FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Munabhai

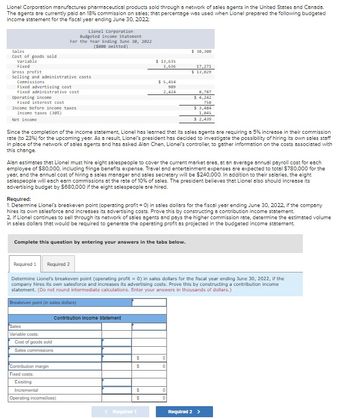

Transcribed Image Text:Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada.

The agents are currently paid on 18% commission on sales; that percentage was used when Lionel prepared the following budgeted

income statement for the fiscal year ending June 30, 2022

Sales

Cost of goods sold

Variable

Fixed

Gross profit

Lionel Corporation

Budgeted Income Statement

For the Year Ending June 30, 2022

($800 omitted)

Selling and administrative costs

Commissions

Fixed advertising cost

Fixed administrative cost

Operating income

Fixed interest cost

Income before income taxes

Income taxes (38%)

Net income

$ 30,300

$ 13,635

3,636

17,271

$ 13,029

$ 5,454

909

2,424

8,787

$ 4,242

758

$ 3,484

1,045

$ 2,439

Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission

rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of hiring its own sales staff

in place of the network of sales agents and has asked Alan Chen, Lionel's controller, to gather information on the costs associated with

this change.

Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each

employee of $80,000, including fringe benefits expense. Travel and entertainment expenses are expected to total $780,000 for the

year, and the annual cost of hiring a sales manager and sales secretary will be $240,000. In addition to their salaries, the eight

salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its

advertising budget by $680,000 if the eight salespeople are hired.

Required:

1. Determine Lionel's breakeven point (operating profit = 0) in sales dollars for the fiscal year ending June 30, 2022, if the company

hires its own salesforce and increases its advertising costs. Prove this by constructing a contribution income statement.

2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume

in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Determine Lionel's breakeven point (operating profit = 0) in sales dollars for the fiscal year ending June 30, 2022, if the

company hires its own salesforce and increases its advertising costs. Prove this by constructing a contribution income

statement. (Do not round intermediate calculations. Enter your answers in thousands of dollars.)

Breakeven point (in sales dollars)

Sales

Variable costs:

Cost of goods sold

Sales commissions

Contribution Income Statement

S

0

Contribution margin

S

0

Fixed costs:

Exisiting

Incremental

Operating income(loss)

S

0

S

0

<Required 1

Required 2 >

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education