Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

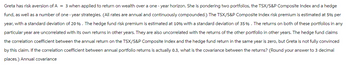

Transcribed Image Text:Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the TSX/S&P Composite Index and a hedge

fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The TSX/S&P Composite Index risk premium is estimated at 5% per

year, with a standard deviation of 20 %. The hedge fund risk premium is estimated at 10% with a standard deviation of 35%. The returns on both of these portfolios in any

particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims

the correlation coefficient between the annual return on the TSX/S&P Composite Index and the hedge fund return in the same year is zero, but Greta is not fully convinced

by this claim. If the correlation coefficient between annual portfolio returns is actually 0.3, what is the covariance between the returns? (Round your answer to 3 decimal

places.) Annual covariance

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Greta has risk aversion of A = 3 when applied to return on wealth over a 1-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of 1-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 9% per year, with a standard deviation of 17%. The hedge fund risk premium is estimated at 11% with a standard deviation of 32%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P 500 and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. Required: a-1. Assuming the correlation between the annual returns on the two portfolios is 0.3, what would be the optimal asset allocation? a-2. What is the expected risk premium on the…arrow_forwardA 280.arrow_forwardGreta has risk aversion of A= 5 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of 1-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 9% per year, with a standard deviation of 17%. The hedge fund risk premium is estimated at 11% with a standard deviation of 32%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P 500 and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. a-1. Assuming the correlation between the annual returns on the two portfolios is indeed zero, what would be the optimal asset allocation? (Do not round intermediate calculations. Enter your…arrow_forward

- Manshukharrow_forwardGreta has risk aversion of A = 5 and a 1-year investment horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of 1-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 7% per year, with a standard deviation of 19%. The hedge fund risk premium is estimated at 11% with a standard deviation of 34%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P 500 and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. What should be Greta's capital allocation? Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. S&P Hedge Risk-free asset % % %arrow_forwardGreta has risk aversion of A = 5 and a 1-year investment horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of 1-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 7% per year, with a standard deviation of 19%. The hedge fund risk premium is estimated at 11% with a standard deviation of 34%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P 500 and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. Calculate Greta's capital allocation using an annual correlation of 0.3. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. S&P Hedge % % Risk-free asset %arrow_forward

- Greta has risk aversion of A = 5 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the TSX/S&P Composite Index and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The TSX/S&P Composite Index risk premium is estimated at 10% per year, with a standard deviation of 16%. The hedge fund risk premium is estimated at 8% with a standard deviation of 26%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the TSX/S&P Composite Index and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. a-1. Assuming the correlation between the annual returns on the two portfolios is 0.3, what would be the optimal asset allocation? (Do not…arrow_forwardA mutual fund manager has a $20 million portfolio with a beta of 0.75. The risk-free rate is 3.75%, and the market risk premium is 7.0%. The manager expects to receive an additional $5 million, which she plans to invest in a number of stocks. After investing the additional funds, she wants the fund's required return to be 12%. What should be the average beta of the new stocks added to the portfolio? Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardGreta has risk aversion of A = 4 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The S&P 500 risk premium is estimated at 5% per year, with a standard deviation of 17%. The hedge fund risk premium is estimated at 10% with a standard deviation of 32%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfolio in other years. The hedge fund claims the correlation coefficient between the annual return on the S&P 500 and the hedge fund return in the same year is zero, but Greta is not fully convinced by this claim. If the correlation coefficient between annual portfolio returns is actually 0.3, what is the covariance between the returns?arrow_forward

- Elsi is a risk-averse investor. She has invested 60% of her investment in share A and all the remainder in share B. Below are projections for the shares as well as the market. A В Market Expected return (%) Standard deviation (%) 10 30 20 40 70 30 Correlations A 1 0.2 1 Market 0.3 0.68 1. Required: a) What are the expected return and standard deviation of returns on the portfolio? b) The correlation between A and B is expected to be -1, what proportion should Elsi invest in A in order to form a minimum variance portfolio? Assume that she will invest only in A and B. c) Elsi is wondering if beta is a more appropriate risk measure for the shares. Explain when beta is a more appropriate measure of risk than standard deviation. d) Calculate the beta of A and B. Construct a portfolio for Elsi. The portfolio will consist of shares A and B and have the same level of systematic risk as the market. e) i) What will be the expected return and standard deviation of returns on the portfolio? ii)…arrow_forwardMr. Devine is a fixed-income portfolio manager. He forecast a cash outflow of $10 million in June and plans to sell his baseline bond portfolio. The fund currently is worth $10 million, has an “A” quality rating, duration of 7 years, weighted average maturity of 15 years, annual coupon rate of 10.25%, and YTM of 10.25% (note: the fund is selling at its par value). Suppose Mr. Devine is afraid that long-term interest rates could increase and decides to hedge his June sale by taking a position in June T-bond futures contracts when the June T-bond contract is trading at 80-16, and the T-bond most likely to be delivered on the contract has a YTM of 9.5%, maturity of 15 years, and a duration of 9 years (1)Using the price-sensitivity model, show how Mr. Devine could hedge his June bond portfolio sale against interest rate risk. (2)Suppose long-term interest rates increase over the period such that at the June expiration, Mr. Devine’s baseline portfolio (A-rated, 10.25% coupon rate, 15-year…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education