FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

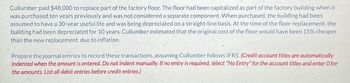

Transcribed Image Text:Cullumber paid $48,000 to replace part of the factory floor. The floor had been capitalized as part of the factory building when it

was purchased ten years previously and was not considered a separate component. When purchased, the building had been

assumed to have a 30-year useful life and was being depreciated on a straight-line basis. At the time of the floor replacement, the

building had been depreciated for 10 years. Cullumber estimated that the original cost of the floor would have been 15% cheaper

than the new replacement, due to inflation.

Prepare the journal entries to record these transactions, assuming Cullumber follows IFRS. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- New Morning Bakery is in the process of closing its operations. It sold Its two-year-old bakery ovens to Great Harvest Bakery for $700,000. The ovens originally cost $910,000, had an estimated service life of 10 years, had an estimated residual value of $60,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. 4. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) View transaction list Journal entry worksheet < Record the sale of ovens. Note: Enter debits before credits.arrow_forwardCompute the annual depreciation to be charged, beginning with 2022. (Round answer to O decimal places, e.g. 45,892.) Annual depreciation expense-building %24arrow_forwardCompany I purchased a piece of land for its natural resources at a cost of $1,500,000. The land is expected to have a salvage value of $250,000. A lumber expert visited the property and estimated the property to have 500,000 pounds of timber. The first year, the company logged 350,000 pounds of timber, and the second year, another 250,000 pounds of timber were logged. Calculate the depletion expense rate AND calculate the depletion expense the company should recognize in Year 1 and Year 2:arrow_forward

- sarrow_forwardIn 1990, Sheridan Company completed the construction of a building at a cost of $860,000 and fırst occupied it in January 1991. It was estimated that the building would have a useful life of 40 years and a salvage value of $26,000 at the end of that time. Early in 2001, an addition to the building was constructed at a cost of $215,000. At that time, it was estimated that the remaining life of the building would be, as originally estimated, an additional 30 years, and that the addition would have a life of 30 years and a salvage value of $9,000. In 2019, it is determined that the probable life of the building and addition will extend to the end of 2050, or 20 years beyond the original estimate. (a) Using the straight-line method, compute the annual depreciation that would have been charged each year from 1991 through 2000. Annual depreciation from 1991 through 2000 $ / yr %24arrow_forwardTree Lovers Inc. purchased 100 acres of woodland in which the company intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $3,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and expects to deplete it over five years (23 acres in year one, 30 acres in year two, 24 acres in year three, 10 acres in year four, and 13 acres in year five). Calculate the depletion expense for the next five years. Year 1 $ Year 2 Year 3 $ Year 4 Year 5 Prepare the journal entry for year one. If an amount box does not require an entry, leave it blank. %24 %24 %24 %24 %24arrow_forward

- Budget Hardware Consultants purchased a building for $800,000 and depreciated it on a straight-line basis over a 35-year period. The estimated residual value is $100,000. After using the building for 15 years, Budget realized that wear and tear on the building would wear it out before 35 years and that the estimated residual value should be $88,000. Starting with the 16th year, Budget began depreciating the building over a revised total life of 20 years using the new residual value. Journalize depreciation expense on the building for years 15 and 16. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the depreciation on the building for year 15. Date Accounts and Explanation Debit Creditarrow_forwardPlease solve this problemarrow_forward[The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine In its factory at the beginning of the year at a cost of $85,400. The machine's useful life is estimated at 20 years, or 402,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 34,200 units of product. Determine the machine's second-year depreciation using the units-of-production method.arrow_forward

- in the new building? 40. In January, Prahbu purchased for $90,000 a new machine for use in an existing production line of his manufacturing business. Assume that the machine is a unit of property and is not a material or supply. Prahbu pays $2,500 to install the machine, and after the machine is installed, he pays $1,300 to perform a critical test on the machine to ensure that it will operate in accordance with quality standards. On November 1, the critical test is complete, and Prahbu places the machine in service on the production line. On December 3, Prahbu pays another $3,300 to perform periodic quality control testing after the machine is placed in service. How much will Prahbu be required to capitalize as the cost of the machine? Donn 11 LO 2-1 researarrow_forwardOn November 10 of year 1, Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000; $300,000 was allocated to the basis of the land and the remaining $900,000 was allocated to the basis of the building. a) Assume the building was purchased and placed in service on March 3 instead of November 10. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? b) Assume the building is residential property. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3?c) What would be the depreciation for 2022, 2023, and 2024 if the property were nonresidential property purchased and placed in service November 10, 2005 (assume the same original basis)?arrow_forwardSage Ltd. owned several manufacturing facilities. On September 15 of the current year, Sage decided to sell one of its manufacturing buildings. The building had cost $6,325,000 when originally purchased 5 years ago, and had been depreciated using the straight-line method with no residual value. Sage estimated that the building had a 25-year life when purchased. Prepare the journal entry to record the sale of the building on Sage's books, assuming 5 years of depreciation has already been recorded in the accounts to the date of disposal. The building was sold for $5,250,000 cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Sept. 15 List of Accounts…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education