FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

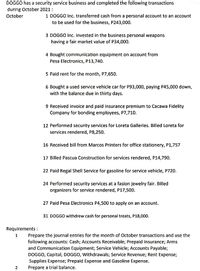

Transcribed Image Text:DOGGO has a security service business and completed the following transactions

during October 2021 :

October

1 DOGGO Inc. transferred cash from a personal account to an account

to be used for the business, P243,000.

3 DOGGO Inc. invested in the business personal weapons

having a fair market value of P34,000.

4 Bought communication equipment on account from

Pesa Electronics, P13,740.

5 Paid rent for the month, P7,650.

6 Bought a used service vehicle car for P93,000, paying P45,000 down,

with the balance due in thirty days.

9 Received invoice and paid insurance premium to Cacawa Fidelity

Company for bonding employees, P7,710.

12 Performed security services for Loreta Galleries. Billed Loreta for

services rendered, P8,250.

16 Received bill from Marcos Printers for office stationery, P1,757

17 Billed Pascua Construction for services rendered, P14,790.

22 Paid Regal Shell Service for gasoline for service vehicle, P720.

24 Performed security services at a fasion jewelry fair. Billed

organizers for service rendered, P17,500.

27 Paid Pesa Electronics P4,500 to apply on an account.

31 DOGGO withdrew cash for personal treats, P18,000.

Requirements :

Prepare the journal entries for the month of October transactions and use the

following accounts: Cash; Accounts Receivable; Prepaid Insurance; Arms

and Communication Equipment; Service Vehicle; Accounts Payable;

DOGGO, Capital; DOGGO, Withdrawals; Service Revenue; Rent Expense;

1

Supplies Expense; Prepaid Expense and Gasoline Expense.

2

Prepare a trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Journalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forward[The following information applies to the questions displayed below.] Sanyu Sony started a new business and completed these transactions during December. 1 Sanyu Sony transferred $65,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company paid $1,800 cash for the December rent. 3 The company purchased $14,200 of electrical equipment by paying $6,000 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased supplies by paying $1,000 cash. 6 The company completed electrical work and immediately collected $1,800 cash for these services. 8 The company purchased $2,820 of office equipment on credit. 15 The company completed electrical work on credit in the amount of $5,500. 18 The company purchased $450 of supplies on credit. 20 The company paid $2,820 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is…arrow_forwardProcedures: 1. Analyze the following business transactions below. For the month of December 2022, Mr. Mira Shikigami had the following transactions: Dec. Mr. Mira Shikigami invested P1,200,000 to start the business, Shikigami Accounting Firm 1 1 The firm obtained a note from Solar Bank amounting to P300,000. The note bears a 6% annual interest payable every June 1 of the following year. The principal is payable in two (2) equal annual installments. 1 The firm paid P15,000 for the necessary permits and licenses for its operation. 1 The firm paid P180,000 for the annual rent of the office space. The lease contract will expire on June 1 of the following year and will be renewed yearly. 3 The firm rendered service to Kyubi Realties, Inc. worth P250,000 on credit. 3 The firm purchased supplies worth P50,000. 9 The firm purchased a laptop in cash, P50,000. The laptop has an estimated useful life of three (3) years with no residual value. The company treats purchases during the first half of…arrow_forward

- The following transactions are taken from Pak Maun Enterprise in November 2020: Nov 1 Starting business with cash in hand RM18,000 and cash in bank account RM100,000 3 Purchased office furniture worth RM24,000 from Kedai Perabot Dinesh 4 Purchased business inventories worth RM12,800 using cheque 5 Sold inventories worth RM6,000 to Kedai Mei Ling 7 Kedai Mei Ling returned defective inventories worth RM920 9 Withdrawal (business inventories) worth RM480 for family use 10 Received cheque from Kedai Mei Ling RM3,400 12 Purchased business inventories worth RM27,200 from Pembekal Syazwani 15 Returned business inventories worth RM560 to Pembekal Syazwani (wrong brand) 16 Cash sale RM2,400 20 Paid to Pembekal Syazwani using cheque RM14,000 22 Paid rental fee RM2,000 using cash 29 Paid workers’ salaries RM2,800 using cheque (i)Record the above transactions into the respective ledgers and balance the accounts.…arrow_forwardOn 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will boldly go and keep their records on a double-entry system. Their assets and liabilities at the date were, office fixtures £1200, a van £32000 and £36800 in the bank account. They have no liabilities at the 1st of August 2021. Their transactions during August 2021 were as follows: -2 August: Maurice & brothers received a loan of £12400 from Santander Bank and they deposited in their bank account. - 3 August: The amount of £2800 was transferred from bank Account to Cash in hand account. - 4 August: Bought a second-hand Van paying by cheque £6200 - 5 August: Bought office fixtures £3400 from Sharp Office Ltd. They Paid £1000 by issuing a cheque and the rest of the fixtures value would remain as a credit. - 8 August: Bought a new van on credit from Toyota Co. £8700 - 15 August: Bought office fixtures paying by cash £110 - 19 August: Paid Toyota Co. a cheque for whole amount of debt.…arrow_forward2. Transfer the journal entry into the general ledger and related subsidiary ledger 3. Prepare a Trial Balance on 31 Jan 2021arrow_forward

