Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

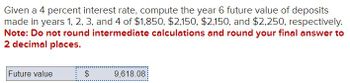

Transcribed Image Text:Given a 4 percent interest rate, compute the year 6 future value of deposits

made in years 1, 2, 3, and 4 of $1,850, $2,150, $2,150, and $2,250, respectively.

Note: Do not round intermediate calculations and round your final answer to

2 decimal places.

Future value

EA

$

9,618.08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Compute The present value of a $5500 deposit in year 1, and another $5000 deposit at the end of year 4 using an 8% interest rate. ( do not round intermediate calculations and around your final answer to two decimal places)arrow_forwardComplete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,100 Interest rate 5% Date borrowed May 9 Date repaid August 14 Exact time Interest Maturity valuearrow_forwardWhat is the value in year 15 of a $260 cash flow made in year 4 if interest rates are 12 percent? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Complete the following, using ordinary interest. (Use Days in a year table.) (Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent.) Maturity value Principal Interest rate Date borrowed Date repaid $1,500 Exact time Interest 8% Mar. 12 June 15 95 %24 %24 **** T:..arrow_forwardFind the principal and the interest amount. Present Value Interest Amount Future Value Interest (Principal) (Maturity Value) Time Rate $2676.15 4.9% 103 days The principal is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The interest amount is $ 1 (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) unarrow_forwarda-1. Calculate the present value of an annual payment of $680.00 you would received for 12 years if the interest rate is 7.01%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value a-2. Calculate the present value of an annual payment of $544.00 you would received for 18 years if the interest rate is 7.01%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b-1. Calculate the present value of an annual payment of $680.00 you would received for 12 years if the interest rate is 17.90%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b-2. Calculate the present value of an annual payment of $544.00 you would received for 18 years if the interest rate is 17.90%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present valuearrow_forward

- Problem #7: You deposit P dollars into an account that earns a nominal rate of i compounded semiannually. At the same time, you deposit 2.2P dollars into an account that earns simple interest at an annual rate of i. If both deposits earn the same amount of interest in the last 6 months of year 8, what is a Problem #7: Answer as a percentage, correct to 2 decimals.arrow_forwardLabel all final answers with the correct units, if applicable. Unless otherwise stated, use 4 decimal places for intermediate computations of interest rates (if needed) then round off final answers to two decimal places. For monetary amounts, use 2 decimal places even for intermediate computations. 1. If P5,000 is invested in a time-deposit for 2 years in a bank that offers 4% annual interest compounded quarterly, how much interest will be earned at the end of 2 years?arrow_forwardNonearrow_forward

- 3arrow_forwardSolve for the unknown interest rate in each of the following: (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value $ 290 410 44,000 43,261 Years 3 18 20 Interest Rate % % % % Future Value $ 345 1,253 209,290 388,485arrow_forwardA $2600 certificate of deposit held for 66 days was worth $2623.36. What simple interest rate was earned? Assume a 360-day year. The certificate of deposit earned an interest rate of %. (Type an integer or decimal rounded to the nearest tenth as needed.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education