant). Based on the dividend growth model, what is the cost of common from reinvested earnings? 10.69% 11.25% 11.84% 12.43% 13.05%arrow_forwardJohn wick Company has total assets of $162,000. It has a profit margin of 6.5 percent on sales of $230,000. If the equity multiplier is 2.5, what is its ROE?arrow_forwardEstimate its cost of common equity, Maxell and Associcates recently hired you. Obtain the following data, D0=$0.90, P0= $27.50, gl=7% constant. Based on the dividend grwoth model, What is the cost of common for reinvested earnings? (10.50%,9.29%,10.08%,9.68%,10.92%)arrow_forward

- You obtained the following data for Game Corporation: D1= $1.25; P0= $27.50; g = 5.00% (constant); and flotation costs = 6.00%. What is the cost of common equity raised by selling new common stock? What is the cost of common from reinvested earnings? Show work in excelarrow_forwardThe Evanec Company’s next expected dividend, D1, is $3.18; its growth rate is 6%; and its common stock now sells for $36.00. New stock (external equity) can be sold to net $32.40 per share.a. What is Evanec’s cost of retained earnings, rs?b. What is Evanec’s percentage flotation cost, F?c. What is Evanec’s cost of new common stock, re?arrow_forwardAssume that you are a consultant to Broske Inc., and you have been provided with the following data: the next expected dividend is $0.67; the current market price is $42.50 and the constant growth rate for the dividends is 8.00% Based on the information given what is the cost of equity?arrow_forward

- HighGrowth Company has a stock price of $20. The firm will pay a dividend next year of $1.03, and its dividend is expected to grow at a rate of 3.6% per year thereafter. What is your estimate of HighGrowth's cost of equity capital? The required return (cost of capital) of levered equity is __ % ? (Round to one decimal place.)arrow_forwardYou forecast to have a ROE of 14%, and dividend payout ratio of 12%. Currently the company has a price of $30 and $7 earnings per share. What is the PEG ratio based on market price?arrow_forwardSlow 'n Steady, Inc., has a stock price of $28, will pay a dividend next year of $3.10, and has expected dividend growth of 1.7% per year. What is your estimate of Slow 'n Steady's cost of equity capital? The required return (cost of capital) of levered equity is __ % ? (Round to one decimal place.)arrow_forward

- You are given the following information about a firm: The growth rate equals 8 percent; return on assets (ROA) is 10 percent; the debt ratio is 20 percent; and the stock is selling at $36. What is the return on equity (ROE)?a. 14.0%b. 12.5%c. 15.0%d. 2.5%e. 13.5%arrow_forwardYou are given the following information about a firm. The growth rate equals 8 percent; return of the assets (ROA) is 10 percent; the debt ration is 20 percent; and the stock is selling at $36. What is the return on equity (ROE)?arrow_forwardA firm has total book value of equity of $2 million, a market to book ratio (market price/book value) of 4, and a book value per share of $5.00. What is the market value per share of the firm's equity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning