Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

PlCalculate dividends yeild???

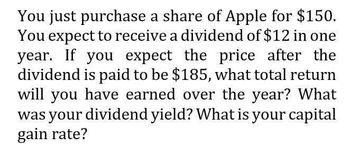

Transcribed Image Text:You just purchase a share of Apple for $150.

You expect to receive a dividend of $12 in one

year. If you expect the price after the

dividend is paid to be $185, what total return

will you have earned over the year? What

was your dividend yield? What is your capital

gain rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You expect that Microsoft will pay a dividend of $1.50 in one year, $1.75 in two years, and $2.00 in three years. After that, dividends are expected to grow at 3% per year. If your required rate of return is 8%, what should be the price of Microsoft today according to the Dividend Discount Model?arrow_forwardYou have an investment opportunity that promises to pay you $12,979 in four years. Suppose the opportunity requires you to invest $9,540 today. What is the interest rate you would earn on this investment? Note: Use tables, Excel, or a financial calculator. Do not round your intermediate values. Enter your answer rounded to the nearest whole percentage. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Solve for i Present Value: n = i = Future Value:arrow_forwardSuppose you purchased a house in San Diego in January of 1994 for $75,000. You then sold that house in December of 2006 for $350,000. Assume that the CPI rose in that period from 107 to 180. What was your total nominal rate of return? How about your annual nominal rate of return? What was your total real return? How about you annual real return?arrow_forward

- Car Rental Service's stock price is expected to be $85 in one year immediately after paying a dividend of $3.87. If its equity cost of capital is 12%, what is the expected capital gain in dollars if you sell the stock one year from today immediately after receiving the dividend?arrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,300 that pays $130 annual income. Also assume the investment's value has increased to $6,900 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places. Rate of return % b. Is the rate of return a positive or a negative number? Positive Negativearrow_forwardWhat is your aftertax return for the year?arrow_forward

- You purchase a stock for $1000 and expect to sell it for $900 after five years but also expect to collect dividents of $130 a year. Calculate the return on this investment.arrow_forwardHow much would you be prepared to pay for a share in 2 years’ time that pays a $1.5 dividend each year constantly ? Assume the required rate of return is expected to remain constant at 9.1% per year.arrow_forwardYou believe that the Non-Stick Gum Factory will pay a dividend of $5 on its common stock next year. Thereafter, you expect dividends to grow at a rate of 1% a year in perpetuity. If you require a return of 12% on your investment, how much should you be prepared to pay for the stock? What is the Stock Price?arrow_forward

- You put up K500 at the beginning of the year for an investment. The value of the investment grows 4% and you earn a dividend of K35.0 Your yield is?arrow_forwardNeed helparrow_forwardThis morning, you purchased a stock that will pay an annual dividend of $1.90 per share next year. You require a 12 percent rate of return and the dividend increases at 3.25 percent annually. What will your capital gain be in dollars on this stock if you sell it three years from now?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning