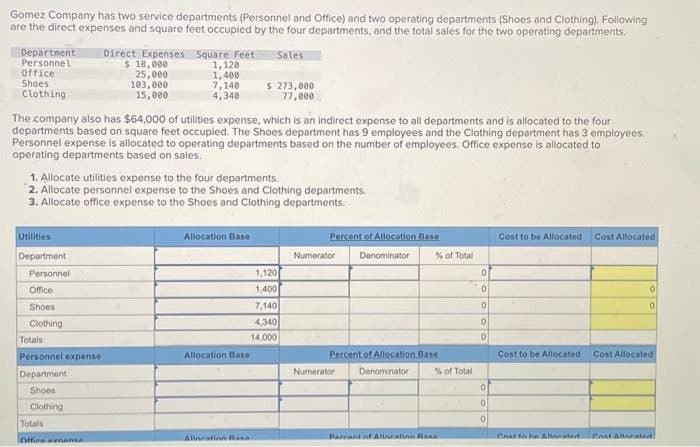

Gomez Company has two service departments (Personnel and Office) and two operating departments (Shoes and Clothing). Following are the direct expenses and square feet occupied by the four departments, and the total sales for the two operating departments. Department Personnel Office Shoes Clothing Direct Expenses Square Feet $ 18,000 25,000 103,000 15,000 1,120 1,400 7,140 4,340 Sales $ 273,000 77,000 The company also has $64,000 of utilities expense, which is an indirect expense to all departments and is allocated to the four departments based on square feet occupied. The Shoes department has 9 employees and the Clothing department has 3 employees. Personnel expense is allocated to operating departments based on the number of employees. Office expense is allocated to operating departments based on sales. 1. Allocate utilities expense to the four departments. 2. Allocate personnel expense to the Shoes and Clothing departments. 3. Allocate office expense to the Shoes and Clothing departments.

Gomez Company has two service departments (Personnel and Office) and two operating departments (Shoes and Clothing). Following are the direct expenses and square feet occupied by the four departments, and the total sales for the two operating departments. Department Personnel Office Shoes Clothing Direct Expenses Square Feet $ 18,000 25,000 103,000 15,000 1,120 1,400 7,140 4,340 Sales $ 273,000 77,000 The company also has $64,000 of utilities expense, which is an indirect expense to all departments and is allocated to the four departments based on square feet occupied. The Shoes department has 9 employees and the Clothing department has 3 employees. Personnel expense is allocated to operating departments based on the number of employees. Office expense is allocated to operating departments based on sales. 1. Allocate utilities expense to the four departments. 2. Allocate personnel expense to the Shoes and Clothing departments. 3. Allocate office expense to the Shoes and Clothing departments.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 9E: A manufacturing company has two service and two production departments. Human Resources and Machine...

Related questions

Question

Please provide answer in text (Without image)

Transcribed Image Text:Gomez Company has two service departments (Personnel and Office) and two operating departments (Shoes and Clothing). Following

are the direct expenses and square feet occupied by the four departments, and the total sales for the two operating departments.

Department

Personnel

Office

Shoes

Clothing

Utilities

Department

Personnel.

Office

Shoes

Clothing

Direct Expenses Square Feet

$ 18,000

25,000

103,000

15,000

The company also has $64,000 of utilities expense, which is an indirect expense to all departments and is allocated to the four

departments based on square feet occupied. The Shoes department has 9 employees and the Clothing department has 3 employees.

Personnel expense is allocated to operating departments based on the number of employees. Office expense is allocated to

operating departments based on sales.

Totals

Personnel expense

Department i

Shoes

Clothing

1,120

1,400

1. Allocate utilities expense to the four departments.

2. Allocate personnel expense to the Shoes and Clothing departments.

3. Allocate office expense to the Shoes and Clothing departments.

Totals

Office evnene

7,140

4,340

Allocation Base

Sales

Allocation Base

$ 273,000

77,000

Alineatinn Rake

1,120

1,400

7,140

4,340

14,000

Percent of Allocation Base

Denominator

Numerator

% of Total

Percent of Allocation Base

Denominator

Numerator

% of Total

Percent of Allocation Rasa

0

0

0

0

0

0

0

0

Cost to be Allocated i Cost Allocated

Cost to be Allocated

0

0

Cost Allocated

Costin e Allenated Cast Allnated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,