ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

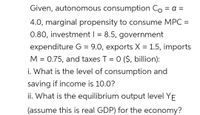

Transcribed Image Text:Given, autonomous consumption Co = a =

4.0, marginal propensity to consume MPC =

0.80, investment | = 8.5, government

expenditure G = 9.0, exports X = 1.5, imports

M = 0.75, and taxes T = 0 ($, billion):

i. What is the level of consumption and

saving if income is 10.0?

ii. What is the equilibrium output level YE

(assume this is real GDP) for the economy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1) Following is information for the economy of Donut. All units are million dollars. Their autonomous consumption is $500, and the marginal propensity to consume is 0.6. Investment spending is constant at $300, and government expenditure is constant at $200. Exports are constant at $100 and imports are constant at $230. Net taxes are constant at $100. Calculate and state your answers for the following questions. A.. What is the value of private saving in this economy when the real GDP is $500? B..What is the value of autonomous aggregate expenditure i.e. AE0? C..What is the size of the multiplier in this economy? D... What is the value of aggregate planned expenditure when real GDP is $1000?arrow_forwardUse the purple rectangle (diamond symbols) to shade the area representing the revenue lost from selling fewer units of output. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling each unit of output at a higher price. 100 90 Revenue Lost 80 70 60 Revenue Gained Demand 30 20 10 + 20 40 60 80 100 120 140 160 180 200 QUANTITY (Units) This monopolist's marginal revenue equals $ (Hint: Enter the negative sign, if necessary.) PRICE (Dollars)arrow_forward7. Assume consumption is represented by the following: C = 400+.75Y. Also assume that planned investment (I) equals 100. a. Given the information, calculate the equilibrium level of income. b. What is the savings function? c. Given the information, calculate the level of consumption and saving that occurs at the equilibrium level of income. d. Suppose planned investment increases by 100. i. Calculate the new equilibrium level of income. ii. Given your answer, what is the size of the multiplier for this economy? e. Use the Keynesian cross diagram to reflect both equilibrium output.arrow_forward

- Refer to the table. Planned Planned Consumption Saving Planned Real GDP Investment $6,000 $1,000 $1,000 $5,000 10,000 0 10,000 14,000 1,000 15,000 18,000 2,000 20,000 22,000 25,000 26,000 30,000 If real Gross Domestic Product (GDP) equals $25,000, what is the average propensity to save? OA. 0.0 OB. 0.88 OC. 0.12 OD. 0.56arrow_forwardGiven a consumption function, C = c0 + cY, specified such that the marginal propensity to consume is 75%, what will consumption expenditure be if total income is £538bn? a. £584+ c0 bn b. £403.5 + c0 bnc. £538 + c bnd. £403.5 bnarrow_forwardTaxes are increased in lump sum by 400 for an economy with an MPC of 0.75. What is the change in consumption: Select one: A. 533.33. В. 1200. С. 30. D. 3.arrow_forward

- Please no written by hand and no emage Suppose that in the economy under consideration the consumption function can be written as C = 200 + .8(Y – T). Furthermore, you know that taxes are autonomous and equal to $10. Now, suppose that investment spending is equal to $50 at every level of disposable income and government spending is constant and equal to $100 at every level of disposable income, suppose that (X – M) is constant and equal to $20 at every level of disposable income. (a)Draw a graph of the consumption function with respect to disposable income. Measure/show consumption spending on the vertical axis and disposable income on the horizontal axis (b) Calculate equilibrium national income Ye from the information given. (c) From the information given above is the government running a deficit or surplus budget? Explain why. (d) Full employment output in this economy (Yf) is equal to $2000 what do you predict is happening to inventories if the full employment level of output is…arrow_forwardAssume consumption is represented by the following function: C=400+0.75Y. Also assume that planned investment (I) equals 100 and there are no government or taxes.arrow_forward4. Assume a closed economy in which disposable income starts at 1,000 and increases by 500; consumption starts at 1,100 and increases by 300; investment spending is 1,000 and government spending is 500. The MPC is 0.6, The multiplier is 2.5, and The consumption equation is C = 500 + 0.6DI Equilibrium GDP is? A 3,500 B 3,000 C 4,000 D 5,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education