FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

GL0305 (Algo) - Based on Problem 3-5A LO P1, P3, P4, P5, P6

On April 1, Rick Mitchell created a new travel agency, Mitchell Travel. The following transactions occurred during the company’s first month.

| April 2 | Mitchell invested $38,000 cash and computer equipment worth $18,600 in the company in exchange for its common stock. |

|---|---|

| April 3 | The company rented furnished office space by paying $2,200 cash for the first month’s (April) rent. |

| April 4 | The company purchased $2,200 of office supplies for cash. |

| April 10 | The company paid $1,800 cash for a 12-month insurance policy. Coverage begins on April 11. |

| April 14 | The company paid $1,540 cash for two weeks’ salaries earned by employees. |

| April 24 | The company collected $16,000 cash for commissions revenue. |

| April 28 | The company paid $1,540 cash for two weeks’ salaries earned by employees. |

| April 29 | The company paid $650 cash for minor repairs to computer equipment. |

| April 30 | The company paid $650 cash for this month’s telephone bill. |

| April 30 | The company paid $1,700 cash in dividends. |

Information for month-end adjustments follows:

- Prepaid insurance of $100 expired this month.

- At the end of the month, $650 of office supplies are still available.

- This month’s

depreciation on computer equipment is $310. - Employees earned $616 of unpaid and unrecorded salaries as of month-end.

- The company earned $1,850 of commissions revenue that is not yet recorded at month-end.

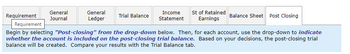

Transcribed Image Text:Requirement

General

Journal

General

Ledger

Trial Balance

Income

Statement

St of Retained

Earnings

Balance Sheet Post Closing

Requirement

Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate

whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial

balance will be created. Compare your results with the Trial Balance tab.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 9 images

Knowledge Booster

Similar questions

- Please help mearrow_forwardFinancial Statements Alex Vera organized Succulent Express at the beginning of February 20Y4. During February, Succulent Express entered into the following transactions: Terry Mason invested $30,000 in Succulent Express in exchange for common stock. Paid $5,400 on February 1 for an insurance premium on a one-year policy. Purchased supplies on account, $1,800. Received fees of $57,000 during February. Paid expenses as follows: wages, $21,600; rent, $6,400; utilities, $2,800; and miscellaneous, $3,200. Paid dividends of $8,000. There was $300 of supplies on hand as of February 28. Financial Statement Effects Balance Sheet Assets = Liabilities + Stockholders' Equity Cash + Supplies + Prepaid Insurance = Accounts Payable + Common Stock + Retained Earnings a.arrow_forwardoperations. April 1 April 2 April 3 April 6 April 9 April 13 April 19 Tanner invested $120,000 cash along with office equipment valued at $28,800 in the company in exchange for common stock. The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200. The company made credit purchases for $14,400 in office equipment and $2,880 in office supplies. Payment is due within 10 days. The company completed services for a client and immediately received $2,000 cash. The company completed a $9,600 project for a client, who must pay within 30 days. The company paid $17,280 cash to settle the account payable created on April 3. The company paid $6,000 cash for the premium on a 12-month prepaid insurance policy. Hint: Debit Prepaid Insurance for $6,000. April 22 The company received $7,680 cash as partial payment for the work completed on April 9. The company completed work for another client for $2,640 on credit. The company paid a $6,200 cash…arrow_forward

- Dhapaarrow_forwardPA5. LO 8.5 Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies S200, Maintenance Expense S140, Miscellaneous Expense S65. Cash on Hand $93. Check #106. J. Increased Petty Cash by S100, check #107.arrow_forwardSubject: acountingarrow_forward

- Alex Vera organized Succulent Express at the beginning of February 20Y4. During February, Succulent Express entered into the following transactions: Terry Mason invested $32,750 in Succulent Express in exchange for common stock. Paid $4,200 on February 1 for an insurance premium on a one-year policy. Purchased supplies on account, $1,560. Received fees of $48,270 during February. Paid expenses as follows: wages, $22,200; rent, $3,700; utilities, $1,850; and miscellaneous, $2,035. Paid dividends of $8,850. There was $858 of supplies on hand as of February 28. Assume that adjusting entries for usage of supplies and expiration of prepaid insurance were recorded on February 28, 20Y4. Based on the information above, determine the net cash flow from operating activities as of February 28, 20Y4.arrow_forwardQ3 James Collier left his job at a large corporation where he had worked as a senior accountant. He was getting $82000 as yearly salary. He established his own J.C. Accounting firm. J.C. Accounting earned total revenue $680000 in first year. The material cost was $49000; costs for rented equipment were $30000, salary given to the security man was $18800 and wages given to workers were $158229 in a year. The interest forgone for the invested funds was $22000 per year. James Collier estimated his entrepreneurial talent was worth $19850 per year. He was also offered $26985 per year to train employees in another firm. Two students assist him managing his account books for which they are paid $6550 each per year. Find accounting profits and economic profits for J.C. Accounting firm. Should James Collier stay in his business? Why? Explicit costs = Implicit costs = Economic costs = Accounting…arrow_forwardRequired information [The following information applies to the questions displayed below.] Rawlco Communications operates 10 radio stations. The following events occurred during September. a. Placed an order for office supplies costing $3,300. Supplier intends to deliver later in the month. b. Purchased equipment that cost $38,000; paid $15,000 cash and signed a promissory note to pay $23,000 in one month. c. Negotiated and signed a one-year bank loan, and then deposited $7,000 cash in the company's checking account. d. Hired a new finance manager on the last day of the month. e. Received an investment of $10,000 cash from the company's owners in exchange for issuing common shares. f. Supplies [ordered in (a)] were received, along with a bill for $3,300. 2. Prepare journal entries to record each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Transaction…arrow_forward

- E2-13 (Algo) Recording Journal Entries LO2-4 Jameson Corporation was organized on May 1. The following events occurred during the first month. a. Received $72,000 cash from the five investors who organized Jameson Corporation. Each investor received 110 shares of $10 par value common stock. b. Ordered store fixtures costing $11,000. c. Borrowed $10,000 cash and signed a note due in two years. d. Purchased $18,000 of equipment, paying $1,100 in cash and signing a six-month note for the balance. e. Lent $1,500 to an employee who signed a note to repay the loan in three months. f. Received and paid for the store fixtures ordered in (b). Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record the receipt of $72,000 cash from five investors who each received 110 shares of $10 par value common stock. Note: Enter…arrow_forwardDec. 2 Paid $1,060 cash to Northview Mall for Security First’ share of mall advertising costs. Dec. 3 Paid $520 cash for minor repairs to the company’s computer. Dec. 4 Received $6,900 cash from Brady Engineering Co. for the receivable from November. Dec. 10 Paid cash to Zahara Hughes for six days of work at the rate of $160 per day. Dec. 14 Notified by Brady Engineering Co. that Security First’ bid of $7,100 on a proposed project has been accepted. Brady paid a $1,550 cash advance to Security First. Dec. 15 Purchased $2,250 of computer supplies on credit from Arnold Office Products. Dec. 16 Sent a reminder to Jackson Co. to pay the fee for services recorded on November 8. Dec. 20 Completed a project for Masters Corporation and received $7,900 cash. Dec. 22-26 Took the week off for the holidays. Dec. 28 Received $4,400 cash from Jackson Co. on its receivable. Dec. 29 Reimbursed K. Hughes for business automobile mileage…arrow_forwardCould you answer 6 Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education