Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

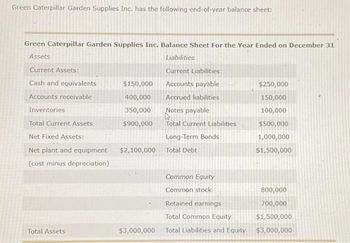

Transcribed Image Text:Green Caterpillar Garden Supplies Inc. has the following end-of-year balance sheet:

Green Caterpillar Garden Supplies Inc. Balance Sheet For the Year Ended on December 31

Assets

Liabilities

Current Assets:

Current Liabilities:

Cash and equivalents

Accounts payable

Accounts receivable

Accrued liabilities

Inventories

Total Current Assets

Net Fixed Assets:

Net plant and equipment

(cost minus depreciation)

Total Assets

$150,000

400,000

350,000

$900,000

$2,100,000

$3,000,000

Notes payable

Total Current Liabilities

Long-Term Bonds

Total Debt

Common Equity

Common stock

Retained earnings

Total Common Equity

Total Liabilities and Equity

$250,000

150,000

100,000

$500,000

1,000,000

$1,500,000

800,000

700,000

$1,500,000

$3,000,000

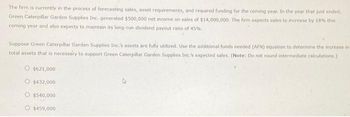

Transcribed Image Text:The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended,

Green Caterpillar Garden Supplies Inc. generated $500,000 net income on sales of $14,000,000. The firm expects sales to increase by 18% this

coming year and also expects to maintain its long-run dividend payout ratio of 45%.

Suppose Green Caterpillar Garden Supplies Inc.'s assets are fully utilized. Use the additional funds needed (AFN) equation to determine the increase in

total assets that is necessary to support Green Caterpillar Garden Supplies Inc.'s expected sales. (Note: Do not round intermediate calculations.)

O $621,000

O $432,000

O $540,000

O $459,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- For the year just completed, Hanna Company had net income of $104,500. Balances in the company’s current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Year Beginning of Year Current assets: Cash and cash equivalents $ 62,000 $ 81,000 Accounts receivable $ 158,000 $ 180,000 Inventory $ 436,000 $ 346,000 Prepaid expenses $ 11,000 $ 14,500 Current liabilities: Accounts payable $ 352,000 $ 400,000 Accrued liabilities $ 9,000 $ 12,000 Income taxes payable $ 33,000 $ 28,000 The Accumulated Depreciation account had total credits of $46,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows as negative amounts.) Hanna Company Statement of Cash Flows—Indirect Method (partial)arrow_forwardBlue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Current Assets: Cash and equivalents Accounts receivable Liabilities Current Liabilities: $150,000 Accounts payable $250,000 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment(cost minus depreciation) $2,100,000 Total Debt $1,500,000 Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity Total Assets $3,000,000 Total Liabilities and Equity $1,500,000 $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Blue Elk Manufacturing generated $500,000 net income on sales of $14,500,000. The firm expects sales to increase by 17% this coming year and also expects to maintain its long-run dividend payout ratio of 30%. Suppose Blue…arrow_forwardharrow_forward

