Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

The following data refers to Company Z:

- Beta = 1.7

- Required return on debt (yield to maturity on a long term bond) = 3.1%

- Tax rate = 21%

- 30-year government bond = 2.3%

- Market risk premium can be assumed to be 5%

Estimate the cost of capital (WACC) for Company Z.

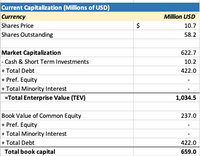

Transcribed Image Text:Current Capitalization (Millions of USD)

Currency

Million USD

Shares Price

$

10.7

Shares Outstanding

58.2

Market Capitalization

622.7

|- Cash & Short Term Investments

10.2

+ Total Debt

422.0

+ Pref. Equity

+ Total Minority Interest

=Total Enterprise Value (TEV)

1,034.5

Book Value of Common Equity

+ Pref. Equity

237.0

+ Total Minority Interest

+ Total Debt

422.0

Total book capital

659.0

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a CDO with a total notional of $500 million, consisting of three tranches: Senior (75%), Mezzanine (15%), and Equity (10%). The underlying portfolio has a total expected loss of 6%. a. Calculate the expected losses for each tranche, assuming they follow the standard tranche subordination rules. b. If the actual realized losses are 30%, determine the losses allocated to each tranche. c. Plot a graph that shows how the payoff of the holders to the Mezzanine tranche owners varies with the value of the assets in the mortgage pool at the time of maturity. d. Represent this payoff as a combination of payoffs of options and risk-free debt for Mezzanine tranche. e. Suppose the CDO manager decides to create a fourth tranche, called the Super- Senior tranche, which has the highest priority in the cash flow waterfall. If the Super-Senior tranche is sized at 50% of the total notional, recalculate the expected losses for all tranches. (hint: Super- Senior tranche is created out of Senior…arrow_forward↑ Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.50%, the company's credit risk premium is 4.50%, the domestic beta is estimated at 1.06, the international beta is estimated at 0.75, and the company's capital structure is now 25% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.30% and the company's effective tax rate is 35% Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates 8.10% b. 7.00% 6.5.00% d. 3.90% ++ a. Using the domestic CAPM, what is Ganado's weighted average cost of capital of the fom's equity risk premium is 10% (Round to two decimal places) tude 1.1.... oline mearrow_forwardGiven the following calculate the Cost of Equity. Beta Equity Risk Premium Pre-tax Yield on Debt Return on the Bond Market Return on the Stock Market Risk Free Rate Tax Weight of Debt in the Total Capital Structure Weight of Equity in the Total Capital Structure 1.5 5.5% 6.0% 4.5% 8.0% 2.5% 25.0% 25.0% 75.0%arrow_forward

- Evans Technology has the following capital structure. Debt Common equity 35% 65 The aftertax cost of debt is 7.50 percent, and the cost of common equity (in the form of retained earnings) is 14.50 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 8.50 percent, and the cost of common equity (in the form of retained earnings) is 16.50 percent. Debt Common equity Weighted average cost of capital b. Recalculate the firm's weighted average cost of capital. Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal…arrow_forwardUsing the data from question 2, please answer question 3.arrow_forwardCalculate the Weighted Average Cost of Capital (WACC) Cost of Equity = 11.02% Cost of Debt = 5.35% Debt-to-Equity Ratio = 15.52%arrow_forward

- klp.1arrow_forwardEstimating Components of both WACC and DDMAn analyst estimates the cost of debt capital for Abbott Laboratories is 3.0% and that its cost of equity capital is 5.0%. Assume that ABT’s statutory tax rate is 21%, the risk-free rate is 2.1%, the market risk premium is 5%, the ABT market price is $84.10 per common share, and its dividends are $1.28 per common share.(a) Compute ABT’s average pretax borrowing rate and its market beta. (Round your answers to one decimal place.) Average borrowing rate = Market beta = (b) Assume that its dividends continue at the current level in perpetuity. Use the constant perpetuity dividend discount model to infer the market's expected cost of equity capital. (Hint: Use Price per share = Dividends per share/Cost of equity capital.) (Round your answer to one decimal place.)arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. Q1. ________is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Q2. Avery Co. has $3.9 million of debt, $2 million of preferred stock, and $2.2 million of common equity. What would be its weight on debt? a. 0.27 b. 0.25 c. 0.48 d. 0.20 Q1. Option 1 rS or Option 2 rD or Option 3 rP or Option 4 rE Please provide the correct answers. Thank you!arrow_forward

- Which statement is correct?a. The cost of debt is determined by taking the present value of the interest payments and principal times one minus the tax rate.b. The difference in computing the cost of capital between using the accumulated profits and issuance of new ordinary shares is the growth rate.c. Increase in flotation costs, increase in the company’s beta and increase in the expected inflation will all lead to d. increase the company’s weighted average cost of capital.e. Increasing the company’s dividend payout would mitigate the company’s need to raise new ordinary shares.f. none of the abovearrow_forwardThe assets of company X have a beta equal to 1. Assume that the company's debt has a beta equal to 0.5 and that X's equity has a beta equal to 2. Consider an investor who holds 10% of the company's total debt liabilities and 10% of the company's equity. The beta of the investor's portfolio is equal to A) 0.1 B)1 C) 0.25 D) 1.25arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education