FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

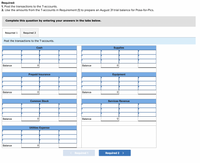

Transcribed Image Text:Required:

1. Post the transactions to the T-accounts.

2. Use the amounts from the T-accounts in Requirement (1) to prepare an August 31 trial balance for Pose-for-Pics.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Post the transactions to the T-accounts.

Cash

Supplies

Balance

Balance

Prepaid Insurance

Equipment

Balance

Balance

Common Stock

Services Revenue

Balance

Balance

Utilities Expense

Balance

< Required 1

Required 2 >

![Required information

Use the following information for Exercises 9-12 below. (Algo)

[The following information applies to the questions displayed below.]

Following are the transactions of a new company called Pose-for-Pics.

1 Madison Harris, the owner, invested $9,250 cash and $39,775 of photography equipment in the company

in exchange for common stock.

2 The company paid $2,100 cash for an insurance policy covering the next 24 months.

5 The company purchased supplies for $1,758 cash.

20 The company received $3,850 cash from taking photos for customers.

31 The company paid $881 cash for August utilities.

Aug.](https://content.bartleby.com/qna-images/question/ccb668bc-10a4-4aaf-a388-7b2b8ddb3a25/51fd49f4-7083-4648-9060-76c3baefd72a/tfvuw8c_thumbnail.png)

Transcribed Image Text:Required information

Use the following information for Exercises 9-12 below. (Algo)

[The following information applies to the questions displayed below.]

Following are the transactions of a new company called Pose-for-Pics.

1 Madison Harris, the owner, invested $9,250 cash and $39,775 of photography equipment in the company

in exchange for common stock.

2 The company paid $2,100 cash for an insurance policy covering the next 24 months.

5 The company purchased supplies for $1,758 cash.

20 The company received $3,850 cash from taking photos for customers.

31 The company paid $881 cash for August utilities.

Aug.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. Received $60,000 cash from the investors who organized Down, Incorporated b. Borrowed $20,000 cash and signed a note due in two years. c. Ordered equipment costing $16,000. d. Purchased $9,000 in equipment, paying $2,000 in cash and signing a six-month note for the balance. e. Received the equipment ordered in (c), paid for half of it, and put the rest on account. 3. Prepare a classified balance sheet at May 31. Include Retained Earnings with a balance of zero. Current Assets Cash Total Current Assets Equipment Total Assets Assets DOWN.INCORPORATED Balance Sheet At May 31 $ 70,000 70,000 25,000 Liabilities Current Liabilities Common Stock Notes Payable (long-term) $ 95,000 $ $ 60,000 20,000 80,000 80,000 0 80,000arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forwardThe following are the transactions of Spotlighter, Inc., for the month of January. Borrowed $4,790 from a local bank on a note due in six months. Received $5,480 cash from investors and issued common stock to them. Purchased $2,700 in equipment, paying $1,050 cash and promising the rest on a note due in one year. Paid $1,150 cash for supplies. Bought and received $1,550 of supplies on account. Prepare journal entries for each transaction.arrow_forward

- You have decided to go into the business of selling Beamers. You decide to operate the business as a corporation, Chris's Beamer Biz, Inc. On January 1, 20X1 the company issued you 100 shares of stock for $20,000 of cash. The company borrowed $10,000 from your Uncle Mike. For the $10,000 borrowed from your uncle, the company signed a note agreeing to pay back that amount on December 31, 20X4 and will pay interest at 10% at the end of each year. On January 1, 20X1, the company bought 11 Beamers for $2,500 each. During the year the company sold 8 Beamers for $8,000 each. They also paid a security deposit of $2,000, advertising expense of $6,000 and 12 months' rent of $18,000. In addition to the cash invested on January 1st, on August 1" you also invest a piece of land that you own into the business that is worth $40,000 in exchange for 200 more shares of stock. The first year's interest to Uncle Mike of $1,000 is paid on December 31 of 20X1. The tax rate is 30% of income before taxes and…arrow_forwardThe following are the transactions relating to the formation of Gray Mowing Services Inc. and its first month of operations. a. The firm was organized and the initial stockholders invested cash of $720. b. The company borrowed $1,080 from a relative of one of the initial stockholders; a short-term note was signed. c. Two zero-turn lawn mowers costing $576 each and a professional trimmer costing $156 were purchased for cash. The original list price of each mower was $732, but a discount was received because the seller was having a sale. d. Gasoline, oil, and several packages of trash bags were purchased for cash of $108. e. Advertising flyers announcing the formation of the business and a newspaper ad were purchased. The cost of these items, $204, will be paid in 30 days. f. During the first two weeks of operations, 47 lawns were mowed. The total revenue for this work was $846; $558 was collected in cash, and the balance will be received within 30 days. g. Employees were paid $504 for…arrow_forwardPark & Company was recently formed with a $6,400 investment in the company by stockholders in exchange for common stock. The company then borrowed $3,400 from a local bank, purchased $1,140 of supplies on account, and also purchased $6,400 of equipment by paying $2,140 in cash and signing a promissory note for the balance. Based on these transactions, the company's total assets are: Multiple Choice $9,800. $15,200. $12,800. $11,940.arrow_forward

- [The following information applies to the questions displayed below.]RunHeavy Corporation (RHC) is a corporation that manages a local band. It had the following activities during its first month. RHC was formed with an investment of $11,900 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $2,300 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,800 each, but no cash was collected yet. Of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,800 fee for one of them. On January 27, RHC paid $3,440 cash for the band’s travel-related costs. On January 28, RHC paid its band members a total of $2,490 cash for salaries and wages for the first…arrow_forwardHello, I need help pleasearrow_forwardVikrambhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education