FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

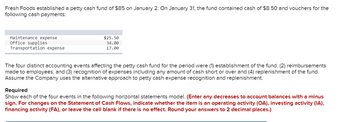

Transcribed Image Text:Fresh Foods established a petty cash fund of $85 on January 2. On January 31, the fund contained cash of $8.50 and vouchers for the

following cash payments:

Maintenance expense

office supplies

Transportation expense

$25.50

34.00

17.00

The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements

made to employees, and (3) recognition of expenses including any amount of cash short or over and (4) replenishment of the fund.

Assume the Company uses the alternative approach to petty cash expense recognition and replenishment.

Required

Show each of the four events in the following horizontal statements model. (Enter any decreases to account balances with a minus

sign. For changes on the Statement of Cash Flows, indicate whether the item is an operating activity (OA), investing activity (IA),

financing activity (FA), or leave the cell blank if there is no effect. Round your answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Petty Cash Fund Entries Journalize the entries to record the following: a. Check No. 12-375 is issued to establish a petty cash fund of $800. b. The amount of cash in the petty cash fund is now $288. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $4297; miscellaneous selling expense, $123; miscellaneous administrative expense, $77. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $500, record the discrepancy in the cash short and over account.) a. Journalize the entry to establish the petty cash fund. If an amount box does not require an entry, leave it blank. 88 b. Journalize the entry to replenish the petty cash fund. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forwardEcoMart establishes a $1,900 petty cash fund on May 2. On May 30, the fund shows $790 in cash along with receipts for the following expenditures: transportation-in, $154; postage expenses, $556; and miscellaneous expenses, $410. The petty cashier could not account for a $10 overage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare the (1) May 2 entry to establish the fund, (2) May 30 entry to reimburse the fund [Hint. Credit Cash Over and Short for $10 and credit Cash for $1,110], and (3) June 1 entry to increase the fund to $2,220. View transaction list Journal entry worksheet 1 2 Record the May 2 entry to establish the fund. Date May 02 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardManarrow_forward

- Waupaca Company establishes a $440 petty cash fund on September 9. On September 30, the fund shows $161 in cash along with receipts for the following expenditures: transportation-in, $56; postage expenses, $68; and miscellaneous expenses, $141. The petty cashier could not account for a $14 shortage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the fund, and (3) an October 1 entry to increase the fund to $475. View transaction list Journal entry worksheet 1 2 3 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date September 09 Record entry General Journal Clear entryarrow_forwardVishunuarrow_forwardOn September 29, the company determined that the petty cash fund needed to be increased to $1,000. What is the correct journal entry?arrow_forward

- Waupaca Company establishes a $480 petty cash fund on September 9. On September 30, the fund shows $240 in cash along with receipts for the following expenditures: transportation-in, $42; postage expenses, $70; and miscellaneous expenses, $117. The petty cashier could not account for a $11 shortage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the fund, and (3) an October 1 entry to increase the fund to $545. View transaction list Journal entry worksheet 1 2 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Cre September 09 Record entry Clear entry View generaarrow_forwardMeng Company maintains a $355 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $91 for office supplies, $182 for merchandise inventory, and $31 for miscellaneous expenses. There is a cash shortage of $11. The journal entry to replenish the fund on January 31 is:arrow_forwardThe following petty cash transactions were made by the Freeman Corporation during the month General Journal of September. Record the transactions in the journal provided in the account order that they appear below. Date Account Debit Credit Sep 1 Established a petty cash fund of $300. 1-Sep Petty Cash 300 Cash 300 Sep 15 Reimbursed the petty cash fund for the following: Stapler, staples, and tape $55 15-Sep 55 Pizza for the office party (meals) $85 85 Maintenance/Janitorial $112 112 The cash in the box before reimbursement was $40.…arrow_forward

- A company established a petty cash fund in April of the current year and experienced the following transactions affecting the fund during April. Prepare journal entries to establish the fund on April 1, to replenish it on April 25, and to record the increase in the fund on April 25. April 1 Prepared a company check for $300.00 to establish the petty cash fund. April 25 Prepared a company check to replenish the fund for the following expenditures made since April 1. Paid $84.50 for cleaning services. Paid $84.00 for postage expense. Paid $103.15 for office supplies. Counted $23.35 remaining in the petty cash box. April 25 The company decides to increase the fund by $100.arrow_forwardPalmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $99 in cash along with receipts for the following expenditures: postage, $41; transportation-in, $14; delivery expenses, $16; and miscellaneous expenses, $30. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to (1) establish the fund on January 1, (2) reimburse it on January 8, and (3) both reimburse the fund and increase it to $250 on January 8, assuming no entry in part 2. Hint: Make two separate entries for part 3. View transaction list Journal entry worksheet 1 3 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date Jan 01 Record entry 4 General Journal Clear entry Debit Credit View general journal >arrow_forward25arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education