FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:B15

x v fx

A

5 Cost per click

6 Number of clicks per day

7 Conversion to sale

8 Average revenue per sale

9 Average profit per sale

10 Days per month

11

14 Costs

15 Ad ROI

16

12 Conversions per month

13 Profit

B

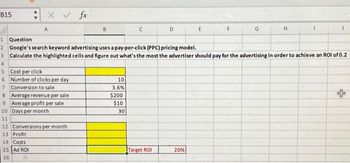

1 Question

2 Google's search keyword advertising uses a pay-per-click (PPC) pricing model.

3 Calculate the highlighted cells and figure out what's the most the advertiser should pay for the advertising in order to achieve an ROI of 0.2

4

10

3.6%

$200

$10

C

30

D

Target ROI

E

20%

G

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ageNOWv2 | Online teachin X + m/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress... A F Variable costs as a percentage of sales for Lemon Inc. are 72%, current sales are $610,000. and fixed costs are $191,000. How much will income from operations change if sales increase by $48,900? Oa. $13,692 decrease Ob. $13,692 increase Oc. $35,208 decrease. Od. $35,208 increase D Q 10+arrow_forward0 O Value Analysis 1016 Price Analysis O Spend Analysis Question 3 Which statement is FALSE: O Price analysis is used for strategic buy O Life cycle cost of ownership is used with critical buy 4 O Spend analysis is based on three main categories of spending costs O Price analysis uses an external benchmark to compare prices Question 4 Cost breakdown problem: A supplier indicates a 20% increase in labor costs and demands a 20% increase in purchasing What is the current purchasing.price? bould be the new purchasing price?arrow_forwardGive typing answer with explanation and conclusion You are given the following information on a Company - ROAop = 10%, tc = 30% and rd = 5% if D/EV = 30%, what is ROE = ? Question 21 options: 8.05% 8.50% 10.00% 15.00% the answer is 8.5% but i dont understand how to get there can someone show me the work and break it downarrow_forward

- Pls give solution of this question with 10 min i will give like for sure .. Try to give solution in typed form. Save the GST" is a popular advertising gimmick. If the GST is 5% of the price of the product, how much would you save off of the list price on the purchase of a T-shirt with a list price of $26.77 in a store during the "Save the GST" promotion?arrow_forwardCalculate the total cost, total selling price and selling price per brownie. Note: Round your answers to the nearest cent. Item Brownies Total quantity bought Unit cost 10 $ 0.95 Total cost Percent markup on cost 70 % Total selling price Percent that will spoil 10 % Selling price per browniearrow_forwardHighknob Co is thinking about introducing a new product.Below are the possible levels of unit sales and the probabilities of their occurrence. What is the expected value of the new product? Possible Market Reaction Sales in Units Probabilities Low Response 20 .10 Moderate Response 40 .20 High Response 65 .40 Very High Response 80 .30arrow_forward

- plz solve it within 30-40 mins I'll give you multiple upvotearrow_forward3. You are selling necklaces on Amazon for $23.99 and your gross margin is 53%. Amazon will let you buy a "sponsored listing" which means your listing will be shown at the top of the Amazon search results. The average CPC is $0.37 per click. Of those people who click on your listing, 7% purchase the necklace. a. What is the ROI for this type of advertising? Assume all sales from users who click on your ad are incremental.arrow_forward4 see picturearrow_forward

- Bear Paints is a national paint manufacturer and retailer. (Click the icon to view additional information.) Assume that management has specified a 20% target rate of return. Read the requirements. Requirement 1. Calculate each division's ROI. First enter the formula, then calculate the ROI for each division. (Enter the ROI as a percent rounded to the nearest hundredth of a percentage, X.XX%.) Paint Stores Paint Stores Consumer Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division. (Enter the sales margin as a percent rounded to the nearest hundredth of a percentage, X.XX%.) Sales margin Consumer Interpret your results. The Paint Stores Consumer + The Paint Stores + Consumer + Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division.…arrow_forwardClaudia wants to perform a break-even analysis on her very busy casual-dining operation. She has obtained the following operating results from last month's income statement and POS system sales records: Guests served: Sales: Variable costs: Fixed costs: Total costs: Profit: 25,000 $210,000 $75,000 $110,000 $185,000 $25,000arrow_forwardsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education