Gulzar Ahmed (GA) is a mid-size company involved in textile business. The firm hasbeen successful and has enjoyed a positive growth trend. Now the firm is planning to gopublic with an issue of common stock, and it faces the problem of setting an appropriateprice for the stock. The company and its investment banks believe that the proper procedure is to conduct a valuation and select several similar firms with publicly traded common stock and to make relevant comparisons.Several textile manufacturers are reasonably similar to Gulzar Ahmed with respect to product mix, asset composition, and debt/equity proportions. Of these companies, Appolo Textiles and Hunter Fashions are most similar. When analyzing the following data, assume that the most recent year has been reasonably “normal” in the sense that itwas neither especially good nor especially bad in terms of sales, earnings, and free cashflows.COMPANY DATA APOLLO HUNTER GULZARSHARES OUTSTANDING 5,000,000 10,000,000 500,000MKT. PRICE PER SHARE $36.00 $46.00 Not AvailEARNINGS PER SHARE $2.20 $3.13 $2.60FREE CASH FLOW PERSHARE $1.63 $2.54 $2.00BOOK VALUE PER SHARE $16.00 $20.00 $18.00TOTAL ASSETS (in millions) $115.00 $250.00 $11.00TOTAL DEBT (in millions) $35.00 $50.00 $2.00Required:I. Gulzar Ahmed is a closely held corporation with 500,000 shares outstanding. Free cash flows have been low and in some years negative due to its recent high sales growth rates, but as its expansion phase comes to an end, the firm’s free cash flows should increase. The company anticipates the following free cash flows over the next 5 years:Year-1 Year-2 Year-3 Year-4 Year-5FCF $1,000,000 $1,050,000 $1,208,000 $1,329,000 $1,462,000After Year 5, free cash flow growth will be stable at 7% per year. Currently, the company has no non-operating assets, and its WACC is 12%. Using the free cash flow valuation model, estimate the firm’s intrinsic value of equity and intrinsic per share price. II. Calculate debt to total assets, P/E, market to book, P/FCF, and ROE for Apollo Textile and Hunter Fashions. For calculations that require a price for Gulzar Ahmed, use the per share price you obtained with the corporate valuation model in Part-I above.

Dividend Valuation

Dividend refers to a reward or cash that a company gives to its shareholders out of the profits. Dividends can be issued in various forms such as cash payment, stocks, or in any other form as per the company norms. It is usually a part of the profit that the company shares with its shareholders.

Dividend Discount Model

Dividend payments are generally paid to investors or shareholders of a company when the company earns profit for the year, thus representing growth. The dividend discount model is an important method used to forecast the price of a company’s stock. It is based on the computation methodology that the present value of all its future dividends is equivalent to the value of the company.

Capital Gains Yield

It may be referred to as the earnings generated on an investment over a particular period of time. It is generally expressed as a percentage and includes some dividends or interest earned by holding a particular security. Cases, where it is higher normally, indicate the higher income and lower risk. It is mostly computed on an annual basis and is different from the total return on investment. In case it becomes too high, indicates that either the stock prices are going down or the company is paying higher dividends.

Stock Valuation

In simple words, stock valuation is a tool to calculate the current price, or value, of a company. It is used to not only calculate the value of the company but help an investor decide if they want to buy, sell or hold a company's stocks.

Gulzar Ahmed (GA) is a mid-size company involved in textile business. The firm has

been successful and has enjoyed a positive growth trend. Now the firm is planning to go

public with an issue of common stock, and it faces the problem of setting an appropriate

price for the stock. The company and its investment banks believe that the proper procedure is to conduct a valuation and select several similar firms with publicly traded common stock and to make relevant comparisons.

Several textile manufacturers are reasonably similar to Gulzar Ahmed with respect to product mix, asset composition, and debt/equity proportions. Of these companies, Appolo Textiles and Hunter Fashions are most similar. When analyzing the following data, assume that the most recent year has been reasonably “normal” in the sense that it

was neither especially good nor especially bad in terms of sales, earnings, and free cash

flows.

COMPANY DATA APOLLO HUNTER GULZAR

SHARES OUTSTANDING

5,000,000

10,000,000

500,000

MKT. PRICE PER SHARE $36.00 $46.00 Not Avail

EARNINGS PER SHARE $2.20 $3.13 $2.60

SHARE $1.63 $2.54 $2.00

BOOK VALUE PER SHARE $16.00 $20.00 $18.00

TOTAL ASSETS (in millions) $115.00 $250.00 $11.00

TOTAL DEBT (in millions) $35.00 $50.00 $2.00

Required:

I. Gulzar Ahmed is a closely held corporation with 500,000 shares outstanding. Free cash flows have been low and in some years negative due to its recent high sales growth rates, but as its expansion phase comes to an end, the firm’s free cash flows should increase. The company anticipates the following free cash flows over the next 5 years:

Year-1 Year-2 Year-3 Year-4 Year-5

FCF $1,000,000 $1,050,000 $1,208,000 $1,329,000 $1,462,000

After Year 5, free cash flow growth will be stable at 7% per year. Currently, the company has no non-operating assets, and its WACC is 12%. Using the free cash flow valuation model, estimate the firm’s intrinsic value of equity and intrinsic per share price.

II. Calculate debt to total assets, P/E, market to book, P/FCF, and

Intrinsic Value of Equity in free cash flow valuation model equals the present value of its free cash flow, the net cash flow left over for distribution to stockholders and debt-holders

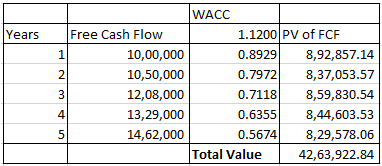

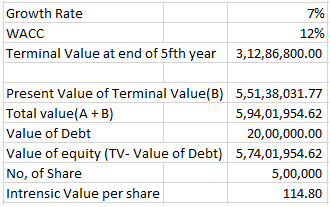

A) Calculation of Intrinsic Value of equity and intrinsic per share price:

Formula :

Intrinsic Value of Equity = Total Value of Firm - Value of Debt

Total Value Of Firm = Present Value of all future free cash flows

Terminal Value = Cash flow for 5Th Year(1+Growth Rate(g))/ (WACC-g)

Intrinsic Value Per Share = Intrinsic Value of Equity/ No. Of Shares

Calculations in Excel:

Step by step

Solved in 3 steps with 3 images