- During 2018, its first year of operations as a delivery service, Carla Vista Corp. entered into the following transactions. The fiscal year end for Carla Vista is December 31. 1. Issued common shares to investors in exchange for $ 90,000 in cash. 2. Borrowed $ 46,000 cash from the bank, due 2020. 3. Purchased delivery vehicles for $ 61,000 cash. 4. Received $ 24,000 from customers for services provided. 5. Purchased supplies for $ 3,700 on account. 6. Paid rent of $ 5,500. 7. Performed services on account for $ 9,000. 8. Paid salaries of $ 28,000. 9. Declared and paid a dividend of $ 12,000 to shareholders. 10. Paid income taxes of $ 200 for the month. Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Sr No Account Titles and…arrow_forwardA company has posted the following transaction: Debit Equipment 7000; Credit Accounts Payable 2000; Credit Cash 4000; and Credit Bank 1000. Which of the following best describes the actual transaction? Select one: a. The company purchased equipment for 7000, paying 4000 in cash, 1000 in cheque, and the remaining on credit. b. The company sold equipment worth 7000, receiving 4000 in cash and 2000 still owed. c. The company purchased equipment for 7000, paying 4000 in cash and the remaining 2000 is to be paid later. ↓ d. The company purchased equipment for 7000 entirely on credit.arrow_forwardWaterworld Boat Shop purchased a truck for $12,000,making a down payment of $5,000 cash and signing a$7,000 note payable due in 60 days. As a result of thistransaction:a. Total assets increased by $12,000.b. Total liabilities increased by $7,000. c. From the viewpoint of a short-term creditor, this trans-action makes the business more liquid. d. This transaction had no immediate effect on the own-ers’ equity in the business.arrow_forward

- Q.1 The following transactions are for the Sun’s Corporation, December, 2018. 12 Jan. Sun’s Corporation issued shares 100000 and value of one share is Rs. 56. 14 Feb. Sun’s Corporation purchased furniture 30000 for cash. 17 Mar. Sold goods on credit for Rs. 90000. 21 Apr. Account receivable collected for Rs 10000, made on 17 March. 21 Apr Sun’s Corporation purchased computer 30000 on account payable. 23 Jun. Paid advertising expense for Rs. 9000. 12 Sep. Paid salary for Rs. 17000 30 Dec. Declared and paid dividend to shareholders 40000. Required: Pass Journal entries. Post each of the above transactions in the Ledger Prepare Trial Balance.arrow_forwardK Bryson Inc. collects cash from customers two ways: 1. Accrued Revenue. Some customers pay Bryson after Bryson has performed service for the customer. During 2020, Bryson made sales of $53,000 on account and later received cash of $45,000 on account from these customers. 2. Unearned Revenue. A few customers pay Bryson in advance, and Bryson later performs service for the customer. During 2020, Bryson collected $6,500 cash in advance and later earned $5,000 of this amount. Journalize the following for Bryson: a. Earning service revenue of $53,000 on account and then collecting $45,000 on account b. Receiving $6,500 in advance and then earning $5,000 as service revenue a. Journalize Bryson earning service revenue of $53,000 on account and then collecting $45,000 on account. Start by recording earning service revenue on account. (Record debits first, then credits. Explanations are not required.) Date 2020 Accounts Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education