FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare the adjusting entry required at December 31.

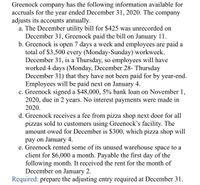

Transcribed Image Text:Greenock

company

has the following information available for

accruals for the year ended December 31, 2020. The company

adjusts its accounts annually.

a. The December utility bill for $425 was unrecorded on

December 31, Greenock paid the bill on January 11.

b. Greenock is open 7 days a week and employees are paid a

total of $3,500 every (Monday-Sunday) workweek.

December 31, is a Thursday, so employees will have

worked 4 days (Monday, December 28- Thursday

December 31) that they have not been paid for by year-end.

Employees will be paid next on January 4.

c. Greenock signed a $48,000, 5% bank loan on November 1,

2020, due in 2 years. No interest payments were made in

2020.

d. Greenock receives a fee from pizza shop next door for all

pizzas sold to customers using Greenock's facility. The

amount owed for December is $300, which pizza shop will

pay on January 4.

e. Greenock rented some of its unused warehouse space to a

client for $6,000 a month. Payable the first day of the

following month. It received the rent for the month of

December on January 2.

Required: prepare the adjusting entry required at December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Record the purchase of supplies account for future use, $7.arrow_forwardWhich accounts remain open at end of year and carried over to the following year?arrow_forwardCarla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education