Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

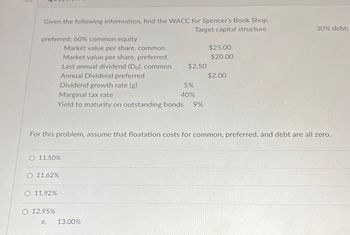

Transcribed Image Text:Given the following information, find the WACC for Spencer's Book Shop.

preferred; 60% common equity

Target capital structure

Market value per share, common.

$25.00

Market value per share, preferred.

$20.00

Last annual dividend (Do), common

$2.50

Annual Dividend preferred.

$2.00

Dividend growth rate (g)

5%

Marginal tax rate

40%

Yield to maturity on outstanding bonds

9%

30% debt;

For this problem, assume that floatation costs for common, preferred, and debt are all zero.

O 11.50%

O 11.62%

O 11.92%

O 12.95%

e, 13.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Railsplitters, Inc. has the following information for its capital structure: Instrument: Amount Issued Current Price YTM Bond A $500 Million 100.82 4.36% Bond B $350 Million 101.36 4.49% Common Stock 42.5 Million Shares $28.21 per share E(R ) Market = 8.65% β = 1.27 Expected Dividend = $1.95 Rf = 2.10% Growth Rate = 2.75% Given this information, if the tax rate of the firm is 30%, what is the after-tax cost of debt?arrow_forwardCan you help me with B and c?arrow_forwardDetermine Garneau's optimal capital structure based on the following information: Debt EPS DPS Stock Price 20% 2.2 1.1 40.12 30% 2.4 40% 2.6 50% 2.8 Equity 80% 70% 60% 50% O a. 20% debt; 80% equity O b. 40% debt; 60% equity O c. 50% debt; 50% equity O d. 30% debt; 70% equity 1.2 1.3 1.4 41.34 40.52 39.42arrow_forward

- The following financial information is available on Rawls Manufacturing Company: Current per share market price $48.00 Current per share dividend $3.50 Current per share earnings $6.00 Beta 1.1 Expected rate of return on market 12.0% Risk-free rate 6.0% Expected long-term growth rate 5.0% Rawls can issue new common stock to net the company $44 per share. Determine the cost of external equity capital using the dividend capitalization model approach. (Compute the answer to the nearest 0.1%.) a 12.6% b. 14.4% c.13.4% d.12.7%arrow_forwardGiven the following information: Percent of capital structure: Debt 35% Preferred stock 20 Common equity (retained earnings) 45 Additional information: Bond coupon rate 11% Bond yield to maturity 9% Dividend, expected common $ 5.00 Dividend, preferred $ 12.00 Price, common $ 60.00 Price, preferred $ 106.00 Flotation cost, preferred $ 4.50 Growth rate 6% Corporate tax rate 25% Calculate the Hamilton Corporation's weighted cost of each source of capital and the weighted average cost of capital. Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.arrow_forwardComplete a,b,&c pleasearrow_forward

- Answer the following questions given the information below: Equity Information 40 million shares $100 per share Beta = 1.15 Market risk premium = 8% Risk-free rate = 3% Debt Information $1 billion in outstanding debt (face value) YTM = 9% What is the cost of equity? What is the cost of debt? What is the after-tax cost of debt? What are the capital structure weights? What is the WACC?arrow_forwardCompute the weighted average cost of capital given the information below. Book Value of Debt $2,500,000,000 Market Value of Debt $2,750,000,000 Book Value of Equity $3,250,000,000 Market Value of Equity $4,000,000,000 Dividend Milberg has just paid $3.25 Current stock price $40.50 Growth rate of dividends 6% Bond information Coupon rate = 4%, maturity = 20 years, maturity value =$1,000 and the current price is $985.25. Assume interest is paid semiannually. Flotation cost of equity 4% Flotation cost of debt 2% Questions 2 through 8 use the following information. Milberg Golf has decided to sell a new line of golf club. The clubs will sell for $1,100 per set and have a variable cost of 80% of revenues per set. The company has spent $450,000 for a marketing study that determined the company will sell 80,000 sets per year for seven years. The company also plans to offer a line of golf balls, which are expected to…arrow_forwardPercent of capital structure: Preferred stock Common equity (retained earnings) Debt Additional information: Corporate tax rate 45 25 15% 40 35% Dividend, preferred $ 10.00 Dividend, expected common $ 5.50 Price, preferred $ 98.00 Growth rate 10% Bond yield 11% Flotation cost, preferred $ 8.20 $ 77.00 Price, common Calculate the weighted average cost of capital for Digital Processing Incorporated Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. Debt Preferred stock Common equity (retained earnings) Weighted average cost of capital Weighted Cost 7.15% 11.14x 7.86 X 26.15 %arrow_forward

- Here is some information about Stokenchurch Incorporated: Beta of common stock = 2.0 Treasury bill rate=4% Market risk premium = 8.3% Yield to maturity on long-term debt = 6% Book value of equity = $520 million Market value of equity = $1,040 million Long-term debt outstanding = $1,040 million. Corporate tax rate = 21% What is the company's WACC? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. WACC %arrow_forwardCalculate Cost of Debt, given: Capital Structure consists of 45% Debt, 45% Preferred Stock, and 10% Equity; DEBT is 25%; Preferred Stock: Sales Price (par value) is $200 and Dividend is $50; Common Stock: Sales Price is $90 and Dividend is $20; Expected Growth Rate is 12%; and the Effective Tax Rate is 26%. 0.29 or 0.19arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education