ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

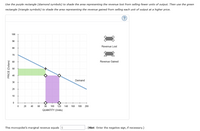

Transcribed Image Text:Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from selling fewer units of output. Then use the green

rectangle (triangle symbols) to shade the area representing the revenue gained from selling each unit of output at a higher price.

100

90

Revenue Lost

80

70

60

Revenue Gained

Demand

30

20

10

+

20

40

60

80

100

120

140

160

180

200

QUANTITY (Units)

This monopolist's marginal revenue equals $

(Hint: Enter the negative sign, if necessary.)

PRICE (Dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Ruth’s Rubies is a single-price monopolist in the market for rubies. Suppose Ruth’s Rubies currently charges $200 for its rubies (i.e. sells 3 rubies). If it lowers the price to $100 (to sell 4 rubies), how large is: The quantity effect? The price effect? Price of a Ruby Quantity of Rubies Demanded Total Revenue Marginal Revenue $500 0 0 400 1 400 400 300 2 600 200 200 3 600 0 100 4 400 200 0 5 0 400arrow_forwardExplain the concept of black marketing as a direct consequence of price ceiling in economics?arrow_forwardThe table below shows the marginal revenue and costs for a monopolist. Demand, Costs, and Revenues Price (dollars) Quantity Demanded $85 79 73 67 61 55 50 150 250 350 450 550 Marginal Revenue (dollars) $85 76 64 1. 250; -$3,625 2. 250; $3,625 3. 350; -$3,625 4. 350; $4625 52 40 28 Marginal Cost (dollars) $25 85 64 61 67 77 Average Total Cost (dol $139.00 103.30 87.50 80.00 77.00 77.00 The monopolist's profit-maximizing level of output is...................its and the monopolist's profit at the profit maximizing output is....arrow_forward

- Answer everything in the photo please.arrow_forwardRefer to the accompanying table, which represents the costs and production for a monopolist. Price Quantity Fixed Cost Variable Cost $20 0 $10 $0 $18 1 $10 $5 $16 2 $10 $8 $14 3 $10 $18 $12 4 $10 $30 $10 5 $10 $44 1) At Q=2, the marginal cost of this firm is $ ____ 2)The profit made by this profit-maximizing firm is $ __arrow_forwardHow do I figure out the second part?arrow_forward

- Alex Potter owns the only well in a town that produces clean drinking water. He faces the following demand P=100-Q, and marginal cost MC=20+2Q, marginal revenue MR= 100-2Q curves. In order to maximize profits, Alex should charge a price of $60 at the profit maximizing quantity with a marginal revenue equal to $60. $60 at the profit maximizing quantity with a marginal revenue equal to $80. $80 at the profit maximizing quantity with a marginal revenue equal to $80. $80 at the profit maximizing quantity with a marginal revenue equal to $60.arrow_forwardItem 7 Suppose a monopolist’s profit-maximizing output is 400 units per week and that the firm sells its output at a price of $40 per unit. The firm has total costs of $8,000 per week. Assume the monopolist is maximizing its profit and earns $20 per unit from the sale of the last unit produced each week.arrow_forwardSubpart 7arrow_forward

- Given the following demand schedule for a monopolist in the diamond industry, assume the marginal cost of producing diamonds is constant and equal to 200 and that there are no fixed costs. Quantity 1 2 3 4 5 Price $500 400 300 200 100 Suppose that rival producers enter the market and the market becomes perfectly competitive. How large is the deadweight loss associated with monopoly in this case? Explain the excess capacity problem. (Note: I am not asking for a definition. I want an explanation of the problem.) Explain what is meant when we say that monopolistic competition is a "second-best" outcome. (Note: I am not asking for a definition. I want an explanation of the problem.)arrow_forwardProblem 1. Market demand is P = 100-0.25Q, where Q is the total quantity demanded by consumers. Monopoly's costs are C = 10Q. (10 marks) a) Calculate prices and quantities if the monopoly uses block pricing with two prices. Calculate CS, DWL and firm's profit and demonstrate on a diagram. b) Find firm's output and profit if the firm engages in perfect price discrimination. Show on a diagram. Iarrow_forwardThe table below shows cost data for producing different amounts of cleaning products. Suppose this market is a monopoly. Use the information in the table to find the output where the monopoly would maximize profit. Price ($) Quantity Total Revenue ($) Total Cost ($) 150 0 0 100 120 5 600 180 100 10 1000 400 90 15 1350 675 80 20 1600 1120 70 25 1750 1750 Profit maximizing quantity: What is the profit the monopoly achieved? $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education