FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

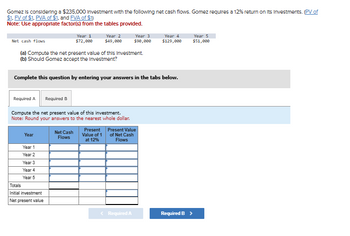

Transcribed Image Text:Gomez is considering a $235,000 Investment with the following net cash flows. Gomez requires a 12% return on its Investments. (PV of

$1, FV of $1. PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Net cash flows

Year 1

$72,000

Year 2

$49,000

Year 3

Year 4

$90,000

$129,000

Year 5

$51,000

(a) Compute the net present value of this Investment.

(b) Should Gomez accept the Investment?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the net present value of this investment.

Note: Round your answers to the nearest whole dollar.

Net Cash

Year

Flows

Present

Value of 1

at 12%

Present Value

of Net Cash

Flows

Year 1

Year 2

Year 3

Year 4

Year 5

Totals

Initial investment

Net present value

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Duo Corporation is evaluating a project with the following cash flows: Year 0 Cash Flow -$ 16,600 1 7,700 2 8,900 3 4 5 8,500 7,300 -4,700 The company uses an interest rate of 11 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach % % Combination approach %arrow_forwardA company is considering a $168,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net Cash Flow (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Year Year 11 Year 2 Year 1 $10,000 Complete this question by entering your answers in the tabs below. Year 3 Year 4 Year 5 Totals Initial investment Net present value Required A Required B Compute the net present value of this investment. (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Year 2 $29,000 Net Cash Flows $ 0 Present Value Factor Year 3 $55,000 Present Value of Net Cash Flows $ $ Required A Year, 4 $42,000 0 0 Year 5 $113,000 Required >arrow_forward1 Moore is considering a $180,000 investment with the following net cash flows. Moore requires a 10% return on its investments. Calculate the NPV and IRR below. In the dropdown box, select whether each indicates whether Moore should accept the investment. 2 3 Year 4 Initial investment 5 1 6 7 8 9 10 11 12 13 14 15 NPV 16 17 IRR 18 19 20 2 4 5 Net Cash Flows (180,000) 60,000 40,000 70,000 125,000 35,000arrow_forward

- A company is considering a $184,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net Cash Flow (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Required A Required B Year 1 $11,000 Year Year 2 $31,000 Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Net Cash Flows Year 3 $61,000 Compute the net present value of this investment. (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Present Value Factor Year 4 $46,000 Present Value of Net Cash Flows Year 5 $123,000arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 4 5 Cash Flow -$ 15,300 6,400 7,600 7,200 6,000 -3, 400 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forwardA mail order business will generate cash flows of $9,000 at the end of each of the next 3 years, $19,000 at the end of year 4, $25,000 at the end of year 5 and $45,000 at the end of year 6. Given that other investments of equal risk earn 8% per annum, calculate the present value and future value of this investmentarrow_forward

- Rayver Cruz is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC: 11.00% Year 1 Cash flows - $800 $350 $350 $350 9.84% O 10.94% 12.15% 13.50% 8.86%arrow_forwardsarrow_forwardJ&R Wealth is considering an investment with the following cash flow: EOY Cash Flow - $500,000 $92,500/year $50,000 1-10 10 If MARR is 12%, what is the ERR? Is this project acceptable?arrow_forward

- Suppose the MARR is 3%. Use the following table to answer the question--The IRR on the incremental cash flow is. CMS FMS Initial Investment $30,000 $39.000 Annual Revenue 6,688 9,102 I Useful Lite (Years) 5 5 OA. 1.0% 2.0% OB. 15.0% 16.0% OC. 20.0% 21.0% OD. 17.0% - 18.0% E. 10.0% 11.0%arrow_forwardPhoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $222,000 and would yield the following annual net cash flows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) Note: Use appropriate factor(s) from the tables provided. Net cash flows Year 1 Year 2 Year 3 Totals Project C1 $ 10,000 106,000 166,000 $ 282,000 Project C2 $ 94,000 94,000 94,000 $ 282,000 a. The company requires a 12% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 12% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B The company requires a 12% return from its investments. Compute net present values using factors from Table B.1 in Appendix B…arrow_forwardPhoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $330,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 46,000 $ 130,000 Year 2 142,000 130,000 Year 3 202,000 130,000 Totals $ 390,000 $ 390,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education