Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

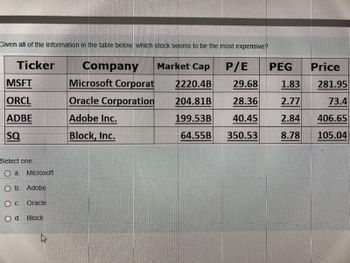

Given all of the information in the table below, which stock seems to be the most expensive?

Select one:

a.

Microsoft

b.

Adobe

c.

Oracle

d.

Block

Transcribed Image Text:Given all of the information in the table below, which stock seems to be the most expensive?

Ticker

Company

Market Cap

P/E PEG

2220.4B

29.68

204.81B

28.36

199.53B

40.45

64.55B 350.53

MSFT

ORCL

ADBE

SQ

Select one:

O a Microsoft

O b.

Adobe

0 c.

Oracle

O d. Block

s

Microsoft Corporat

Oracle Corporation

Adobe Inc.

Block, Inc.

Price

1.83

281.95

2.77

73.4

2.84 406.65

8.78

105.04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a. Given the following information, calculate the expected value for Firm C's EPS. Data for Firms A = and B are as follows: E(EPSA) = $5.10, and OA = $3.59; E(EPSB) $4.20, and B $2.97. Do not round intermediate calculations. Round your answer to the nearest cent. E(EPSC): $ A Firm A: EPSA Firm B: EPSB Firm C: EPSC BU Probability b. You are given that oc = $4.11. Discuss the relative riskiness of the three firms' earnings using their respective coefficients of variation. Do not round intermediate calculations. Round your answers to two decimal places. CV The most risky firm is -Select- V = 0.1 0.2 0.4 0.2 0.1 ($1.65) $1.80 $5.10 $8.40 $11.85 (1.20) 1.35 4.20 7.05 9.60 (2.54) 1.35 5.10 8.85 12.74arrow_forwardFill in the blanks with the number that corresponds to the correct word or phrse below: 1. Deflation 2. GDP deflator 3. Consumer price index (CPI) 4. base 5. Labor statistics 6. Employment cost index 7. dollar 8. Producer price index 9. International price index 10. Consumer expenditure survey 11. Percentage change 12. indices Price are created to calculate an overall average change in relative prices over time. To convert the money spent on the market basket of goods, to an index number, economists arbitrarily choose one year to be the year, or starting point from which we measure changes in prices. The year, by definition, has an index number equal to 100. The inflation rate is not derived by subtracting the index numbers, but rather through the calculation. Index numbers have no signs or other units attached to them. The most commonly cited measure of inflation in the United States is the The Bureau of is responsible for the computation of the Consumer Price Index. is a national…arrow_forwardanswer the questions as soon as possiblearrow_forward

- You have learnt: Po kg; g = ROE × b. - 1. Derive the P/E ratio as a function of b 2. Prove that if ROE < k, a stock with a higher b has a lower P/E ratioarrow_forwardPlease Solve in 20minsarrow_forwardYour team was asked to compute for the cost of equity for prospect companies using CAPM method and the manager provided you the following information: Cisco Co. Salesforce Co. 3% Risk free rate Beta Market return Cost of equity 1.25 12% 14.50% 119 15% SAP SE Co. 4% 1.3 11.80% What is the market return for SAP SE Co? Answer: Adobe Co. 5% 1.4 8%arrow_forward

- The NASDAQ market functions as which type of market? A. over-the-counter B. auction C. standard D. fixed locationarrow_forwardAssume you are given the following abbreviated financial statement. (look at the picture sent) On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.)arrow_forwardBased on the diagram, which represents the EOQ model.Which line segment identifies the quantity of safety stock maintained? a. AB b. AE c. AC d. BC e. EFarrow_forward

- You have collected the following NH-NL indicator data: . If you are an technician following a momentum-based strategy, are you buying or selling today? A momentum-based trader would be selling because the NH-NL indicator indicates that new lows are now outpacing new lows, with a continuing strong upward trend. (Select from the drop-down menus.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Day NH-NL Indicator 1 (yesterday) 104 2 99 3 61 10 4567806 42 -18 -43 -80 -84 9 -91 -69 - ☑arrow_forwardMicrosoft is the only stock in your portfolio. To reduce the risk you decide to add another stock in your portfolio. In fact you pick another stock that has a correlation coefficient of 1 with Microsoft. Which risk do you reduce by adding the second stock to your portfolio? O A. Systematic risk O B. Company specific risk O C. Risk free rase risk O D. Technology risk OE. None of the abovearrow_forwardThe Dow Jones Industrial Average is an example of: O an arithmetic-weighted index. a common-weighted index. O a value-weighted index. a price-weighted index. a geometric-weighted index.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education