FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

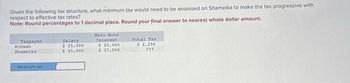

Transcribed Image Text:Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with

respect to effective tax rates?

Note: Round percentages to 1 decimal place. Round your final answer to nearest whole dollar amount.

Taxpayer

Mihwah

Shameika

Minimum tax

Salary:

$ 25,000

$ 65,000

Muni-Bond

Interest

$ 25,000

$ 37,500

Total Tax

$ 2,250

222

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 2abc. Help me answer the given question. Do not round off answers while solving, instead just the final answer will be rounded off to one decimal places.arrow_forwardProblem 1-51 (LO 1-5) (Algo) Given the following tax structure: Taxpayer Mae Salary $ 13,000 Pedro Venita $ 26,000 $ 13,000 What tax would need to be assessed on Venita to make the tax horizontally equitable? Tax Total Tax $ 650 $ 1,690 ???arrow_forwardPleas calculate the AVERAGE and MARGINAL TAX based on the tax bracket provided below. (Hint: every box in the table may NOT be used.) $0 $1,001 $3,001 Tax Bracket $10,001 $20,001 $40,001 $1,000 $3,000 $10,000 $20,000 $40,000 & Above Average Tax:__`17.729% Marginal Tax:__`25¹% Tax 5% 10% 15% 25% 30% 45% $ $ Taxable Income Amount Taxed type your ansv type your ansv type your ansv = type your ansv $16,500 $ $ $ $ Actual Tax Paid type your answe type your answe type your answe type your answe type your answe Amount Remaining $ $ $ $ type your answe type your answe type your answe type your answearrow_forward

- Given the following tax structure: Taxpayer Mae Pedro Venita Salary $ 22,500 $ 45,000 $ 22,500 What tax would need to be assessed on Venita to make the tax horizontally equitable? Total Tax $ 1,980 $ 4,635 ???arrow_forwardUsing the tax table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of household with taxable income of $59,500. Tax amount b. A single person with taxable income of $35,800. Tax amount c. Married taxpayers filing jointly with taxable income of $71,100. Tax amountarrow_forwardYou own an a townhome with an assessed value of $184,400. The tax rate is $2.20 per $100 of assessed value. (Round your answers to the nearest cent.) (a) What is the amount of property tax (in $)? $ 4056.8 (b) If the state offers a 4% discount for early payment, how much (in $) would the tax bill amount to if you paid early? 2$arrow_forward

- Given the following tax structure: Taxpayer Mae Salary $ 11,000 Pedro $ 21,000 Total tax $ 550 222 Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount. b. This would result in what type of tax rate structure? Complete this question by entering your answers in the tabs below. Required A Required B. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount. Minimum tax Required A Required B >arrow_forward2. Help me answer the given question. Do not round off answers while solving, instead just the final answer will be rounded off to one decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education