FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:←

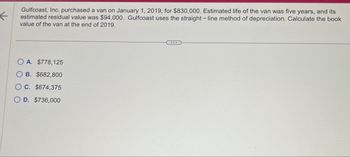

Gulfcoast, Inc. purchased a van on January 1, 2019, for $830,000. Estimated life of the van was five years, and its

estimated residual value was $94,000. Gulfcoast uses the straight-line method of depreciation. Calculate the book

value of the van at the end of 2019.

OA. $778,125

B. $682,800

C. $674,375

OD. $736,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On January 1, 2014, Tanaka, Inc. purchased equipment for $27,000. Tanaka uses straight-line depreciation and estimates a 10-year useful life and a $3,000 salvage value. On December 31, 2021, Tanaka sells the equipment for $14,200. In recording this sale, Tanaka should reflect: Select one: a. A $1,400 gain b. A $1,600 gain c. A $3,000 gain d. A $6,400 gain e. None of the abovearrow_forwardPeanut Company purchased a machine on January 1, 2019, for $100,000 with a $20,000 salvage value and an eight-year useful life. The company uses double-declining-balance depreciation. Required:Compute the depreciation expense for 2019 and 2020. Year DepreciationExpense 2019 $fill in the blank 1 2020 $fill in the blank 2arrow_forwardOn July 1, 2018, Mundo Corporation purchased factory equipment for $50,000. Residual value was estimated at $2,000. The equipment will be depreciated over 10 years using the doubledeclining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depreciation expense of:arrow_forward

- On Jan 1, 2019, Tuesday company purchased a delivery vehicle costing $40,000. The vehicle has an estimated 9 year life and $4,000 residual value. What is vehicle's accumulated depreciation as of December 31, 2020? Assuming they use straight line depreciation method. Do not put any decimal places.arrow_forwardOman Cables Co. Purchased a machine for OR45,000 on January 1, 2020. The machine is expected to have a four - year life, with a residual value of OR5,000 at the end of four years. Using the sum - of - the years' - digits method, depreciation for 2021 would be Select one: a. 16,000 b. 12,000 C. 13,500 O d. none of the above is correctarrow_forwardSwann Company sold a delivery truck on April 1, 2019. Swann had acquired the truck on January 1, 2015, for $42,000. At acquisition, Swann had estimated that the truck would have an estimated life of 5 years and a residual value of $5,000. Swann uses the straight-line method of depreciation. At December 31, 2018, the truck had a book value of $12,400. Required: 1. Prepare any necessary journal entries to record the sale of the truck, assuming it sold for: a. $12,000 b. $9,000 2. How should the gain or loss on disposal be reported on the income statement? 3. Assume that Swann uses IFRS and sold the truck for $12,000. In addition, Swann had previously recorded a revaluation surplus related to this machine of $4,000. What journal entries are required to record the sale?arrow_forward

- The Vermont Construction Company purchased a hauling truck on January 1 of 2019, at a cost of $35,000. The truck has a useful life of eight years with an estimated salvage value of $6,000. Determine the book depreciation amount to be taken over the useful of the truck using straight-line method and double declining balance methods.arrow_forwardEquipment was purchased for $83700 on January 1, 2021. Freight charges amounted to $4000 and there was a cost of $12000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $16000 salvage value at the end of its 5-year useful life. What is the amount of accumulated depreciation at December 31, 2022 if the straight-line method of depreciation is used? O $16740. $13540. $28140. $33480.arrow_forwardCan you also show me how to do this one? 12. XYZ Co. purchased new trucks at the beginning of 2018 for $600,000. The trucks had an estimated life of four yearsand an estimated residual value of $50,000. They use straight-line depreciation. At the beginning of 2019, XYZ sold thetrucks for $480,000 and purchased new trucks for $700,000.A. Calculate book value of the trucks at the end of 2018.B. Calculate the gain (loss) on the sale of the trucks at the beginning of 2019. Calculate the amount and indicate if it is a gain or a loss.arrow_forward

- Depreciation calculation methods Gandolfi Construction Co. purchased a CAT 336DL earth mover at a cost of $1,000,000 in January 2019. The company's estimated useful life of this heavy equipment is 8 years, and the estimated salvage value is $200,000. Required: a. Using straight-line depreciation, calculate the depreciation expense to be recognized for 2019, the first year of the equipment's life, and calculate the equipment's net book value at December 31, 2021, after the third year of the equipment's life. b. Using declining-balance depreciation at twice the straight-line rate, calculate the depreciation expense to be recognized for 2021, the third year of the equipment's life.arrow_forwardNewman Co. purchased CNC router cutting and engraving machinery at a cost of $320,000 in January 2019. The company's estimated useful life of this high tech equipment is 5 years, and the estimated salvage value is $48,000. Using the straight-line method, the net book value at December 31, 2021, after the third year of the machinery's life, would be: Multiple Choice $128,000. $163,200. $211,200. $156,800.arrow_forwardSwann Company sold a delivery truck on April 1, 2019. Swann had acquired the truck on January 1, 2015, for $40,500. At acquisition, Swann had estimated that the truck would have an estimated life of 5 years and a residual value of $3,000. Swann uses the straight-line method of depreciation. At December 31, 2018, the truck had a book value of $10,500. Required: 1. Prepare any necessary journal entries to record the sale of the truck, assuming it sold for: a. $9,875 b. $7,275 2. How should the gain or loss on disposal be reported on the income statement? 3. Assume that Swann uses IFRS and sold the truck for $9,875. In addition, Swann had previously recorded a revaluation surplus related to this machine of $5,000. What journal entries are required to record the sale?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education