FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

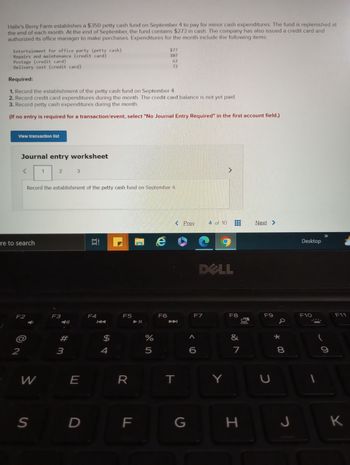

Transcribed Image Text:Halle's Berry Farm establishes a $350 petty cash fund on September 4 to pay for minor cash expenditures. The fund is replenished at

the end of each month. At the end of September, the fund contains $273 in cash. The company has also issued a credit card and

authorized its office manager to make purchases. Expenditures for the month include the following items:

Entertainment for office party (petty cash)

Repairs and maintenance (credit card)

Postage (credit card)

Delivery cost (credit card)

Required:

1. Record the establishment of the petty cash fund on September 4.

2. Record credit card expenditures during the month. The credit card balance is not yet paid.

3. Record petty cash expenditures during the month.

(If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

ere to search

F2

2

W

1

S

2

Record the establishment of the petty cash fund on September 4.

F3

#m

3

3

E

D

100

Et

F4

$

4

F5

R

F

LL

$77

107

62

72

%

5

F6

< Prev

玉

T

G

F7

<C

4 of 10

DOLL

A

Y

F8

&

7

H

00

Next >

F9

U

* 00

8

J

Desktop

F10

I

C

F11

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Awy Company has a petty cash fund for small expenses. The fllowing transactions occurred over a period of 2 months. May 1 Established a petty cash fund by issuing a Landmark Bank check for $100 May 14 Replenish the petty cash fund by issuing a check for $200. As of this date the fund consists of $20 in cash and some petty cash receipts: shipping costs $46; postage expenses $50; entertainment expenses $36, and other expenses $8. post May 31 Replenish the petty cash fund by issuing a check for $197. As of this date the fund consists of $22 in cash and some petty cash receipts: shipping costs $43; charitable donation expense $24; postage expenses $53; and other expenses $51. June 14 Replenished the petty cash fund by issuing a check for $190. At this date the fund consists of $30 in cash and several petty cash receipts: shipping costs $46; entertainment expenses 48; load of postal objects 40 ; and other expenses $30. June 17 Increase the petty cash fund amount to $270 by issuing a check…arrow_forwardKiona Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $350 to establish the petty cash fund. 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. a. Paid $109.20 for janitorial expenses. b. Paid $89.15 for miscellaneous expenses. c. Paid postage expenses of $60.90. d. Paid $80.01 to Facebook for advertising expense. e. Counted $26.84 remaining in the petty cashbox. 16 Prepared a company check for $200 to increase the fund to $550. 31 The petty cashier reports that $380.27 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. f. Paid postage expenses of $59.10. g. Reimbursed the office manager for mileage…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $349.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78.…arrow_forward

- Ovy Inc. established a $175 petty cash fund on August 15, 2012. On August 31, 2012, the fund contained receipts for the following: newspaper advertising $62, postage $26, office supplies $47. A cheque was prepared to reimburse the fund and increase the balance to $200.Required:3. Record the journal entry on August 15 to establish the fund.4. Record the journal entry on August 31 assuming there was $35 cash in the petty cash box.5. Record the journal entry on August 31 assuming there was $45 cash in the petty cash boxarrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $319.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78. May 31 h. Paid $44.17 in…arrow_forwardSheridan Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Established the petty cash fund by writing a check payable to the petty cash custodian for $225. Replenished the petty cash fund by writing a check for $220.30. On this date, the fund consisted of $4.70 in cash and these petty cash receipts: freight-out $96, entertainment expense $48.70, postage expense $41.70, and miscellaneous expense $32.50. Increased the amount of the petty cash fund to $325 by writing a check for $100.00. Replenished the petty cash fund by writing a check for $309.30. On this date, the fund consisted of $15.70 in cash and these petty cash receipts: postage expense $139.80, entertainment expense $96.40, and freight-out $71.80. Aug. 1 (a) 15 16 31 Journalize the petty cash transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers…arrow_forward

- Fiona's Florals, a retail business, started a $250 petty cash fund on June 1. Below are descriptions of the transactions to establish the petty cash fund, disburse petty cash during June, and replenish the petty cash fund on June 30. DATE June 1 June 5 June 8 June 15 June 22 June 25 June 29 June 30 Required: TRANSACTIONS Issued Check 550 for $250 to establish a petty cash fund. Paid $32 from the petty cash fund for office supplies, Petty Cash Voucher 1. Paid $33 from the petty cash fund for postage stamps, Petty Cash Voucher 2. Paid $20 from the petty cash fund for delivery service, Petty Cash Voucher 3. Paid $42 from the petty cash fund to the owner, Fiona Chu, for her personal use, Petty Cash Voucher 4. Paid $32 from the petty cash fund to have the store windows washed, Petty Cash Voucher 5. Paid $49 from the petty cash fund for delivery service, Petty Cash Voucher 6. Issued Check 590 for $208 to replenish the petty cash fund. 1. Record the transaction to establish the petty cash…arrow_forwardAssume that the custodian of a $450 petty cash fund has $57.10 in coins and curency plus $387.00 in recipts at the end of the month. The entry to replenish the petty cash fund will include:?arrow_forwardThe custodian of a $600 petty cash fund discovers that the fund has $ 112.50 in coins and currency plus $ 472.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include:arrow_forward

- T. L. Jones Trucking Services establishes a petty cash fund on April 3 for $200. By the end of April, the fund has a cash balance of $97. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items: Utilities (credit card) Entertainment (petty cash) Stamps (petty cash) Plumbing repair services (credit card) $ 435 44 59 630 Required: Record the establishment of the petty cash fund on April 3, all expenditures made during the month, and the replenishment of the petty cash fund on April 30. The credit card balance is paid in full on April 30. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardPenny-Wise Pound-Fool Company established a $400 petty cash fund on September 1, 2021. The fund is replenished at the end of each month. At the end of September 2021, the fund contained $74 in cash and each of the following receipts: Office Supplies $142 Advertising 96 Postage 40 Miscellaneous 38 Required: Prepare the necessary general journal entry to establish the petty cash fund on September 1 and to replenish the fund on September 30.arrow_forwardManarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education