FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

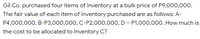

Transcribed Image Text:Gil Co. purchased four items of inventory at a bulk price of P9,000,000.

The fair value of each item of inventory purchased are as follows: A-

P4,000,000, B-P3,000,000, C-P2,000,00O, D – P1,000,000. How much is

the cost to be allocated to Inventory C?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gil Co. purchased four items of inventory at a bulk price of P9,000,000. The fair value of each item of inventory purchased are as follows: A-P4,000,000, B-P3,000,000, C-P2,000,000, D – P1,000,000. How much is the cost to be allocated to Inventory C?arrow_forwardFiery Corporation has an EUP of 248,750 units. Beginning inventory units of 22,500, 40% incomplete; ending inventory units of 24,000 60% complete. Conversion costs of beginning inventory of P9,800; current period conversion costs of P204,125. Using FIFO method, the EUP of completed and transferred units is?arrow_forward0. Banana Company uses the retail method of inventory valuation. The following information is available: Beginning inventory: P186,196 at cost; P302,250 at retail Purchases: P703,740 at cost; P1,120,000 at retail Freight in: P12,400 Purchase discounts: P14,400 Purchase returns: P25,050 at cost; P48,300 at retail Net additional markups – P100,000 Net markdowns – P205,000 Sales revenue – P900,000 - What is the estimated cost of the ending inventory using FIFO retail? *arrow_forward

- Kwafja Ltd. made only three purchases of a particular item of merchandise during its first year of operation. Each purchase was for 100 units and the prices paid were $41 per unit in the first purchase, $42 per unit in the second purchase, and $46 per unit in the third purchase. The ending inventory consisted of 150 units. Under the first-in, first-out method, the value assigned to the ending inventory would be: O a) $6 200 Ob) $6 450 O c) $6 500 O d) $6 700arrow_forwardColeman Company has provided the following information: beginning inventory, $100,000; cost of goods sold, $450,000; and ending inventory, $80,000. How much were Coleman's inventory purchases? Group of answer choices A)$450,000 b)$410,000 C)$430,000 D)$420,000 e)None of the abovearrow_forwardThe management of Aspen company believes that under the lower of cost or market rule, the 2 items below are reported in ending inventory at $129,500. Inventory cost is reported using LIFO. Item A: 2,260 in inventory; cost is $23 each; replacement cost is $15 each; estimated sale price is $32 each; estimated distribution cost is $2 each: and normal profit is 10% of sale price. İtem B: 1,540 in inventory; cost is $52 each: replacement cost is $35 each; estimated sale price is $95 each: estimated distribution cost is $25 each: and normal profit is 20% of sale price. a. Compute your inventory valuation by item and in total for the Aspen Company inventory reported above. Inventory valuation for Item A Inventory valuation for Item B Total inventory valuation b. Prepare the entry, if any, to report inventory at the lower-of-cast-or-market. Assume that all adjustments directly impact cost of goods sold and inventory.arrow_forward

- Forest Company has five products in its inventory. Information about ending inventory follows. Product Quantity Unit Cost A 1,000 B 800 с 600 D 200 E 600 $ 10 15 3 7 14 Unit Replacement Unit Selling Cost Price $ 16 18 8 6 13 $ 12 11 2 4 12 The cost to sell for each product consists of a 15 percent sales commission. The normal profit for each product is 40 percent of the selling price. Required: 1. Determine the carrying value of ending inventory, assuming the lower of cost or market (LCM) rule is applied to individual products. 2. Determine the carrying value of inventory, assuming the LCM rule is applied to the entire inventory. 3. Assuming inventory write-downs are common for Forest, record any necessary year-end adjusting entry based on the amount calculated in requirement 2.arrow_forward(ADDITIONAL INFO) Sales 450,000 1,440,000 2,126,250 Ethel uses the estimated net realizable value method to allocate the joint cost. The cost of product E sold for the year ended July 31, 2021 is: a. 1,470,000 b. 1,440,000 c. 990,000 d. 1,350,000 The cost of ending inventory for product D is: a. 270,000 b. 225,000 c. 180,000 d. 540,000 The gross profit (loss) of product F is: a. 168,750 b. 101,250 c. 1,226,250 d. (483,750)arrow_forwardBonita Company had 100 units in beginning inventory at a total cost of $12,000. The company purchased 200 units at a total cost of $30.000. At the end of the year, Bonita had 88 units in ending inventory. (a) Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round average-cost per unit and final answers to0 decimal places, eg. 1,250.) FIFO LIFO Average-cost The cost of the ending inventory The cost of goods sold eTextbook and Mediaarrow_forward

- Poe, Co. uses LIFO for its inventory valuation. The original cost of Item #BB-8, the only inventory item of Poe, was $12,000. The current selling price and replacement cost are $13,500 and $9,500, respectively. Costs to sell are estimated to be $2,700. The normal profit margin is 10% of the original cost.arrow_forwardIbe Corporation has an EUP of 248,750 units. Beginning inventory units of 22,500, 40% incomplete; ending inventory units of 24,000 60% complete. Conversion costs of beginning inventory of P9,800; current period conversion costs of P204,125. The total EUP of completed and transferred units is:arrow_forwardQq.12. Subject :- Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education