- The net income reported on the income statement for the current year was $282,126. Depreciation recorded on fixed assets and amortization of patents for the year were $33,351, and $9,402, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows: End Beginning Cash $37,370 $64,930 Accounts receivable 106,715 123,079 Inventories 80,207 102,432 Prepaid expenses 8,982 4,271 Accounts payable (merchandise creditors) 77,139 54,111 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? Select the correct answer. $303,001 $363,468 $381,785 $306,304arrow_forwardCurrent fiscal year Accounts receivable: 4,532 Inventory: 5,372 Property, plant, and equipment, net: 9,178 Accounts payable: 3,183 Long-term debt: 14,001 Depreciation and amortization expense: 1,831 Net income: 5,791 The next year's forecasted balances for above accounts Accounts Receivable: 4,351 Inventory: 5,050 Property, plant, and equipment, net: 9,637 Accounts payable: 4,584 Long-term debt: 18,341 Depreciation and amortization expense: 1,977 Net income: 4,922 1. Using only the information given abouve what is the forecasted amount for Cash Flows from Operating Activities?arrow_forwardGreen Moose Industries has the following end-of-year balance sheet: Green Moose Industries Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Accounts payable Accrued liabilities. Notes payable Total Current Liabilities Cash and equivalents Accounts receivable Inventories Total Current Assets Net Fixed Assets: Net plant and equipment (cost minus depreciation) Total Assets O $64,000 $150,000 400,000 350,000 $900,000 O $57,600 Long-Term Bonds O $54,400 $2,100,000 Total Debt O $51,200 Common Equity Common stock Retained earnings Total Common Equity $3,000,000 Total Liabilities and Equity The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Industries generated $400,000 net income on sales of $13,500,000. The firm expects sales to increase by 16% this coming year and also expects to maintain its long-run dividend payout ratio of…arrow_forward

- The year-end financial statements for North Railway report the following information: 0.46 0.41 1.74 (In millions) 0.25 Revenues Year ended December 31, Property and equipment, net Total assets Year 2 Year 1 The annual property, plant, and equipment turnover (PPET) is: $15,095 $21,967 61,250 59,510 84,122 81,703arrow_forwardCold Duck Manufacturing Inc. has the following end-of-year balance sheet: Cold Duck Manufacturing Inc. Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Cash and equivalents $150,000 Accounts payable $250,000 Accounts receivable 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment(cost minus depreciation) $2,100,000 Total Debt $1,500,000 Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Assets $3,000,000 Total Liabilities and Equity $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Cold Duck Manufacturing Inc. generated $350,000 net income on sales of…arrow_forwardThe following information is from Lacy's Inc. $ millions Prior Fiscal Year Current Fiscal Year Net Year-End Assets Revenue Income $21,330 14,403 $18,955 $1,070 a. Compute the asset turnover ratio for the current fiscal year. b. Compute the return on assets ratio for the current fiscal year. Numerator a. Asset Turnover Ratio $ Check b. Return on Assets Ratio $ Numerator Denominator / $ Denominator / $ || Result Resultarrow_forward

- The following information was extracted from the records of Lodh Ltd for the year ended 30 June 2021. Lodh LTD Statement of financial position (extract) As at 30 June 2021 Relevant Assets Accounts Receivable $50,000 Allowance for doubtful debts (4,000) $46,000 Prepaid rent 42,000 Plant 200,000 Accumulated depreciation – Plant (25% on cost) (50,000) 150,000 DTA beginning balance 1,000 … Relevant Liabilities Interest Payable 2,000 Provision for long service leave 10,000 Unearned revenue 20,000 DTL beginning balance 5,000 … Additional information · The tax depreciation for plant is considered at 30% of $200,000 (original cost) at 30 June 2021. · Long service leave has not been taken by any employee during the year. · There…arrow_forwardThe following are financial data taken from the annual report of Foundotos Company: Year 2 $134,448 51,981 37,154 57,504 Net sales Gross property, plant and equipment Accumulated depreciation Intangible assets (net) A. Calculate the following ratios for Year 1 and Year 2: 1. Fixed asset turnover 2. Accumulated depreciation divided-by-gross fixed assets B. What do the trends in these ratios reveal about Foundotos? Year 1 $130,060 47,744 34,180 36,276arrow_forwardces For the year just completed, Hanna Company had net income of $90,500. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable December 31 End of Year $ 55,000 $ 152,000 $ 451,000 $ 12,000 $ 356,000 $ 8,000 $ 35,000 Beginning of Year $ 83,000 $184,000 $ 343,000 $ 14,000 $ 400,000 $ 11,500 $ 27,000 The Accumulated Depreciation account had total credits of $58,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash and cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial) +arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education