FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Grover's Steel Parts produces parts for the automobile industry. The company has monthly fixed expenses of $610,000 and a contribution margin of 75% of revenues. Grover feels like he's in a giant squeeze play: The automotive manufacturers are demanding lower prices, and the steel producers have increased raw material costs. Grover's contribution margin has shrunk to 45% of revenues. The company's monthly operating income, prior to these pressures, was $162,500.

Transcribed Image Text:pany has monthly fixed expenses of $610,000 and a contribution margin of 75% of

e increased raw material costs. Grover's contribution margin has shrunk to 45% of re

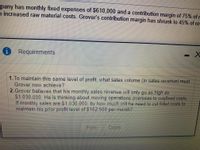

i Requirements

1. To maintaln this same level of profit, what sales volume (in sales revenue) must

Grover now achieve?

2. Grover believes that his monthly sales revenue will only go as high as

$1,030.000 He is thinking about moving operations overseas to cut-fixed costs.

If monthly sales are S1.030,000 by how much will he need to cut fixed costs to

maintain his prior profit level of $162.500 per month?

Print,

Done:

Transcribed Image Text:Requirement 1. To maintain this same level of profit, what sales volume (in sales revenue) must Grover now achieve?

Begin by identifying the formula to compute the sales in units at various levels of operating income using the contribution margin approach.

= Target sales in dollars

Contribution margin per unit

Contribution margin ratio

Fixed expenses

Operating income

Units sold

Variable expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perusall Chalmers Corporation operates in multiple areas of the globe, and relatively large price changes are common. Presently, the company sells 105,600 units for $50 per unit. The variable production costs are $20, and fixed costs amount to $2,079,000. Production engineers have advised management that they expect unit labor costs to rise by 10 percent and unit materials costs to rise by 15 percent in the coming year. Of the $20 variable costs, 25 percent are from labor and 50 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 12 percent. It is also expected that fixed costs will rise by 10 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 8 percent during the year. Saved Required: a. Compute the volume in units and the dollar…arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured In a small plant that relies heavily on direct labor workers. Thus, varlable expenses are high, totaling $15.000 per ball, of which 60% Is direct labor cost Last year, the company sold 62.000 of these balls, with the following results: $ 1,558, 000 930, e00 Sales (62,889 balls) Variable expenses Contribution margin Fixed expenses 620,e00 426,000 $ 194, 000 Net operating income Required: 1. Compute (a) last year's CM ratio and the break-even polnt in balls, and (b) the degree of operating leverage at last year's sales level. 2 Due to an Increase in labor rates, the company estimates that next year's varlable expenses will increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt in balls? 3. Refer to the data in (2) above. If the expected change in…arrow_forwardNonearrow_forward

- Chalmers Corporation operates in multiple areas of the globe, and relatively large price changes are common. Presently, the company sells 156,200 units for $50 per unit. The variable production costs are $20, and fixed costs amount to $2,084,500. Production engineers have advised management that they expect unit labor costs to rise by 10 percent and unit materials costs to rise by 15 percent in the coming year. Of the $20 variable costs, 25 percent are from labor and 50 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 12 percent. It is also expected that fixed costs will rise by 10 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 8 percent during the year. Required: A. Compute the volume in units and the dollar sales level…arrow_forwardChalmers Corporation operates in multiple areas of the globe, and relatively large price changes are common. Presently, the company sells 110,200 units for $50 per unit. The variable production costs are $20, and fixed costs amount to $2,079,500. Production engineers have advised management that they expect unit labor costs to rise by 10 percent and unit materials costs to rise by 15 percent in the coming year. Of the $20 variable costs, 25 percent are from labor and 50 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 12 percent. It is also expected that fixed costs will rise by 10 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 8 percent during the year. Required: a. Compute the volume in units and the dollar sales level…arrow_forwardChalmers Corporation operates in multiple areas of the globe, and relatively large price changes are common. Presently, the company sells 183,800 units for $50 per unit. The variable production costs are $20, and fixed costs amount to $2,087,500. Production engineers have advised management that they expect unit labor costs to rise by 10 percent and unit materials costs to rise by 15 percent in the coming year. Of the $20 variable costs, 25 percent are from labor and 50 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 12 percent. It is also expected that fixed costs will rise by 10 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 8 percent during the year. Required: a. Compute the volume in units and the dollar sales level…arrow_forward

- Scholes Systems supplies a particular type of office chair to large retailers such as Target, Costco, and Office Max. Scholes is concerned about the possible effects of inflation on its operations. Presently, the company sells 81,000 units for $65 per unit. The variable production costs are $35, and fixed costs amount to $1,410,000. Production engineers have advised management that they expect unit labor costs to rise by 15 percent and unit materials costs to rise by 10 percent in the coming year. Of the $35 variable costs, 40 percent are from labor and 20 percent are from materials. Variable overhead costs are expected to increase by 20 percent. Sales prices cannot increase more than 10 percent. It is also expected that fixed costs will rise by 5 percent as a result of increased taxes and other miscellaneous fixed charges. The company wishes to maintain the same level of profit in real dollar terms. It is expected that to accomplish this objective, profits must increase by 7 percent…arrow_forwardThe fixed costs of Chun Company are $309,000 and the total variable costs for its only product are 45% of the sales price, which is $100. Chun currently sells 7,400 units per month and is looking to sell more. Consider each of the following independently: The marketing manager thinks sales are too low in St. Kitts and Nevis and suggests that sales there would be increased by 120 units per month if an additional $9,000 per month was spent advertising there. What should be the effect on monthly income if this additional advertising is done? (DECREASE BY 2400, DECREASE BY 4975, INCREASE BY 404,600, OR INCREASE BY 329400)arrow_forwardSolve the following problem: The service department at Major Motors sold $48,000 in service last month. They had direct costs of $16,500 to pay their technicians. They were not given credit for any parts sales or expenses because that was the responsibility of their separate parts department. They were, however, allocated $29,250 in fixed expenses. What is the gross profit Major Motors earned last month?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education