FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

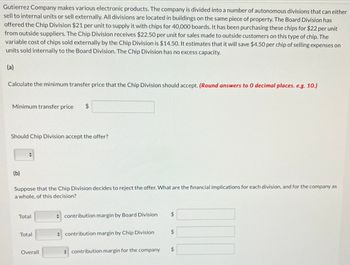

Transcribed Image Text:Gutierrez Company makes various electronic products. The company is divided into a number of autonomous divisions that can either

sell to internal units or sell externally. All divisions are located in buildings on the same piece of property. The Board Division has

offered the Chip Division $21 per unit to supply it with chips for 40,000 boards. It has been purchasing these chips for $22 per unit

from outside suppliers. The Chip Division receives $22.50 per unit for sales made to outside customers on this type of chip. The

variable cost of chips sold externally by the Chip Division is $14.50. It estimates that it will save $4.50 per chip of selling expenses on

units sold internally to the Board Division. The Chip Division has no excess capacity.

(a)

Calculate the minimum transfer price that the Chip Division should accept. (Round answers to 0 decimal places. e.g. 10.)

Minimum transfer price $

Should Chip Division accept the offer?

(b)

Suppose that the Chip Division decides to reject the offer. What are the financial implications for each division, and for the company as

a whole, of this decision?

Total

Total

Overall

contribution margin by Board Division

contribution margin by Chip Division

contribution margin for the company

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $179,800 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Incremental profit (loss) Sales Value at Split-Off Point Spock Uhura $209,700 Sulu 300,900 454,100 Save for Later $ Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) sold as is Allocated Joint Costs $39.700 60,700 79,400 Spock process further Cost to Process Further $110,400 process further 85,100 249,700 $ Sales Value of Processed Product Indicate whether each of the…arrow_forwardWildhorse Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Wildhorse has the following arrangement with Sheffield Inc. Sheffield purchases equipment from Wildhorse for a price of $930,600 and contracts with Wildhorse to install the equipment. Wildhorse charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Wildhorse determines installation service is estimated to have a standalone selling price of $59,400. The cost of the equipment is $600,000. Sheffield is obligated to pay Wildhorse the $930,600 upon the delivery of the equipment. Wildhorse…arrow_forwardBlue Africa Inc. produces laptops and desktop computers. The company’s production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company’s production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $241,000. The total cost of the Cafeteria Department is $403,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 530 Cafeteria Department 24 2,400 Laser Department 40 4,800 Forming Department 50 800 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to each of the production departments.arrow_forward

- Sarasota Company makes various electronic products. The company is divided into a number of autonomous divisions that can either sell to internal units or sell externally. All divisions are located in buildings on the same piece of property. The Board Division has offered the Chip Division $24 per unit to supply it with chips for 36,000 boards. It has been purchasing these chips for $25 per unit from outside suppliers. The Chip Division receives $27.80 per unit for sales made to outside customers on this type of chip. The variable cost of chips sold externally by the Chip Division is $17.80. It estimates that it will save $4.80 per chip of selling expenses on units sold internally to the Board Division. The Chip Division has no excess capacity. (a) Calculate the minimum transfer price that the Chip Division should accept. (Round answers to O decimal places. e.g. 10.) Minimum transfer price $ Should Chip Division accept the offer? (b) Suppose that the Chip Division decides to reject the…arrow_forwardCantel Company produces cleaning compounds for both commercial and household customers. Some of these products are produced as part of a joint manufacturing process. For example, GR37, a coarse cleaning powder meant for commercial sale, costs $1.80 a pound to make and sells for $2.00 per pound. A portion of the annual production of GR37 is retained for further processing in a separate department where it is combined with several other ingredients to form SilPol, which is sold as a silver polish, at $5.00 per unit. The additional processing requires 1/5 pound of GR37 per unit; additional processing costs amount to $3.70 per unit of SilPol produced. Variable selling costs for SilPol average $0.20 per unit. If production of SilPol were discontinued, $4,900 of costs in the processing department would be avoided. Cantel has, at this point, unlimited demand for, but limited capacity to produce, product GR37. 2. Assume that the cost data reported for GR37 are obtained at a level of output…arrow_forwardSunland Co. is a full-service manufacturer of surveillance equipment. Customers can purchase any combination of equipment, installation services, and training as part of Sunland's security services. Thus, each of these performance obligations are separate with individual standalone selling prices. Sandhill Inc. purchased cameras, installation, and training at a total price of $84,000. Estimated standalone selling prices of the equipment, installation, and training are $94,500, $7,350, and $3,150, respectively. How should the transaction price be allocated to the equipment, installation, and training? Equipment $ Installation $ Training $arrow_forward

- Armada Shipping is a global logistics company. The company is organized into two divisions: Contracts and Retail. The Contracts Division, which is by far the larger division, handles customers who have regular shipping requirements and have signed contracts specifying costs and schedule for up to one year. The Retail Division handles shipments for customers who have only occasional shipping requirements and pay on an as-used basis. Billing for all customers is handled by the corporate Accounts Receivable Department. Accounts Receivable performs two major activities: billing and accounts. Billing refers to preparing and sending the bills as well as processing the payments. Accounts refers to establishing accounts, ensuring credit status, following up on collection, and so on. The costs of the Accounts Receivable Department are allocated to the two divisions based on the number of bills prepared. The manager of the Contracts Division has complained that the allocated costs from Accounts…arrow_forwardSpeed Racer in Victoria makes bicycles for people of all ages. The frames division makes and paints the frames and supplies them to the assembly division where the bicycles are assembled. Speed Racer is a successful and profitable corporation that attributes much of its success to its decentralized operating style. Each division manager is compensated on the basis of division operating income. The assembly division currently acquires all its frames from the frames division. The assembly division manager could purchase similar frames in the market for $480. The frames division is currently operating at 80% of its capacity of 4,000 frames (units) and has the following details: Voltage Regulator Direct materials ($150 per unit x 320 units) $480,000 Direct manufacturing labour ($60 per unit x 3,200 units) 192,000 Variable manufacturing overhead costs ($30 per unit × 3,200 units) 96,000 Fixed manufacturing overhead costs $624,000 All the frames…arrow_forwardCarving Creations jointly produces wood chips and sawdust used in agriculture. The wood chips and sawdust are actually by-products of the company’s core operations, but Carving Creations accounts for them just like normally produced goods because of their large volumes. One jointly produced batch yields 3,000 cubic yards of wood chips and 10,000 cubic yards of sawdust, and the estimated cost per batch is $21,400. However, the joint production of each good is not equally weighted. Management at Carving Creations estimates that for the time it takes to produce 10 cubic yards of wood chips in the joint production process, only 2 cubic yards of sawdust are produced. Given this information, allocate the joint costs of production to each product using the weighted average method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education