FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

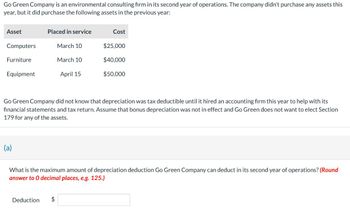

Transcribed Image Text:Go Green Company is an environmental consulting firm in its second year of operations. The company didn't purchase any assets this

year, but it did purchase the following assets in the previous year:

Asset

Placed in service

Cost

Computers

March 10

$25,000

Furniture

March 10

$40,000

Equipment

April 15

$50,000

Go Green Company did not know that depreciation was tax deductible until it hired an accounting firm this year to help with its

financial statements and tax return. Assume that bonus depreciation was not in effect and Go Green does not want to elect Section

179 for any of the assets.

(a)

What is the maximum amount of depreciation deduction Go Green Company can deduct in its second year of operations? (Round

answer to O decimal places, e.g. 125.)

Deduction

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Northwest Delivery Company acquired an adjacent lot to construct a new warehouse, paying $75,000 and giving a short-term note for $90,000. Legal fees paid were $2,500, delinquent taxes assumed were $22,400, and fees paid to remove an old building from the land were $14,500. Materials salvaged from the demolition of the building were sold for $7,500. A contractor was paid $660,000 to construct a new warehouse. Determine the Cost of the land to be reported on the balance sheet.arrow_forward6..An in-place machine with B = $110,000 was depreciated by using Modified Accelerated Cost Recovery System (MACRS) over a 3-year period. The machine was sold for $60,000 at the end of year 2 when the company decided to import the item that required the use of the machine. In year 2, gross income (GI) = $1 million and operating expenses (OE) = $500,000. Determine the tax liability in year 2 if Te = 35%.arrow_forwardPastina Company manufactures and sells various types of pasta to grocery chains as private label brands. The company’s fiscal year-end is December 31. The unadjusted trial balance as of December 31, 2011, appears below: The equipment is being depreciated using the straight-line method over an eight-year useful life with $10,000 salvage value. The company estimates that 4% of all year-end accounts receivable probably will not be collected. Employee wages are paid twice a month, on the 22nd wages earned for the 1st through the 15th , and on the 7th of the following month for wages earned from the 16th through the end of month. Wages earned from December 16 through December 31, 2011, were $1,565. On October 1, 2011, Pastina borrowed $50,800 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 10%. The principal is due in 10 years. On April 1, 2011, the company lent a supplier $28,000 and a note was signed requiring principal and…arrow_forward

- A factory owned by Wonder Inc. was destroyed by fire. Wonder Inc. lodged an insurance claim for the value of the factory building, plant and an amount equal to one year’s net profit. During the year, there were a number of meetings with the representatives of the insurance company. Finally, before the year-end, it was decided that Wonder Inc. would receive compensation of 90% of its claim. Wonder Inc. received a letter that the settlement check for that amount had been mailed, but it was not received before year-end. How should Wonder Inc. treat this in its financial statements? Disclose the contingent asset in the footnotes. Wait until next year when the settlement check is actually received and not recognize or disclose the receivable at all since at year-end it is a contingent asset. Because the settlement of the claim was conveyed by a letter from the insurance company, that also stated that the settlement check was in the mail for 90% of the claim, record the 90% of the claim…arrow_forwardXYZ Ltd. is a manufacturing company that produces specialized machinery. The company has been in business for the last 10 years and has always used the straight-line method of depreciation to calculate the depreciation expense for its machinery. However, the company's financial controller has recently proposed that they switch to the double- declining balance method instead. The financial controller argues that this method would result in a more accurate depreciation expense calculation and better reflect the actual usage of the machinery over time. Questions: 1. What is the straight-line method of depreciation? 2. What is the double-declining balance method of depreciation? 3. What are the advantages and disadvantages of using the straight-line method? 4. What are the advantages and disadvantages of using the double-declining balance method? 5. Should XYZ Ltd. switch to the double-declining balance method of depreciation? Why or why not?arrow_forwardHarris Corporation is a technology start-up in its second year of operations. The company didn’t purchase any assets this year but purchased the following assets in the prior year: Asset Placed in Service Basis Office equipment August 14 $ 10,400 Manufacturing equipment April 15 72,000 Computer system June 1 20,000 Total $ 102,400 Harris did not know depreciation was tax deductible until it hired an accountant this year and didn’t claim any depreciation deduction in its first year of operation. (Use MACRS Table 1 and Table 2.) Problem 10-55 Part a (Algo) a. What is the maximum amount of depreciation deduction Harris Corporation can deduct in its second year of operation? (Leave no answer blank. Enter zero if applicable.)arrow_forward

- Calvin Corporation's office was burglarized. The thieves stole 10 laptop computers and other electronic equipment. The lost assets had an original cost of $35,000 and accumulated tax depreciation of $19,400. Calvin received an insurance reimbursement of $20,000 related to the theft loss and immediately purchased new replacement computer equipment. In each of the following cases: a. Determine Calvin's recognized gain, if any, and the tax basis of the replacement property. Assume that Calvin would elect to defer gain recognition when possible. The replacement property cost $27,000. b. Determine Calvin's recognized gain, if any, and the tax basis of the replacement property. Assume that Calvin would elect to defer gain recognition when possible. The replacement property cost $18,000.arrow_forwardFleet rental car company purchased 10 new cars for a total cost of $180,000. The cars generated income of $150,000 per year and incurred operating expenses of $60,000 per year. The company uses MACRS depreciation and its marginal tax rate is 28% (Note: Per IRS regulations, cars have a class life of 5 years). The 10 cars were sold at the end of the third year for a total of $75,000. Assuming a MARR of 10% and using NPW, determine if this was a good investment on an after-tax basis.arrow_forwardCullumber paid $48,000 to replace part of the factory floor. The floor had been capitalized as part of the factory building when it was purchased ten years previously and was not considered a separate component. When purchased, the building had been assumed to have a 30-year useful life and was being depreciated on a straight-line basis. At the time of the floor replacement, the building had been depreciated for 10 years. Cullumber estimated that the original cost of the floor would have been 15% cheaper than the new replacement, due to inflation. Prepare the journal entries to record these transactions, assuming Cullumber follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education