Halpern Corporation is authorized to issue 1,000,000 shares of $3 par value common stock. During 2021, its first year of operation, the company has the following stock transactions.

Jan. 1. Paid the state $5,000 for incorporation fees

Jan. 15 Issued 500,000 shares of stock at $6 per share.

Jan. 30 Attorneys for the company accepted 500 shares of common stock as payment for legal services rendered in helping the company incorporate. The legal services are estimated to have a value of $7,000.

July 2. Issued 100,000 shares of stock for land. The land had an asking price of $900,000. The stock is currently selling on a national exchange at $8 per share.

Sept. 5 Purchased 15,000 shares of common stock for the treasury at $8 per share.

Dec. 6. Sold 11,000 shares of the

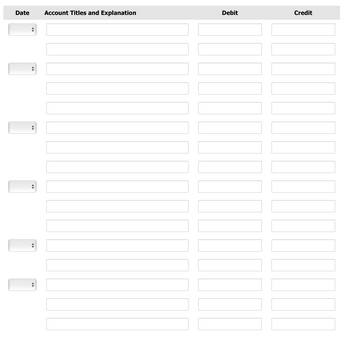

Journalize the transactions for Halpern Corporation. (Record

Step by stepSolved in 2 steps

- Oriole Inc. (OI) is a backyard pond design and installation company. Ol was incorporated during 2023, with an unlimited number of common shares, and 42,000 preferred shares with a $3 dividend rate authorized. Ol follows ASPE. The following transactions took place during the first year of operations with respect to these shares: Jan. 1 Jan. 15 Feb. 20 Mar. 3 May 10 Sept. 23 Nov. 28 Dec. 31 The articles of incorporation were filed and state that an unlimited number of common shares and 42,000 preferred shares are authorized. Dec. 31 25,200 common shares were sold by subscription to 3 individuals, who each purchased 8,400 shares for $42 per share. The terms require 8% of the balance to be paid in cash immediately. The balance was to be paid by December 31, 2024, at which time the shares will be issued. 58,800 common shares were sold by subscription to 7 individuals, who each purchased 8,400 shares for $42 per share. The terms require that 8% of the balance be paid in cash immediately,…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,300 common shares at $4.4 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $32,000. 31 Issued 76,000 common shares in exchange for land, building, and equipment, which have fair market values of $356,000, $476,000, and $44,000, respectively. Mar. 4 Purchased equipment at a cost of $8,120 cash. This was thought to be a special bargain price. It was felt that at least $10,400 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $92,000. The Income Summary account was closed. 2021…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,300 common shares at $4.4 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $32,000. 31 Issued 76,000 common shares in exchange for land, building, and equipment, which have fair market values of $356,000, $476,000, and $44,000, respectively. Mar. 4 Purchased equipment at a cost of $8,120 cash. This was thought to be a special bargain price. It was felt that at least $10,400 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $92,000. The Income Summary account was closed. 2021…arrow_forward

- 6arrow_forwardHow do I solve subsections D and E?arrow_forwardFlint's Dance Studios Ltd. is a public company, and accordingly uses IFRS for financial reporting. The corporate charter authorizes the issuance of an unlimited number of common shares and 70,000 preferred shares with a $2 dividend. At the beginning of the December 31, 2020 year, the opening account balances indicated that 30,000 common shares had been issued for $5 per share, and no preferred shares had been issued. Opening retained earnings were $311,000. The transactions during the year were as follows: Jan. 15 Issued 12,000 common shares at $6 per share. Feb. 12 Issued 2,300 preferred shares at $56 per share. Sept. 2 Issued 5,000 common shares in exchange for land valued at $30,000. Oct. 31 Declared and paid a dividend on preferred shares of $2 per share. Nov. 1 Declared and paid a dividend on common shares of $1.20 per share. Nov. 15 Purchased and retired 500 preferred shares at $58 per share. Dec. 31 After preliminary closing entries, the Income Summary account had a credit…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education