FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ook

nt

ht

F

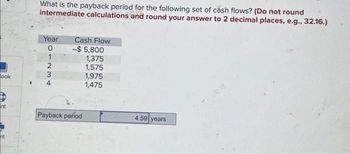

What is the payback period for the following set of cash flows? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Year

01234

0

Cash Flow

-$ 5,800

1,375

1,575

1,975

1,475

Payback period

4.59 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Raghubhaiarrow_forwardUse the following information Year 0 1 2 3 Cash flow -$1000 $300 $500 $700 WACC= 8.0% Calculate: a) NPV b) IRR c) Payback d) MIRR e) EAAarrow_forwardIncome from Net Cash Year Operations Flow $100,000 $180,000 2 40,000 120,000 40,000 100,000 10,000 90,000 10,000 120,000 The net present value for this investment is 4, 5.arrow_forward

- Cash Accounts receivable Equipment, net Land Total assets Current Year $7,440 $4,000 44,000 91,680 $197.120 Percent change Prior Year Required: Compute the annual dollar changes and percent changes for each of the following items $8,000 18,000 40,000 66,000 $132.000 (Use cells A2 to C7 from the given information to complete this question. Decreases should be entered with a minus sign. Round your percentage answers to one decimal place.) Cash Accounts receivable Equipment, net Horizontal Analysis Calculation of Percent Change Numerator: Current Year $7,440 54,000 44,000 Prior Year $8,000 18,000 40,000 Denominator: Dollar Change Changearrow_forwardAccounts payable $281,700 Prepaid insurance $6,800 Property and equipment 672,500 Contributed capital 380,600 Cost of service expense 183,600 Other revenue 114,100 Supplies inventory 216,900 Deferred revenue 83,600 Service revenue 904,000 Depreciation expense 57,750 Bonds payable 229,600 Accounts receivable 607,550 Interest receivable 4,300 Rent expense 30,500 Retained earnings 187,400 Cash 351,340 Notes payable 356,040 Accrued liabilities 23,400 Investments 146,400 Prepaid rent 11,200 Accumulated depreciation 128,900 Administrative and general expense (includes interest, utilities, etc.) 64,300 Supplies expense 336,200 Income tax payable 0 Based on the following data for Checkmate Company, prepare a Statement of Retained Earnings and demonstrate that the accounting equation remains in balance after the retained earnings account has been updated. (Assume that the…arrow_forwardFree Cash Flow method Needed for this what is the total value? How did you get therearrow_forward

- If discretionary expenses are $500, cash flow before discretionary expenses are $2,000, and discretionary capital expenditures are $500, what is the discretionary payout percentage? A. 50% B. 25% C. 20% D. 250%arrow_forwardWhat is the IRR of the following set of cash flows? Year 0 123 Cash Flow -$ 10,640 6,500 5,500 3,500arrow_forward($ thousands) Present value at 19% Net cash flow Net present value 0 1 4 -13,700 -1,594 -13,700 -1,339 3,541 (sum of PVs). Period 2 3 6 3,057 6,433 10,644 10,095 5,867 2,159 3,817 5,308 4,230 2,066 5 7 3,379 1,000 Restate the above net cash flows in real terms. Discount the restated cash flows at a real discount rate. Assume a 19% nominal rate and 11% expected inflation. NPV should be unchanged at +3,541, or $3,541,000. Note: Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest whole number. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Real Net Cash Flows NPVarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education