FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

hello, I just need help on the ones I got incorrect on Req D

Transcribed Image Text:GrandSlam Inc. incurred the following costs during March:

Selling expenses

Direct labor

Interest expense

Manufacturing overhead, actual

Raw materials used

Administrative expenses

$158,600

290,000

42,300

100,050

485,000

123,400

During the month, 18,500 units of product were manufactured and 11,100 units of product were sold. On March 1, GrandSlam carried no

inventories. On March 31, there were no inventories for raw materials or work in process.

Required:

a. Calculate the cost of goods manufactured during March and the average cost per unit of product manufactured.

b. Calculate the cost of goods sold during March.

c. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in the

financial statements?

d. Prepare a traditional (absorption) income statement for GrandSlam for the month of March. Assume that sales for the month were

$1,043,000 and the company's effective income tax rate was 35%.

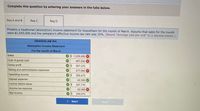

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req A and B

Req C

Req D

Prepare a traditional (absorption) income statement for GrandSlam for the month of March. Assume that sales for the month

were $1,043,000 and the company's effective income tax rate was 35%. (Round "Average cost per unit" to 2 decimal places.)

GRANDSLAM INC.

Absorption Income Statement

For the month of March

Sales

$ 1,035,000 X

Cost of goods sold

467,630 X

Gross profit

2$

567,370

Selling and administrative expenses

277,900 X

Operating income

$

289,470

Interest expense

42,300

Income before taxes

247,170

Income tax expense

42,300 X

Net income

2$

204,870

Req C

Req D >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can i have the answers for all in formula steps not excel please. Kind of hard to understand.arrow_forwardIm having an issue with this problem. Thank you!arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forward

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardDescribe the steps to be taken to correct an error.arrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease see attached picturearrow_forwardMake sure to calculate the NPV correctly! The previous answer was wrong!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education