Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

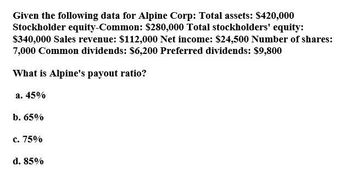

Transcribed Image Text:Given the following data for Alpine Corp: Total assets: $420,000

Stockholder equity-Common: $280,000 Total stockholders' equity:

$340,000 Sales revenue: $112,000 Net income: $24,500 Number of shares:

7,000 Common dividends: $6,200 Preferred dividends: $9,800

What is Alpine's payout ratio?

a. 45%

b. 65%

c. 75%

d. 85%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forwardWinston Watch’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winston’s market/book ratio?arrow_forward

- Gadubhaiarrow_forwardThe following information pertains to Windsor Company. Assume that all balance sheet amounts represent average balance figures. Total assets $330000 Stockholders' equity-common 210,000 Total stockholders' equity 298,000 Sales revenue 110,000 Net income 20,600 Number of shares of common stock 7,500 Common dividends 4,700 Preferred dividends 8,300 What is Windsor's payout ratio? a. 8%. b. 22.82%. c. 16%. d. 36%.arrow_forwardStockholder Profitability Ratios The following information pertains to Montague Corporation: Net income $60,000 Average common equity $1,500,000 Preferred dividends $7,500 Average common shares outstanding 100,000 Required: Calculate the return on common equity and the earnings per share. Round your answers to two decimal places. Return on common equity fill in the blank 1 % Earnings per share $fill in the blank 2 per sharearrow_forward

- The following information pertains to Sunland Company. Assume that all balance sheet amounts represent average balance figures. Total assets Stockholders' equity-common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common dividends Preferred dividends What is Sunland's payout ratio? O 24.6%. O 9.6%. O 17.9%. O 37.9%. $355000 235000 294000 97000 21100 6000 5200 8500arrow_forwardStockholder Profitability Ratios The following information pertains to Capital Corporation: Net income $1,005,000 Average common equity $16,500,000 Preferred stock, $10 par, 230,000 issued, 10% cumulative $2,300,000 Average common shares outstanding 525,000 Required: Calculate the return on common equity and the earnings per share. Round your answers to two decimal places. Return on common equity fill in the blank 1 % Earnings per share $fill in the blank 2arrow_forwardWhat is the company's book value per share?arrow_forward

- Shareholder Profitability Ratios The following information pertains to Capital Corporation: Net income $1,005,000 Average common equity $16,500,000 Preferred shares, $10 par, 230,000 issued, 10% cumulative $2,300,000 Average common shares outstanding 525,000 Required: Calculate the return on common equity and the earnings per share. Round your answers to two decimal places. Return on common equity fill in the blank 1 % Earnings per sharearrow_forwardAssume a company provided the following information: Net income $ 60,000 Number of common shares outstanding, beginning of the year Number of common shares outstanding, end of the year Market price per share 45,000 55,000 $ 11.25 $ 0.50 $ 200,000 $ 80,000. Dividends per share Total assets, end of the year Total liabilities, end of the year The dividend yield ratio is closest to: Multiple Choice 6.5%. 41.7%. 7.8%.arrow_forwardFinancial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning